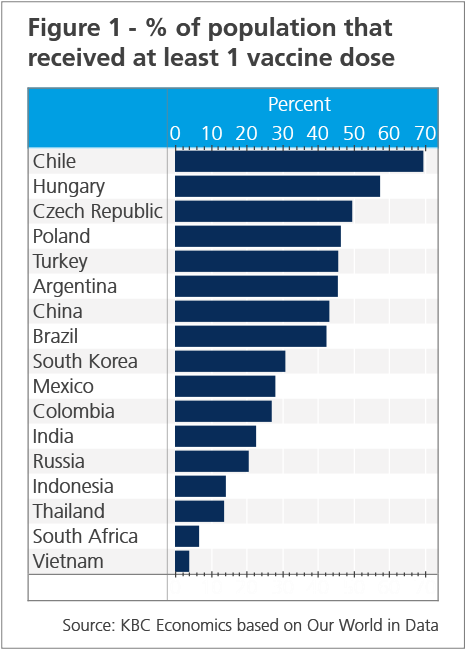

Emerging Markets Quarterly Digest: Q3 2021

Content table:

Read the publication below or click here to open the PDF.

A (fragile) recovery continues

The recovery in emerging markets is on fragile footing heading into the second half of the year. Lagging (but accelerating) vaccination progress in many countries, the spread of more contagious Covid-19 variants, rising—albeit temporary—inflation, and uncertainty over the future of Fed policy all complicate the economic outlook, especially for more vulnerable economies.

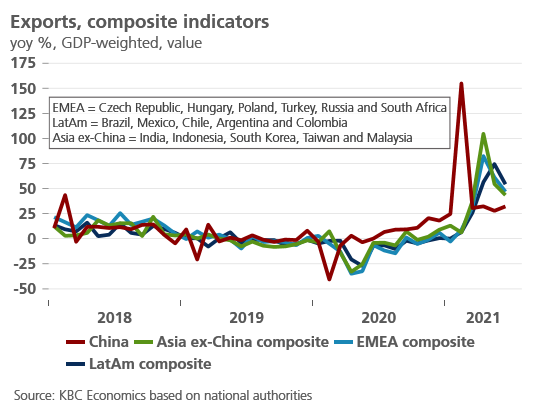

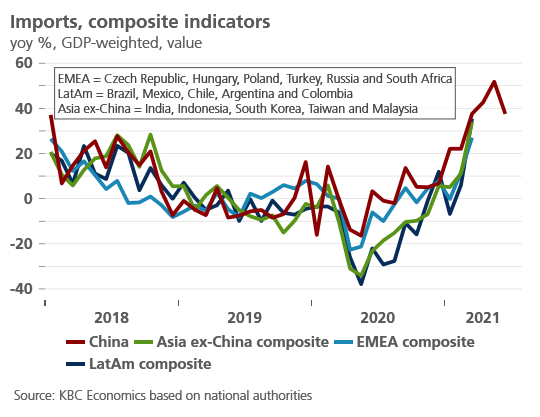

It is certainly not all doom and gloom, however. The global recovery is supporting goods exports and manufacturing industries. Vaccination is underway, even if it is not as fast as in wealthier economies. Covid-19 cases have come down significantly in Central Europe and India since the beginning of the year, and cases are starting to come down finally in Latin America as well. Meanwhile, though the spread of the Delta variant in some Asian economies is worrisome, daily infections still remain relatively low. Finally, though recent Fed communication caused some moderate weakness in emerging market assets since June, the somewhat surprising decline in long-term yields suggests that markets accept that inflation is largely transitory, and Fed policy will be very accommodative for quite some time.

