Fiscal policy in corona times: treading cautiously

In the fight against the Covid-19 crisis, governments worldwide took measures to mitigate the financial and economic impact of the crisis on families and businesses amounting to more than 13% of world GDP by 2020. In addition, the so-called 'automatic fiscal stabilisers' did their job. The emergency aid led to a drastic deterioration in public finances, but from a macro-economic point of view it is only a pure shifting of funds operation, which was higher in wealthy industrialised countries. In Europe, the banking sector also played a crucial role. It is still too early for a final evaluation of the policies, but there are indications that they may have helped to safeguard 15% of employment and 25% of GDP in Europe. However, they do not sufficiently address the need for risk capital for businesses.

While in the US fears of a post-pandemic fiscal cliff have subsided thanks to new giant fiscal packages, in Europe the debate on the direction fiscal policy should take is still ongoing. The temptation may arise to compare the US and European budget figures. Yet this is not a race for spending the most. More than ever, budgetary policy is a matter of treading cautiously. To limit the economic damage of the pandemic and to avoid prematurely stifling the economic recovery, fiscal policy support must not be drawn back too early. But emergency measures must be and remain temporary and targeted. At the same time, changing economic conditions and needs must be closely monitored so that policy can be adjusted in a timely manner. This is not just a matter of spending money, but also of taking structural measures. These have to ensure that the supply side of the economy can respond with sufficient flexibility to the stimulation of demand and that the available private savings can also be used smoothly to finance the economic recovery.

In the fight against the Covid-19 crisis, governments all over the world are deploying an arsenal of measures. In addition to freedom-restricting measures to contain the spread of the virus, massive public funds are being used to cushion the financial and economic impact on families and businesses. In the first instance, the pandemic naturally requires additional health spending. However, the largest part of the additional budget expenditures goes to income and liquidity support for families and businesses.

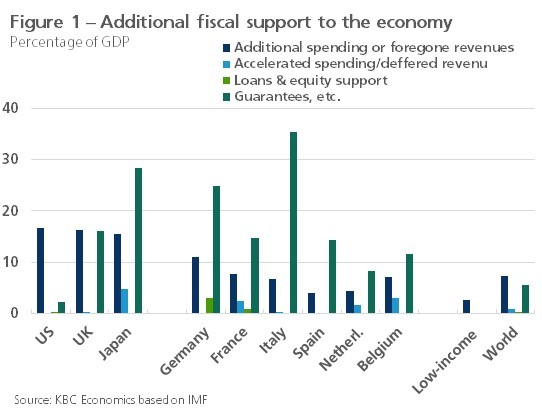

According to the IMF's inventory, additional measures with a direct impact on the government budget amounted to more than 6,800 billion euros (7.4% of world GDP) in 2020. In addition, governments around the world created opportunities to provide liquidity and capital support through equity participations, loans and guarantees amounting to over 6% of GDP. In principle, such measures have no or only a limited immediate impact on the government budget1, but they create budget risks for the future and have an immediate impact on government debt.

Almost all countries have taken emergency measures, but figure 1 illustrates that emergency financial assistance during the crisis was much higher in wealthier advanced economies. In the US, UK and Japan, measures with a direct budgetary impact amounted to more than 15% of GDP, more than double the world average. By contrast, in the poorest developing countries, they averaged less than 3% of GDP. In the large euro area countries, the size of measures fluctuated around the world average, but with rather large differences between countries. These reflect, among other things, differences in budgetary strength.

.... and automatic stabilisers

The fact that the euro area countries have taken relatively fewer extra measures does not necessarily mean that the government intervention to mitigate the pandemic shock for families and businesses is smaller in these countries. After all, the graph only shows the estimated cost of the extra measures. However, because of the more developed social security system, the governments in these countries automatically absorb a larger part of an economic downturn, without the need for specific decisions. In the US, on the other hand, unemployment benefits, for example, fade very quickly and specific decisions are needed to extend them during the pandemic. Such measures drive up the US figures as shown, whereas they could be omitted in the euro area countries because the so-called 'automatic stabilisers', which are not included in these figures, do a larger part of the job. Temporary unemployment systems are often an intermediate category. In many countries, they existed before the pandemic but were expanded or made more generous during the pandemic.

Moreover, European countries, including Belgium, the Netherlands and France, also cushioned part of the pandemic shock by bringing forward normally foreseen government expenditures or by postponing the payment of taxes, without permanently removing the obligation to pay. Such measures provide temporary income and liquidity relief to households and businesses, but in principle have no immediate impact on the budget deficit. They form the second group of measures in Figure 1 (light blue).

