Food prices rise less sharply, but risks lurk around the corner

Last Thursday, Eurostat published the first estimate of price developments in the euro area in May. Exuberant month-on-month increases in food prices, as we have seen over the past year, were absent for the second month in a row. This is encouraging, as food prices can have a significant impact on inflation expectations and on the budgets of low-income households. Based on falling farm-gate prices, we can expect continued moderate growth in producer and consumer prices in the food sector, although extreme global weather conditions are a major risk factor.

The energy crisis as the main culprit

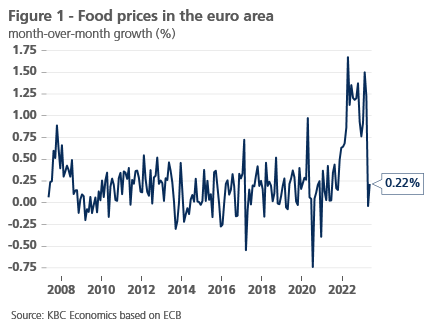

Food prices have increased sharply in the euro area since the beginning of 2022 (see Figure 1). There are several explanations for this. Besides extreme drought, the Russian invasion of Ukraine and the accompanying energy crisis are the main culprits. Energy is an essential input in the agricultural and food processing industries. Fuels and electricity are needed for irrigation, heating, mechanisation, transportation, storage, refrigeration and crop processing. When energy prices rise, production costs for farmers and food producers increase. Fertilisers and pesticides were an extreme example of this. Indeed, these agents are often produced using energy-intensive processes. Finally, companies' rising profit margins should be mentioned, as already described in "Euro area inflation: difficult easing ahead".

However, it is important to note that the impact of energy prices on food prices can vary depending on the degree of energy intensity in food production, dependence on imports and exports, and the degree of competition in the market. For example, European cereal prices strongly follow the international market.

Falling farm-gate prices

Already in the first months of this year, agricultural price inflation in the euro area was negative (see Figure 2). A notable outlier is grain prices which were most affected by the Russian incursion. Ukraine is Europe's granary. Grain prices surged in early 2022 only to fall sharply after the conclusion of the grain deal. The question then arises: how strongly and how fast do falling agricultural prices translate into falling producer and consumer prices?

It takes time before price changes of agricultural products are passed on to consumers. This is because there is an extensive network of intermediaries involved in transporting and trading agricultural products from farm to consumer. This includes wholesalers, processors, distributors and retailers. Each intermediary adds its own costs and margins to the product. These intermediate steps in the distribution chain require time and can delay price change all the way to the consumer. Moreover, contractual obligations need to be considered. In some cases, farmers and producers already have long-term contracts with buyers or distributors. These contracts may contain price agreements that hinder the direct pass-through of changes in agricultural prices.

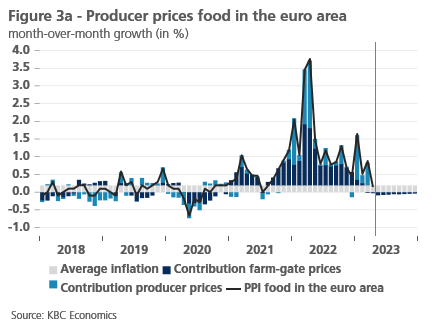

Figure 3a and 3b show how strongly and how quickly farm-gate prices will eventually affect producer and consumer prices. The contribution of farm-gate prices is shown in dark blue. Figure 3a shows that they are a principal factor in final producer prices. In light blue, the inflation coming from food processing is shown. It may take several months before the change in farm-gate prices becomes visible in producer prices. Calculated from historical data2 , the observed decline in farm-gate prices will push producer prices below trend growth for the rest of 2023, albeit limited.

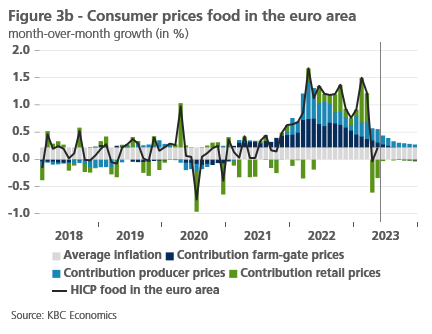

Figure 3b shows how agricultural prices (dark blue) and food processing (light blue) contribute to consumer prices. At the start of the year, prices were raised mainly at the end of the production and distribution process (shown in green). The normal inflation rates for food in the past two months were also caused at that place in the production and distribution process. Indeed, the decline in agricultural prices takes about six months to reach consumers. That is, earlier increases in agricultural prices still affect consumers today and a fall in agricultural prices will only push consumer prices below trend growth in the second half of the year.

Inflation expectations

Food product prices are an important factor in determining households' overall inflation expectations. If consumers perceive a steady rise in food prices, they may assume that inflation is generally rising. This may affect their expectations for price increases in other sectors and may influence their behaviour, such as their willingness to spend, save or invest. Thus, the fact that prices in the food sector are not rising further sharply is a relief for the ECB (European Central Bank). It may make a (long-held) restrictive monetary policy less necessary. Moreover, it reduces the divergence between inflation in different countries. Indeed, in southern and eastern European countries, a larger share of the household budget is spent on food.

Extreme weather conditions

Not only has southern Europe's drought problem been in the news frequently in recent months, but other regions are also seeing pressure on food production due to extreme temperatures. The US corn belt is seeing its expected production drop. Crops there are often planted in autumn to be harvested in summer. Besides an extreme drought this spring, a freezing winter has also negatively affected production. Alarm bells are also being sounded in China. Wheat fields in central China are under water after exceptional rainfall, and rice cultivation in the Yangtze River basin is suffering from the heat.

Conclusion

Previous increases in farm-gate and producer prices have not yet been fully passed on to consumers. For the second half of the year, we can nevertheless expect moderate price growth based on the recent fall in farm-gate prices. This would be a boost for the ECB and make a (long-held) restrictive monetary policy less necessary. However, a global negative supply shock due to extreme weather conditions threatens to throw a spanner in the works.

1 BVAR model with identification of structural shocks based on Ferrucci, Gianluigi, Rebeca Jiménez-Rodríguez, and Luca Onorante. "Food Price Pass-Through in the Euro Area-The Role of Asymmetries and Non-Linearities." (2010).