Vaccination and variants

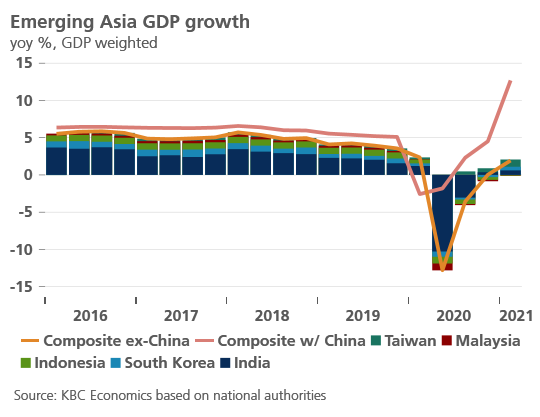

The trajectory of the pandemic remains the main risk factor for most economies through the end of 2021. This becomes particularly clear when looking at the economic outlook for emerging Asia. While many Asian economies (with a few exceptions) managed to keep the spread of the virus relatively contained compared to countries in Europe, North America and Latin America in 2020 and much of H1 2021, a slower vaccination rollout and a recent uptick in cases in a number of countries in the region highlights that no economy is fully in the clear just yet. At the moment, daily cases are rising particularly sharply in Thailand, Indonesia, and Malaysia.

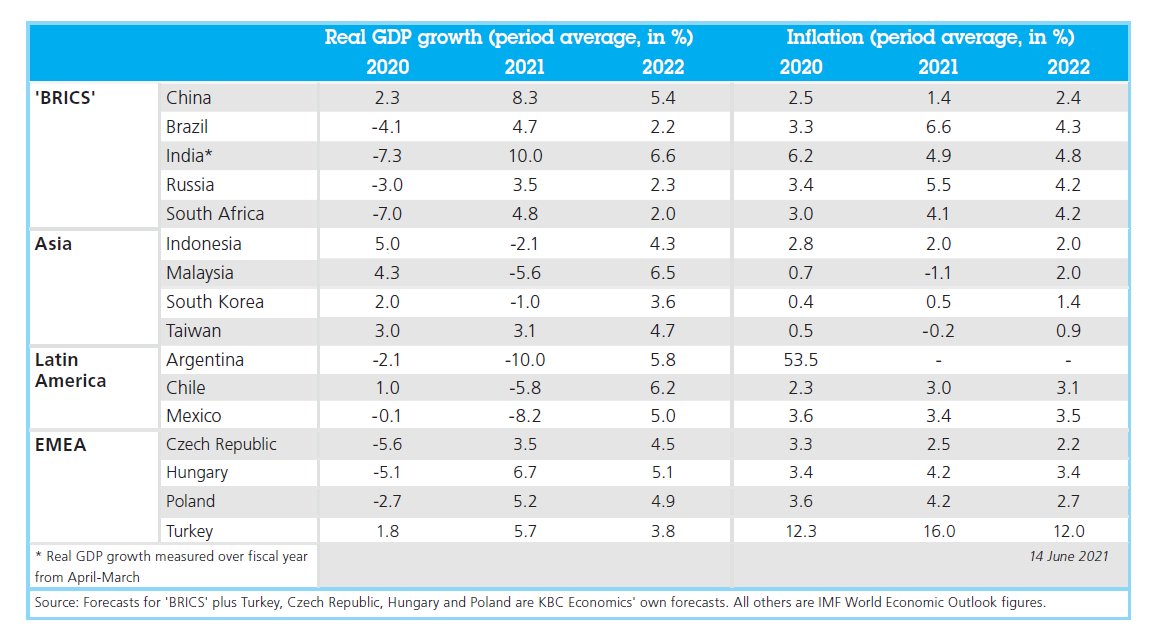

The ongoing spread of the virus, and growing concerns about the Delta variant and the extent to which it can escape vaccine protection, could further delay the normalization of the services sector of emerging markets economies, particularly in Asia and the above mentioned countries where tourism is a key contributor to GDP growth. While this is also a concern for economies in Central Europe, higher vaccination coverage tempers the risk to some degree. Indeed, among major emerging markets, (partial) vaccination rates are highest in Europe and Latin America (Figure 1). On a more positive note, the vaccination pace is accelerating in some emerging markets. We see this particularly in Argentina, Brazil, South Africa, Turkey, South Korea, Malaysia and Thailand since the end of May/middle of June.