The figure also shows that Germany, in particular, has made more use of direct capital and liquidity support from the government. In contrast to the US, most of the other major industrialised countries have created much more scope for using government guarantees to maintain liquidity in the economy via the banking system. This reflects the typical financial structure of these countries, with a dominant role for capital market financing in the US and a dominant role for bank financing in Japan and the European countries

However, the figures on government guarantees require nuance. A recent survey by the European Systemic Risk Board2 shows that all 31 ESRB member states3 have used government guarantees. However, of the EUR 1,580 billion (9.5% of GDP) in safeguards announced as of 30 September 2020 according to ESRB data, 'only' EUR 435 billion (2.6% of GDP) had been drawn down at that time. Nevertheless, according to this study, government guarantees were by far the largest public intervention. Subsidies (0.7% of GDP), tax deferrals (0.5% of GDP), government loans (0.4% of GDP) or tax cuts (0.1% of GDP) were much smaller.

At the same time, the ESRB overview confirms the very important role of the banking sector in the stabilisation. It allowed for the temporary deferral of payments of interest and/or outstanding capital on existing loans amounting to 5% of GDP. In this way, these so-called 'moratoria' exceeded in size the entirety of the governments' fiscal measures.

Deteriorating public finances...

It is certain that these measures are causing a significant deterioration in public finances worldwide. However, it is not yet possible to make a precise numerical estimate, partly because some measures, such as deferrals of tax payments or government guarantees, have or may have a delayed fiscal impact. On the other hand, temporary measures will expire, and the end of the pandemic should automatically improve public finances. However, the extent to which this happens will depend on the permanent economic damage caused by the pandemic (see below). And in the meantime, many measures are being prolonged as long as the pandemic is not brought fully under control. This will also increase deficits in 2021.

Incidentally, uncertainty does not always imply that budget figures are worse than expected. In Germany, for instance, first estimates put the general government deficit in 2020 at EUR 158.2 billion. This is far below the deficit of more than EUR 200 billion that the German government still assumed when it prepared the draft budget for 2021 in mid-October 2020. But because the implementation of measures is delayed and because measures have to be kept longer than initially foreseen due to the ongoing pandemic, the deficit in 2021 will be higher than expected in October 2020.

Despite the downside of the sharp deterioration in public finances, there is a broad consensus among economists that the fiscal policy response to the pandemic of providing massive financial support to families and businesses is the right one. The expansionary fiscal policy is also supported by a highly accommodative monetary policy that ensures that financing conditions in the economy remain very low. This neutralises one of the traditional arguments against public deficits, namely that they crowd out private spending by driving up interest rates.

.... necessary, but not a panacea

By increasing their budget deficits, governments try to limit the long-term structural damage to the economy. Bankruptcies are avoided - at least temporarily - and the accompanying rise in unemployment should also be kept in check.

It is still too early for a definitive evaluation of the effectiveness of the policy. But a recent IMF study of 26 European countries suggests that the policy may be successful to a significant degree, at least assuming it is applied as designed4. In the developed European economies, by the end of 2020 the corporate liquidity gap would be 80% smaller than without the measures. At 5% of GDP, it would not have been much bigger than before the pandemic, with admittedly large differences from country to country and from sector to sector. For the emerging European economies, the results are less favourable, but there the government measures were also generally more limited. For the European countries studied as a whole, the measures could have prevented 15% loss in employment and a 25% loss in value added.

These results put the deterioration of public finances into perspective. The deterioration helps to prevent a disruption of household and business finances. Figure 2 illustrates how, in Belgium, the two movements offset each other and, on balance, hardly change the financial balance of the Belgian economy as a whole. A similar picture holds true for the euro area as a whole, with the nuance that the savings surplus of the total economy vis-à-vis the rest of the world increases slightly. In other words, the governments' emergency supports are, to a large extent, also a pure shifting of funds operation between the large macro-economic sectors. They can help to limit structural economic damage and thus the lasting welfare loss. In this way, the basis for economic recovery after the pandemic can also be safeguarded as much as possible.

But the measures will not solve all the problems. There will very likely be at least some permanent damage (see also KBC Economic Opinion of 26 March 2021). For Belgium, an analysis by the Federation of Belgian Enterprises and Graydon finds that, despite all the government measures, about 20% of the companies are facing serious financial problems, even though they were financially very healthy before the outbreak of the pandemic. These are mainly, but not exclusively, small or young enterprises. They are particularly in need of capital support.

These findings are in line with the conclusions of the IMF study for the 26 European countries. Especially small and young enterprises and hard-hit sectors continue to face large liquidity shortages despite the government measures. Moreover, the existing government measures are much less effective in remedying solvency problems. Without additional capital support, 15 million jobs would be at risk in Europe. The IMF study estimates the capital shortfall of companies that were solvent before the pandemic at 2-3% of GDP.

Avoiding a fiscal cliff in a US-way?

