EU as a regulatory superpower... but with limits

Increasingly, the EU is being dismissed as an economic power beyond its peak. Economic growth in the bloc has been lagging behind that of the United States and, even more so, emerging markets for years. Moreover, it remains a sore point that the EU often finds it difficult to speak with one voice on the international stage. Nevertheless, the EU remains a force to be reckoned with. Although the economic size of the bloc may be decreasing in relative terms, the EU's influence still extends far beyond its borders. Indeed, the EU succeeds in unilaterally setting many of the rules governing products and services worldwide without pursuing an aggressive or theatrical strategy. This is called the Brussels effect. Even without the UK, the EU is unlikely to lose its role as an international super-regulator any time soon. A good agreement between the EU and the UK on the alignment of their regulatory regimes can contribute to this, especially in a world where Europe is not a technological front-runner.

Global impact despite declining economic power

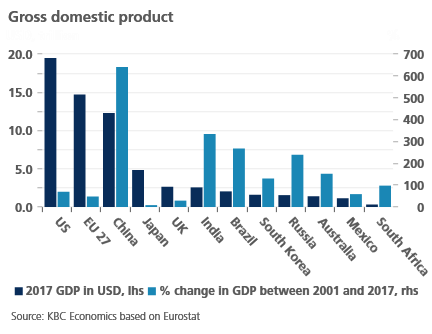

With the emergence of developing economies such as China, India and Brazil, the relative economic size of the EU, the US and Japan is declining every year (Figure 1). On top of this, the EU has also seen the departure of an economically sizeable member state with Brexit. Indeed, the UK economy accounted for around 15% of the EU's total GDP.

Nevertheless, the EU has been at the top of the list of successful disseminators of economic regulation for years. In early 2020, Professor Anu Bradford published a book on this subject entitled 'The Brussels Effect: How the European Union Rules the World'. In her book, professor Bradford describes how the EU, a group of countries often overshadowed by other superpowers such as the US and China, has managed to dominate many economic sectors when it comes to regulation.

What is striking is that the EU mainly fulfils this role largely without sanctions and displays of power. The EU regulates its internal market for the goods and services that companies trade in this market. For many non-EU companies, the EU is still too large and interesting a market, with relatively prosperous consumers, to ignore. Subsequently, these companies often apply the rules imposed on them in the EU to their other markets as it is often more beneficial, from an efficiency point of view, to follow the same rules globally in order to benefit from economies of scale. This ensures that the EU is very successful in imposing its standards and values on the rest of the world through internal regulation, good and bad. Important examples of this can be found in the areas of consumer and environmental protection.

Brexit can increase rules

For many ordinary Britons, the EU was a thorn in their side for many years, partly because of the many rules it imposed on the UK. Crazy, often erroneous stories about these ruleswere told. For example, according to the British media, the EU would have banned Christmas wish lists and crayons and imposed that all bananas should be straight.

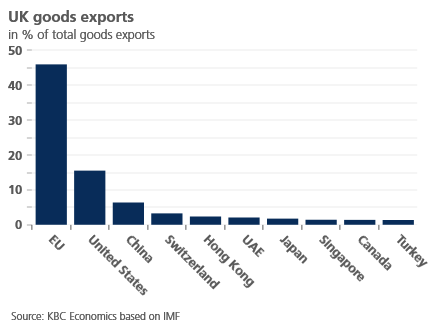

As mentioned earlier, the EU is losing some of its economic clout in the world with the exit of the UK. Yet Brexit will not ensure that the UK completely escapes the EU's regulatory grip. Indeed, many British businesses will continue to have to follow EU rules even after the exit, as around half of UK goods exports end up in the EU (Figure 2). Even if the UK enters into a trade agreement with the US over the next few years, British companies are unlikely to completely ignore a large, prosperous and nearby trading bloc such as the EU.

With the UK's departure from the EU, an important force against further regulation and in favour of liberalisation immediately disappeared. Despite traditional British opposition to European regulation, the UK's departure from the EU threatens to reduce the global relevance of European regulation. This is not only because the EU27 has less weight on the international stage, but also because the EU27 threatens to fall prey to an enormous regulatory zeal, in which national and strategic interests, rather than the public interest, come first. France and Germany, in particular, agree on such an approach on a European scale, which is likely to be seen internationally as protectionism. Nevertheless, the UK can continue to provide a counterweight, provided that a good agreement is reached between the UK and the EU27 on continued regulatory cooperation. Greater international cooperation, including with the US, is also recommended for all Western economies in a world where emerging economies are gaining strength. Developing leading-edge regulation is a valuable and positive alternative to trade disputes.

Limits to its power

One of the reasons why the EU succeeds in dominating global regulation is that the US has been tending towards deregulation for many years. This created a vacuum that was easily filled by the stricter EU. The power that follows from the possibility of spreading one's own values and standards around the world should not be underestimated. This is an awareness that has grown over the years within the EU. Where the Brussels effect was initially an unplanned side effect of efforts to regulate the internal market, it has recently been increasingly actively used as a geopolitical instrument to achieve the EU’s external agendas. For example, through the European Green Deal, the EU wants to play a leading role on the international stage in the transition to a more sustainable economic model.

However, the EU should not become overconfident either. Not all EU rules are followed globally and too much regulation, especially in the area of major technological innovations such as 5G, could put European companies at a competitive disadvantage and leave them hopelessly behind compared to their competitors abroad. In the longer term, this could result in an accelerated loss of the economic power of the EU. Cooperation, including regulatory cooperation, will therefore become increasingly important for the EU if it is to remain a relevant force in the future.