Emerging economies fall behind

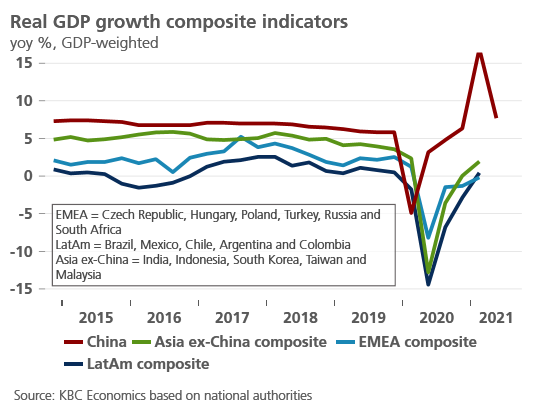

Despite this acceleration in pace, poorer emerging markets are still well behind wealthier economies in terms of vaccination progress. This unequal progress is adding to the desynchronized nature of the global economic recovery. While China led the global recovery already in Q2 2020 and throughout the rest of last year, the United States is now taking the lead with exceptionally strong growth fueled by significant fiscal support and economic reopening. The rate of that growth is expected to have peaked already in the second quarter but will remain strong throughout this year and the next. The euro area is a few steps behind, with the recovery expected to have started only in Q2 2021 and picking up speed throughout the rest of this year as reopening progresses. Meanwhile, generally slower (relative to advanced economies) vaccination rates and the spread of the virus mean many emerging economies faced significant headwinds to growth in H1 2021, and others will face those headwinds in H2 2021, particularly for contact-intensive services sectors.