Recently there had been fears, especially in the US, that the expiry of the temporary pandemic support measures would lead to a fiscal cliff: the phasing out of government support would jeopardise the recovery of the US economy after the pandemic. With the adoption of two huge fiscal packages in December 2020 and March 2021 and the preparation of a third package for later this year, that danger has been averted (see also: KBC Economic Opinion of 4 February 2021).

In Europe, the debate on future fiscal policy is still in full swing. A consensus is emerging around the idea that consolidating public finances too quickly would stifle the economic recovery and should therefore be avoided. The idea finds support in the European experience, where after the Global Financial Crisis of 2008-2009, among other things too restrictive fiscal policies in some countries contributed to the euro crisis of 2011.

In early March 2021, the European Commission indicated that the guidelines of the European fiscal framework would not be applied in 2022 either. The 2020 and 2021 exception would be extended if the economy had not returned to pre-crisis levels. The eurozone finance ministers also agreed at the Eurogroup meeting on 15 March that support for the economy from the public budget should not be cut prematurely. The German government - with a not insignificant voice in this European debate - does not seem to be planning a quick return to the Schwarze Null either.

The authorities are therefore continuing to extend most of the support measures until the pandemic has been fully brought under control. The first evaluations of the initial measures suggest that this is a justified reaction. But it remains important that emergency measures are temporary and highly targeted. In April, EU countries will make clear how they see the recovery policy after the pandemic in their policy plans, which they have to submit to the European Commission within the framework of European policy coordination. From the second half of 2021, the Next Generation EU (EUR 750 billion) recovery fund (5.6% of GDP, spread over three years) will also come into effect.

The temptation will be great to compare the US fiscal stimulus figures with the European ones. Undoubtedly, the US figures will be higher than the European ones. But it should not automatically imply that US policy is so much better. It is not a competition to spend the most.

First, as illustrated above using fiscal measures from 2020, the US figures are not simply comparable with the European ones. Second, not every economy necessarily needs measures of the same size or nature. That depends on the size of the unused production capacity and the flexibility with which it can be deployed. It depends on the structural strengths or weaknesses of an economy.

At least until the dust of the pandemic settles, there will be considerable uncertainty about the extent of unused capacity and structural economic damage. Nevertheless, estimates of the gap between potential GDP and actual GDP (the output gap) by the OECD, the IMF and the European Commission suggest that the need for fiscal stimulus would be greater in the euro area than in the US. But even that does not mean that the US figures for fiscal stimulus are a guide for the euro area. Indeed, there is much debate among economists about the adequacy of output gap estimates. Some fear, therefore, that President Biden's budget plans go too far for the US economy and will fuel inflation in addition to real economic welfare growth.

Moreover, stimulating demand only makes sense if the supply side of the economy can meet it. Given the rigidities in European economies, this will often only be possible with reforms that allow the supply side to reorganise sufficiently quickly to meet demand. Therefore, stimulating demand in Europe must go hand in hand with economic reforms, as provided for in the agreement concerning the Next Generation EU. The adequacy of European recovery policies must therefore be measured not only in terms of the amounts of money spent, but also in terms of the reforms implemented.

Finally, the financing of the recovery does not have to come solely from the public purse. As mentioned above, the increase in government budget deficits over the past year has created macro-economic savings surpluses for households and companies (see Figure 2 for Belgium). Moreover, the above-mentioned evaluations of recovery policies indicate increasing solvency needs of companies, including those that were financially sound before the pandemic. In other words, there is a need for risk capital.

However, the government is not well placed to provide that itself. An important part of the recovery policy must therefore be to improve the general investment climate, so that private savings are more readily used to strengthen the capital base of companies with a viable business model. At the same time, no public money should be spent and banks should not be forced to keep alive companies that are not viable today and in the future and do not have sufficient financial buffers themselves (so-called 'zombie companies'). This would keep scarce resources immobilised in an unproductive manner and undermine the effectiveness of demand-stimulating policies.

Thus, more than ever, fiscal policy becomes a matter of treading cautiously. To limit the economic damage of the pandemic and to avoid prematurely stifling the economic recovery, fiscal policy support must not be drawn back too early. But emergency measures must be and remain temporary and targeted. At the same time, changing economic conditions and needs must be closely monitored so that policies can be adjusted in a timely manner. This is not just a matter of spending money, but certainly of taking structural measures as well.

1As far as viable businesses with a normal return are concerned.

2ESRB (2021), 'Financial stability implications of support measures to protect the real economy from the COVID-19 pandemic'..

3EU countries, UK, Norway, Iceland and Liechtenstein.

4C. Ebeke, N. Jovanovic, L. Valderrama and J. Zhou (2021), "Corporate Liquidity and Solvency in Europe during COVID-19: The Role of Policies," IMF Working Paper. The study simulates balance sheets and profit and loss accounts at the end of 2020 for more than four million companies in 26 countries, assuming that the measures have been applied as announced. Actual implementation cannot yet be taken into account.