Higher interest rates weigh on US housing market

In the aftermath of the Corona pandemic, US house prices rose sharply. There were obviously good reasons for this. Families longed for a bigger house or some extra greenery in times of lockdowns, which created a demand shock. There was also a supply shock due to rising material prices and, in addition, low interest rates made borrowing more affordable. So, there were fundamental reasons for a sharp rise in prices. However, the question remains whether the entire rise can be considered fundamental and whether there was an overvalued market.

Sustained high inflation rates will force the Fed to raise policy rates further in 2022. And that leads to uncertainty, including concerning the housing market. What will be the impact on the US housing market and prices as borrowing becomes more expensive? The number of homes sold already fell, as did housing starts.

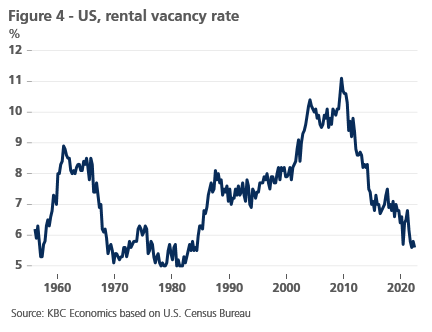

Affordability

Figure 1 shows an affordability index for the US housing market. This index is equal to 100 when a normal (median) home is affordable to a household with a median income. The higher the index, the more affordable a home is. The recent decline, after a period of relatively low house prices given disposable income growth and the monetary environment, is almost entirely due to rising interest rates. Indeed, with unchanged house prices, higher interest rates result in higher monthly housing loan repayments for households.

Such an index can hide differences between different income groups. For first-time buyers, those buying their first home, the index tends to be lower.

Monetary policy versus housing market

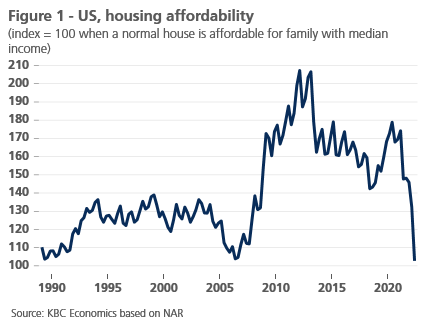

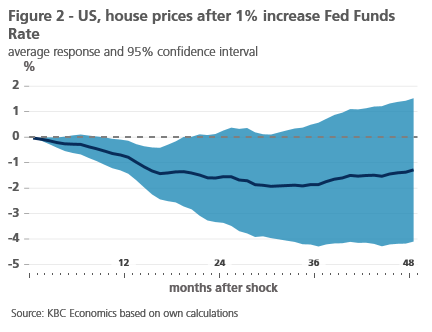

Rising interest rates reduce the affordability of a home and can thus lead to downward pressure on prices. Figures 2 and 3 show the effect of a monetary tightening of 100 basis points on house prices and the number of housing starts, calculated using a local projections model. The results show that real house prices can fall by up to 2% per 100 basis point increase. However, it takes more than 1-2 years before such price effects are fully materialised. Hence, house prices can be labelled as 'sticky' and the effects of current monetary policy are not yet fully visible in house prices. Thus, the negative month-on-month growth of -1.32 % in August, the lowest monthly growth in house prices in more than a decade, appears to be just the beginning. The number of housing starts typically responds faster to a change in monetary policy, at a rate of almost 5% per 100bp. The construction sector thus appears to be an important channel through which the Fed can slow the economy by hiking interest rates.

Crash in the making?

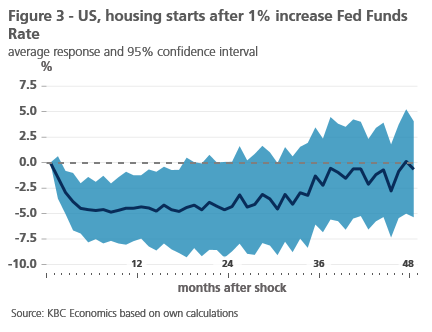

Apart from changes in the fundamental factors that determine house prices, the housing market may be under- or overvalued. In other words, house prices may deviate from the 'fundamental' price. The Fed in its latest stability report calculated an overvaluation between 20% and 30%. That is close to the overvaluation measured prior to the housing market crash of 2007-2008. Is history repeating itself? That the US housing market is cooling and house prices will continue to fall is certain. Whether this will lead to a real crash with far-reaching consequences for the financial system is less likely. After all, the amount of mortgage loans that can be catalogued as "subprime" or "near-prime" has barely increased in recent years and is much lower than during the growth of the previous housing market bubble. In fact, the share of these lower-quality loans fell as the growth in home loans in 2020 and 2021 was almost entirely prime loans. The risk of households being unable to repay their home loans in the event of an economic downturn is therefore lower on average. Also, the rental market does not suggest an oversupply of housing. The vacancy rate in the residential rental market, shown in Figure 4, is at a low level.