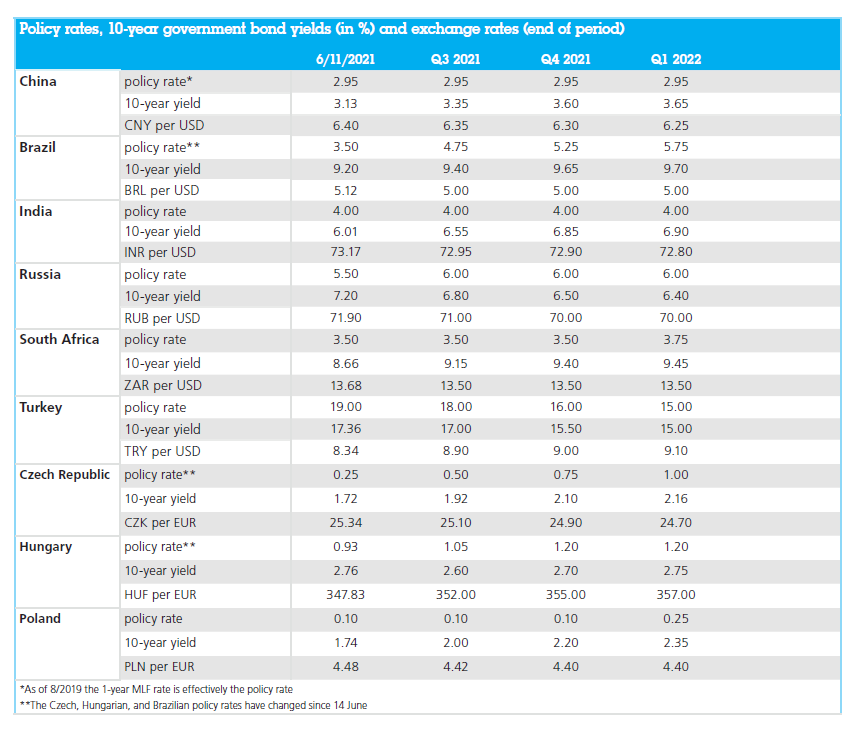

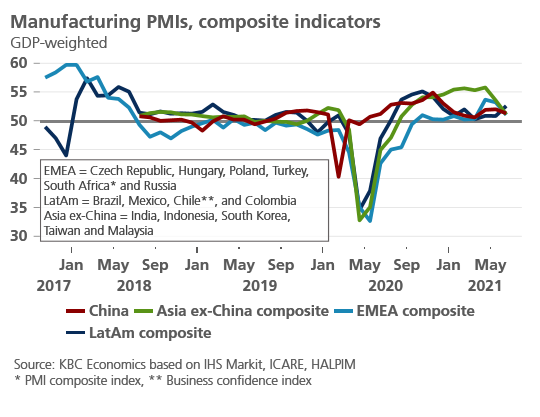

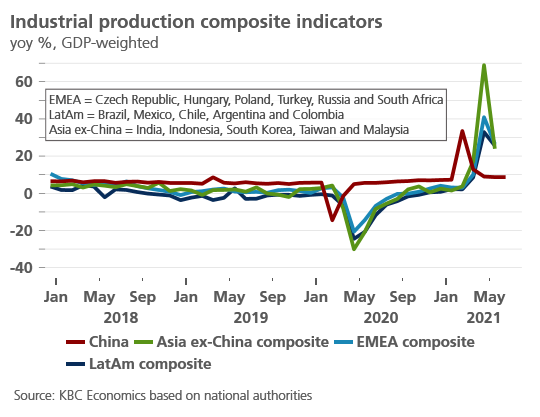

This is not to say that the economic recovery among emerging markets has been derailed. Indeed, many emerging markets have benefited from recovering demand in advanced economies. This has supported both goods exports and commodity prices. But even within the manufacturing sector, a divergence since the beginning of the year is clear. This is evidenced by business sentiment surveys for the EU, US, and the largest emerging markets (Figure 2).

Diverging economy, diverging policy

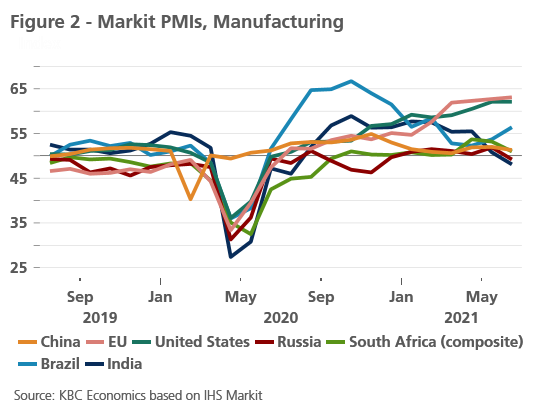

The asynchronous nature of the global recovery raises certain complications for emerging markets. These complications are further compounded by rising inflationary pressures. In particular, the more advanced stage of the recovery in the US has brought into the spotlight discussions over when the Fed’s extremely accommodative policy stance will start to be unwound. At the Fed’s June meeting, the so-called dot plot revealed that a majority of Fed policymakers now see rates being raised in 2023, which is earlier and faster than previously expected. Furthermore, Fed officials have started making comments about the potential timing of tapering (as early as this year).

