Hard times for Belgian retailers despite far-reaching digitisation

Alibaba is coming to Belgium. It sounds like a fairytale, especially for Belgian policymakers: a major international e-commerce player will find its way to the country at last. The firm’s future base in Liège is more than welcome. But the question remains as to whether this is good news for Belgian retailers, who are suffering under intensifying competition from the big e-commerce platforms. Despite increasing digitisation and a relatively successful digital track record, Belgian retail is under immense pressure. The sector is clearly fighting back and is managing to create higher added value. All the same, it’s a David and Goliath battle.

Digital rules!

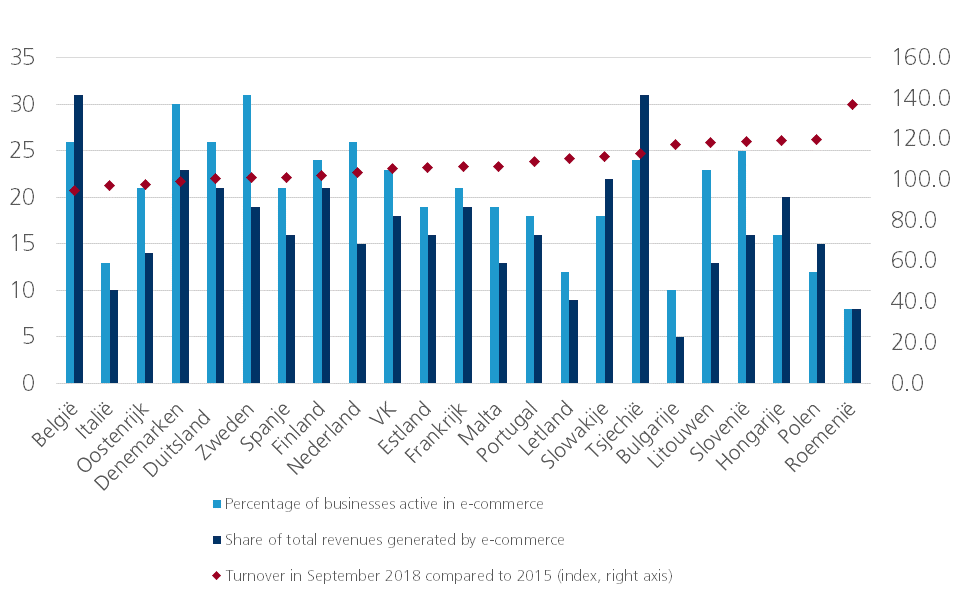

While a trade war rages internationally, a fierce struggle is also going on in our domestic market. Traditional retail is confronted with intense competition from e-commerce. It’s a question not only of an alternative sales channel, but of a full-scale revolution for the entire sector. Small retailers are having to battle with large businesses or even multinationals, which have unleashed a colossal competitive battle through an enormous range of products and services, often at extremely keen prices. Economies of scale are a powerful weapon in this war, which means it’s not enough for smaller players simply to go digital themselves, possibly in combination with a traditional bricks-and-mortar store. What’s more, a great deal of competition is emanating from abroad, given that most of the big players active in the Belgian market are not based in this country but in others, often our neighbours. Alibaba will be the only exception. In the meantime, foreign trade has given way to a sharp increase in Belgian imports, with negative implications for the turnover, jobs and added value created by Belgian retail. All this is clear from Figure 1.

Figure 1 – Evolution of output, added value and jobs in Belgian retail

Total turnover rose steadily in recent years, but only at a limited pace. The number of jobs fell over that period, but has recovered somewhat lately, thanks to the economic upturn. Added value alone showed decent growth, albeit in absolute terms. If we compare the pattern of added value in retail with the general evolution of total added value in the Belgian economy (Figure 2), it is clear that retail has performed relatively weakly. Retail added value has risen by just 21% since 1995, compared to 92% for the Belgian economy as a whole.

Figure 2 – Evolution of added value – retail versus total

Moving up the chain

Even so it’s not all doom and gloom in Belgian retail. The increase in added value combined with a stabilising number of jobs has pushed up the ratio between the two from 35 in 1995 to 60 in 2015. In other words, value added per employee is growing in Belgian retail, indicating that the sector is rising up the economic value chain. This is an important development, as it differs clearly from the low cost/low service strategy of the larger international players.

Far-reaching digitisation

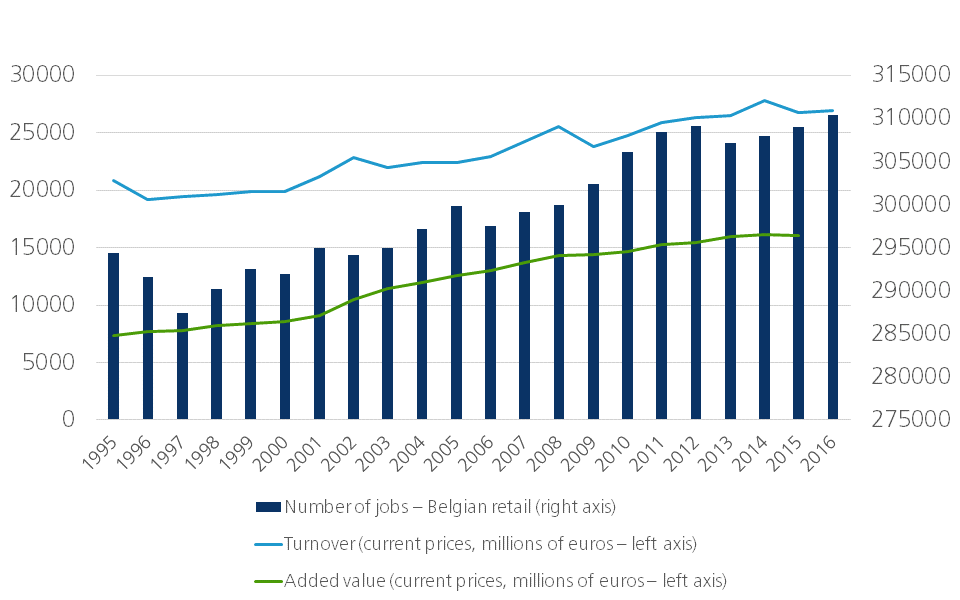

What’s more, despite these downward macroeconomic trends in retail, the sector is definitely not performing badly when it comes to digitisation. Many businesses have been investing in digital sales channels, partly in response to the international digital market revolution. An international comparison shows that Belgium scores highly for e-commerce in retail. Figure 3 indicates that Belgium is amongst Europe’s leaders when it comes to the number of retail businesses active in e-commerce (26%). Belgium also scores exceptionally well in terms of the share of turnover generated by e-commerce (31%). Where the problem lies, however, is the current growth of e-commerce activities. E-commerce turnover contracted by about 5% between 2015 and 2018. This tells us that despite their strong digital performance, Belgian retailers are finding it exceedingly difficult right now to cope with fierce international competition. It’s not a lack of digitisation that is responsible for this, but an unequal economic battle between large and small players. The challenges facing the sector are substantial, but David did eventually manage to defeat Goliath…

Figure 3 – Digital performance of Belgian retailers