Food exports are support pillar of the Belgian economy

Chocolate, beer and mussels - a summary of most foreigners’ knowledge about the culinary specialties of our country. Our national symbols are not only the pride of the nation, but also important economic pillars. As valued export products, they create jobs and spur investments that support our economy. But our gastronomic richness is much more varied than the national symbols. The food sector, from agriculture to the food industry, still has great potential, in particular through further geographical expansion and product diversification. Especially in times of economic uncertainty, the food sector is a mainstay of the Belgian economy. Because we always have to eat and drink, don't we?

Land of milk and honey

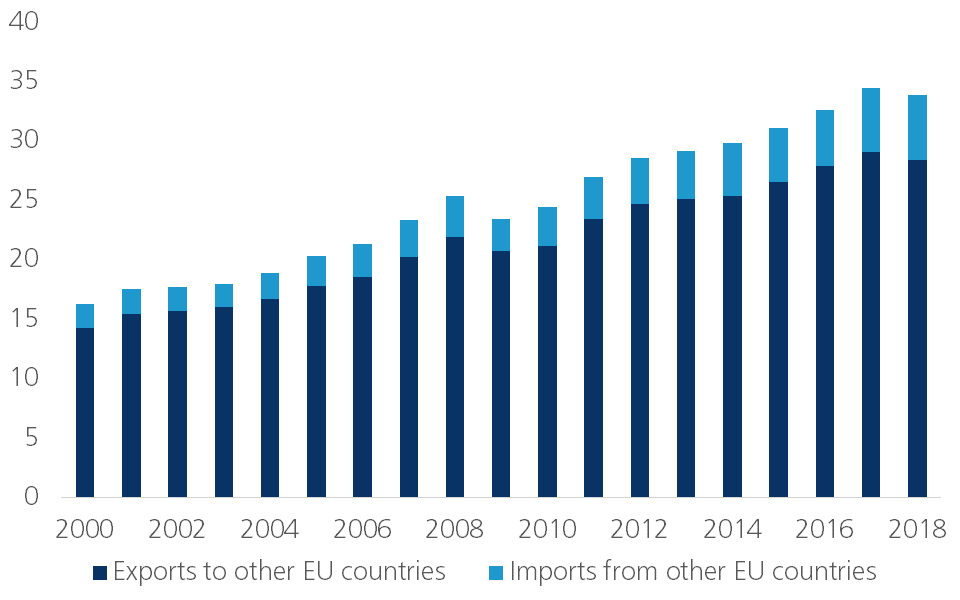

Belgium’s international food trade has grown strongly in recent years. Between 2000 and 2018, Belgian food exports more than doubled (+108%). This export growth was accompanied by a similar increase in imports (+105%). Although Belgium has a positive trade balance in the food sector, the synchronous evolutions in exports and imports indicate that the sector is highly integrated in international networks (figure 1). The importance of food in total Belgian exports has gradually increased to around 9%, making it one of the most important export activities of our open economy, and much more important than in most other European economies. The success story of the Belgian food sector is therefore a story of internationalisation and globalisation. Not only are the Belgian celebrities such as beer and chocolate doing well abroad, but dairy products, meat, fruit and vegetables are also important export products for the sector.

The food sector did well out of this growth in trade. The food industry is the most important industrial employer in Belgium and also generates the largest share of total industrial turnover (18.5% in 2018). The geographical spread of economic activity across all regions and provinces is important in this respect. It provides employment close to home.

Figure 1 – International trade flows of Belgian food sector (in billions euro)

Geographical dynamics

Despite the export success of the food industry, Belgium remains strongly focused on the European market, and especially on our neighbouring countries (figure 2). Like many other sectors, the Belgian food sector has relatively little presence in non-European markets compared to other EU exporters. This seems surprising given the reputation of Belgian food products far beyond national borders. Our tendency to focus mainly on nearby markets is clearly still a burden on the sector, despite considerable efforts by the export agencies to focus more on distant markets. But of course other factors also play a role. The relatively small scale of many family businesses and possibly a lack of funding for a sustained international expansion remain obstacles. Nevertheless, there have been many positive trends here in recent years. More and more Belgian companies are exploring opportunities abroad.

In addition, international factors are also hampering foreign expansion. The sector is subject to significant tariff and non-tariff barriers to trade. Agricultural and food products are among the most protected economic activities in the world. The rise of standards for the protection of food safety is of particular concern. Countries often intrinsically abuse valuable regulations in order to prevent foreign suppliers from entering their markets.

Figure 2 – Exports of the Belgian food sector (in billions euro)

Champions as ambassadors

Our national symbols are outperforming abroad, including in distant markets. For example, in the Chinese and American markets, exports of drinks and chocolate products dominate. They may be able to play the role of ambassador for the entire Belgian food sector. In this way, they can be the door openers for other Belgian food products. This, of course, requires cooperation between companies, in which export agencies and sector federations can play an important role. It is clear that product diversification in Belgian food exports still has great potential.

Another clear trend is the shift in exports from commodities (fruit, vegetables, meat, etc.) to processed food products. Typically, the food industry generates higher added value and more job creation. As stronger external demand can further strengthen this trend, it will also provide larger support to the entire Belgian economy.

Better a good neighbour than a distant friend

The economic potential of further geographical expansion and export diversification is of course only meaningful if the stronger performance in our neighbouring countries can also be continued. At country level, Belgian exports are under pressure in Germany. Foreign competition, especially from Central Europe (Poland in particular), is a tough challenge, especially for fruit and vegetable exporters. On the other hand, exports to the Netherlands benefit greatly from expansion in the dairy sector. Exports to the UK are suffering from the brexit uncertainty, and in particular the depreciation of the British Pound. On the other hand, the shift from basic to processed food products is noticeable in all our neighbouring countries.

All these trends and opportunities show that the food industry has strong growth potential, but at the same time faces significant challenges. The increasing protectionism that surrounds us often affects agriculture and food in the front line. Given its economic importance and growth potential, this sector deserves special attention from our policy makers.