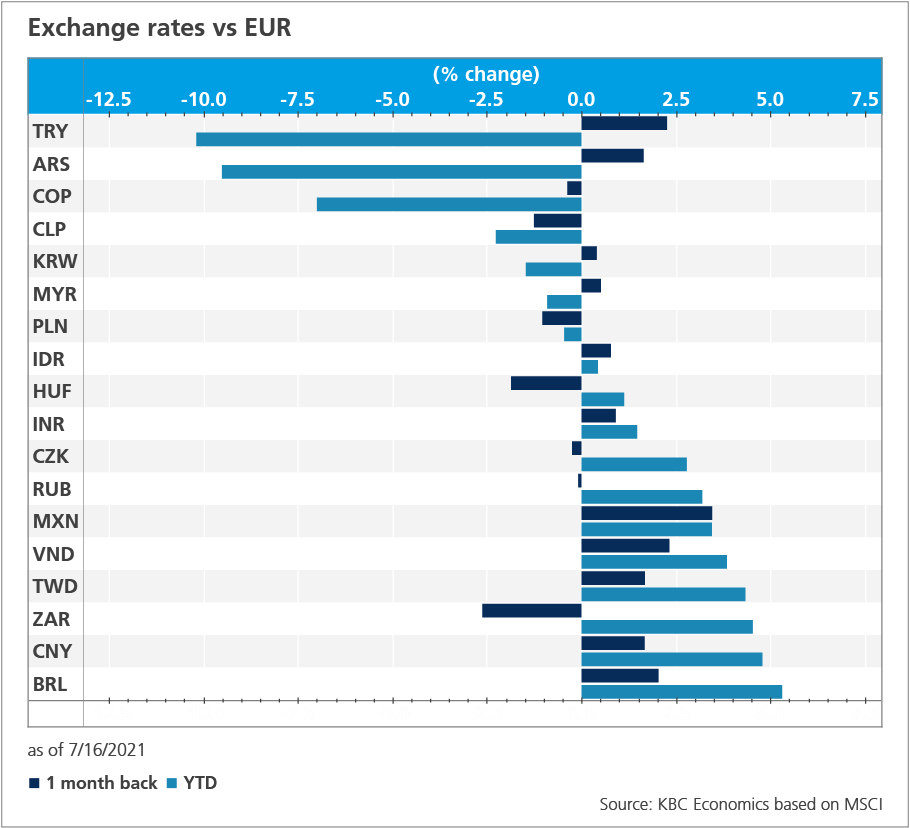

The prospect of tighter Fed policy and rising interest rates can often cause turbulence for emerging economies as markets may reallocate investments away from emerging markets (either due to rising yields elsewhere or perceived higher risks). Those with large outstanding (external) imbalances (e.g., high debt levels denominated in USD and wide current account deficits) are particularly vulnerable to a sudden shift in capital flows. While the June FOMC meeting did lead to a general depreciation of emerging market currencies versus the USD, emerging market assets haven’t had a disastrous few weeks, and capital flows appear to be holding up well, according to the Institute of International Finance (IIF). There may be several reasons for this.

First, since the June FOMC, the US yield curve has flattened, with short-term rates rising but longer-term rates coming down. This somewhat surprising market reaction suggests that markets tend to accept the Fed’s view that current high inflation in the US is driven mainly by temporary factors and will subside in the medium-term, thus allowing the Fed to maintain relatively easy policy for some time before gradually normalizing policy. Easier financial conditions are generally supportive of emerging market assets and will give emerging markets more time to see their economies recover and reopen.

However, it is not only Fed policy changes (or future expected changes) that can prompt emerging market central banks to tighten policy themselves. Domestic inflation also plays a large role. Indeed, after Russia and Brazil first tightened policy in March, Hungary, the Czech Republic, and Mexico followed suit in June. In all cases, rising inflation figures were a key factor leading to the hikes. While much like in advanced economies, the causes behind recent inflation pressures in emerging markets are largely transitory (energy and food prices being main drivers), emerging markets tend to be more sensitive to such inflation, with higher risks of entrenchment and market reactions. Hence, emerging market central banks are more likely to react faster to higher inflation.

The second reason why emerging market assets have held up despite recent interest rate developments is that emerging market imbalances are generally more contained than they have been in recent past episodes of Fed tightening (or expectations thereof). This can be seen, for example, when comparing current account balances as a % of GDP and real effective exchange rates relative to long-run averages.

