Impossible fight against self-fulfilling prophecies

If you were hoping for a calm and carefree Christmas period, you have probably been disappointed, at least if you’re interested in financial markets. The substantial volatility and correction of international stock markets was inspired by lower growth expectations for the global economy. The global growth outlook has deteriorated due to structural and late-cyclical factors as well as due to weaker economic sentiment driven by continued negative risks. Moreover, pessimism is spreading nationally and internationally. Regardless of underlying economic facts and figures, this process results in lower actual growth figures. Reversing this negative trend is hard to achieve. Rather, new positive factors are needed to trigger a more positive evolution in the economic outlook.

Global growth is declining. Undoubtedly this will be the main message from the IMF in its updated economic outlook at the upcoming World Economic Forum in Davos. The growth slowdown is both structural and due to evolutions in economic sentiment. The structural reasons behind the growth slowdown can be found in the US and China. The US experienced one of its longest economic booms in history. The gradual overheating of the US economy, as is apparent from continued strong job creation and accelerating wage growth, will ultimately lead to an economic cooling down. This is just the normal way of things at the later stages of any economic cycle and hence, is not really problematic. The Fed has been able to increase interest rates substantially. Therefore, a relatively soft landing in the US economy is the most likely scenario at this moment. The Chinese growth slowdown is structural too. China is no longer the ‘factory of the world’, that produces standard products based on a labour intensive production process. Instead, the Chinese economy is more and more targeting the developing domestic market with increasing attention to services sectors and technological activities. This transition process is not smooth and requires lots of money, leading to Chinese debt piling up. China’s growth performance remains impressive, but the growth level is clearly under pressure. Moreover, the bilateral US-China trade conflict, and in particular the already applied tariff rate increases, is starting to bite, with negative impacts on the economic performance of both major economies, adding to the growth slowdown.

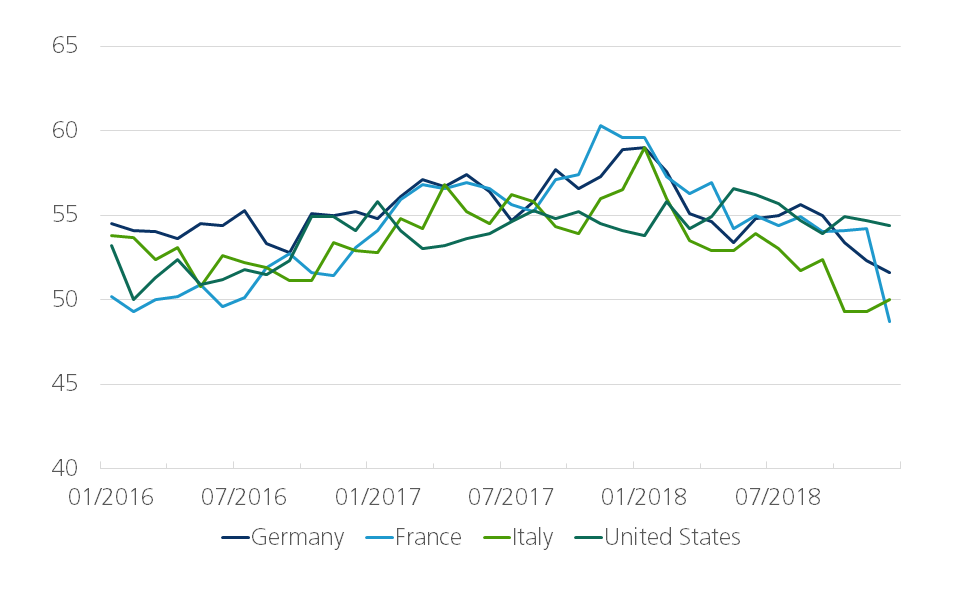

Apart from a structural weakening in the economic outlook, emotional factors play a role too. A long list of risk factors clearly contrasts with the still reasonable global growth outlook. In particular, the persistence of these risk factors is striking. Risks like Brexit, the trade war, the growing debt mountain, and concerns about the Italian economy have been on the list for a while. Worst case scenarios have never come true so far, but unfortunately these risks increasingly weigh on sentiment (see figure 1).

Figure 1 - Composite indicator of business confidence (index, above 50 = expansion)

Source: KBC Economics based on Markit

Globally, the economic sentiment deteriorates as consumers and producers are listening to each other. Economists, analysts and journalists add to this by repeating and spreading these alarming messages. As such, pessimism disperses within the borders of countries as well as internationally, often neglecting the specific local circumstances. Consequently, we are now confronted with an internationally synchronized deterioration in sentiment, despite substantial structural differences among economies. Although there is fundamentally no economic rationality supporting this contagion effect, it simply happens and even becomes the mainstream economic scenario. From an economic perspective we call this phenomenon ‘self-fulfilling prophecies,’ events that are caused by simply expecting them.

Self-fulfilling prophecies are common in economics. Fighting against self-fulfilling prophecies is very hard, and most likely even impossible. It requires insights and courage to go against these kinds of trends. Analysts and trend watchers are often seduced to join the mainstream way of thinking, and even to strengthen the negative sentiment in an attempt to make original statements. Nevertheless, decent economic analysis cannot but take into account these self-fulfilling prophecies. The reality is that once such process is started, it is hard to reverse the trend. As such, a kind of ‘perpetuum mobile’ arises, which is self-destructing for the economic outlook.

The fight against self-fulfilling prophecies is therefore an impossible fight most of the time. It is much more likely that new factors cause a positive switch in expectations and hence in actual economic developments. As a matter of fact, apart from downward risks, any economic scenario is subject to upward risks too. The latter, however, do not get much attention in the public debate. Bad news sells much better, right?

At this moment as well, there are several upward risks to the consensus-scenario. On the one hand, there is another side of the coin for many downward risks. For example, it is not impossible that the UK will stay in the EU, given the current political turmoil. On the other, there are other factors that may give positive stimulus to the economy. The demonstrations by the ‘yellow jackets’, a phenomenon that is clearly spreading internationally, causes a shift in the European and national political agendas towards policies that enhance people’s purchasing power. A more stimulating fiscal policy can have a positive impact on growth, at least if it goes hand in hand with continued structural reforms. The normalization of monetary policy may help too. American academics have pointed out that the US business cycle reacted positively to the Fed’s more restrictive monetary policy. This is hopeful news for the European economy when the ECB continues its monetary policy normalization in the future. Also, technological innovation may trigger positive surprises, as it stimulates productivity gains and leads to launching new products and services. The business sector has made substantial investments in recent years. It is possible we will still reap some of the rewards that these investments bring along.

It is clear that 2019 will be an important year for the global economy. Economic growth remains strong but might be jeopardized. Either the self-fulfilling prophecies will come true and the negative sentiment will dominate, or positive developments will take the lead. From a purely rational perspective, the former is almost certain, while the latter is not at all unlikely. The net result is that the probability of a growth slowdown from 2019 onwards is high. However, don’t listen to this conclusion… because it might cause another self-fulfilling prophecy.