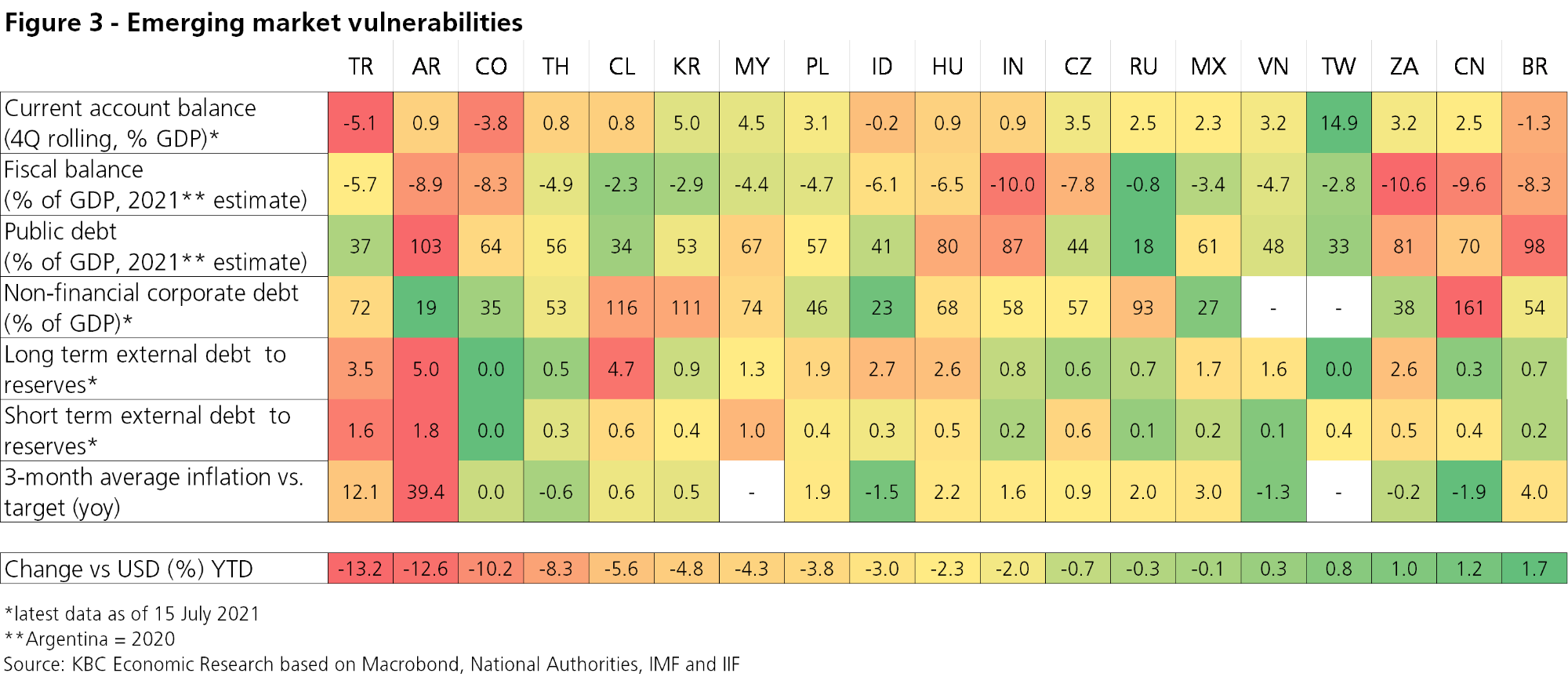

However, there are still certain economies that stand out for their vulnerabilities. Aside from Argentina and Turkey, which suffer from long-standing imbalances and a history of less-conventional policymaking, Brazil, South Africa, India, and Colombia tend to have high fiscal deficits and/or debt levels, and in the case of Colombia, also a weaker current account balance (Figure 3). Most Asian economies, meanwhile, tend to be better positioned in terms of financial vulnerabilities. Hence these economies may be able to continue with easier policy for longer as they face the headwinds of the ongoing pandemic. The exception appears to be South Korea, which has signaled that it is likely to raise rates this year, mostly as a result of rising inflation.

Emerging Asia

Though Asian economies are susceptible to the various important risks facing our baseline scenario (namely, spreading variants, supply shortages, and higher albeit transitory inflation), overall, the region is still set to benefit from the ongoing global recovery. While business sentiment indicators for the manufacturing industry did edge down in June from multi-year highs, they still remain above 50 (i.e. signalling expansion) in most economies in the region. In parallel, exports have remained relatively strong, partially reflecting the ongoing strong demand for high-tech products, including semi-conductors.

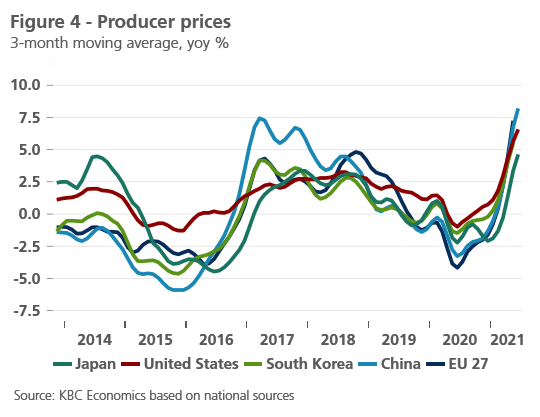

While this high demand has supported growth in the region since the second half of 2020, supply shortages and higher commodity prices have also caused producer prices in much of Asia (as well as elsewhere) to jump (Figure 4). On top of this, the spread of new Covid-19 cases in pockets of the region may add to supply disruptions.

Meanwhile, the generally slower recovery in the services sector also faces important headwinds from the rising spread of the Delta variant. Those economies where tourism is highly important to GDP, including Thailand and Malaysia, face a particularly difficult setback. Malaysia, for example, went into a full lockdown (with the exception of essential sectors) on June 1, and most of the country and economy still remain in lockdown. In Thailand, new Covid-19 restrictions have come more recently, with a new curfew imposed in Bangkok from 12 July and non-essential shops closing. Hence, the risks to the otherwise strong economic outlook for the region are mounting.

China

The Chinese economy grew a stronger-than-expected 7.9% year-over-year in the second quarter. This is down from the mechanically strong 18.3% yoy registered in Q1, which was a function of the extreme economic decline seen a year earlier during China’s major lockdown. From a quarterly perspective, the economy gained momentum in Q2 2021, with seasonally adjusted quarter-over-quarter GDP growth of 1.3%, up from 0.4% in Q1 according to the data release. When looking at GDP by expenditure, we can see that while consumption has recovered relative to last year, as a percentage of total GDP growth its contribution remained roughly stable between Q1 and Q2 (contributing just over 60% to yoy GDP growth). Instead it appears that net exports led the positive momentum, contributing 1.5 ppts (19%) to yoy GDP growth (up from 12% the quarter earlier).

The boost from external trade is not entirely surprising, given the ongoing, gradual reopening of many major economies around the world, leading to strong demand. Furthermore, activity data on the manufacturing side signaled a strong end to Q2, with June exports accelerating on a year-over-year basis (in USD terms) and industrial production accelerating on a month-over-month basis. Furthermore, though business sentiment indicators have declined somewhat in recent months, they continue to signal expansion in both the manufacturing and services sectors.

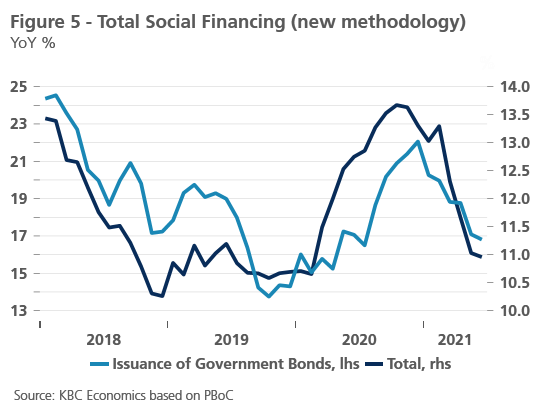

Notably, the Chinese central bank (PBoC) cut the Reserve Requirement Ratio (RRR) for all banks in July by 50 basis points (from 11.0% to 10.5% for large banks, and from 9.0% to 8.5% for medium-sized banks). While the cut had prompted some to anticipate rather weak Q2 GDP figures, the move seems to be rather pre-emptive and reflects China’s advanced stage of the recovery. While the messaging behind the cut conveys a desire to promote lending to small businesses, the decision also signals an end to the marginal tightening stance China has held for the past several months, which was evident through the evolution of credit growth (i.e. total social financing) in the economy (figure 5).

This policy move once again highlights the desynchronized nature of the recovery, as many central banks are only just starting to tighten monetary policy, or even signal that monetary policy may be tightened in the coming years. Meanwhile China’s monetary policy support throughout the pandemic was much more subdued. After reducing the Medium-term Lending Facility (MLF) Rate from 3.25% to 2.95% between February and April 2020 and reducing the Reserve Ratio Requirement for large banks in March 2020, China’s main monetary policy tools have largely remained on hold. However, China did start to tighten policy through other means at the end of 2020, partly reflecting the government’s desire to once again address risks related to growing debt burdens and rising real estate prices. Given China’s advanced stage of the recovery and expectations for some moderation in growth going forward, the RRR cut suggests the authorities are conscious to avoid an overly tight monetary policy stance.

India

India’s economy faced a very difficult start to the year, with its fragile economic recovery getting pummelled by a severe second wave of the pandemic. Daily infections reached a peak at the end of April, meaning the wave started in Q1 and spanned most of Q2. And indeed, in quarter-over-quarter terms, India’s GDP growth slowed significantly from 9.4% in Q4 2020 to 1.2% in Q1 2021, leaving FY 2020 growth at -7.3%. Q2 was likely much worse, with the economy expected to have contracted sizably. Indeed, the composite business sentiment indicator (manufacturing and services), collapsed from 57.3 in February (indicating a strong expansion) to 43.1 in June (indicating contraction).

Meanwhile, inflation has risen in India in May, despite the expected economic slowdown and driven instead primarily by food inflation (but also higher energy prices). Reserve Bank of India (RBI) officials have indicated that the price pressures are seen as temporary, which has since been supported by a stabilisation in inflation at 6.3% yoy in June. Unlike some other emerging markets that have already started to raise rates due to higher inflation, it is therefore likely that the RBI will wait until 2022 to start its hiking cycle. Though Inflation did stabilise in June, a late monsoon season in India could threaten to increase food prices further.

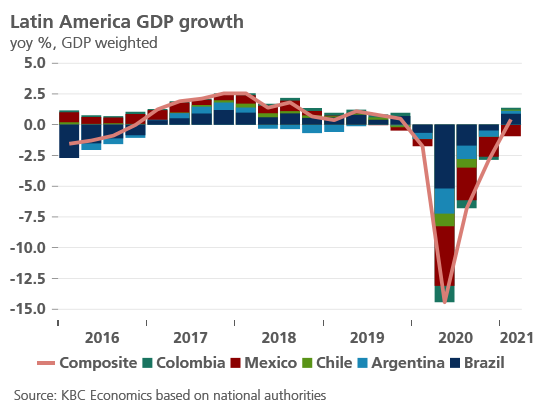

Latin America

The outlook for Latin America is brightening somewhat following a long, difficult end of 2020 and start to 2021. Daily Covid-19 cases are finally starting to subside in Brazil, Colombia, Chile, and Argentina, and the pace of vaccination, though well behind that of advanced economies, has started to pick up, particularly in Argentina and Brazil. While Chile sits on the top of the world vaccination charts behind only Israel, with 59% of the population fully vaccinated (as of 9 July), the country has also only recently started to emerge from lockdown measures reimposed in June. While it is not clear if the most recent wave in Chile was a result of the reportedly lower efficacy of the types of vaccines used, the too-quick reopening of the economy before enough people had received a second dose, or some combination, it is a reminder that most countries in the region are far from leaving the pandemic behind.

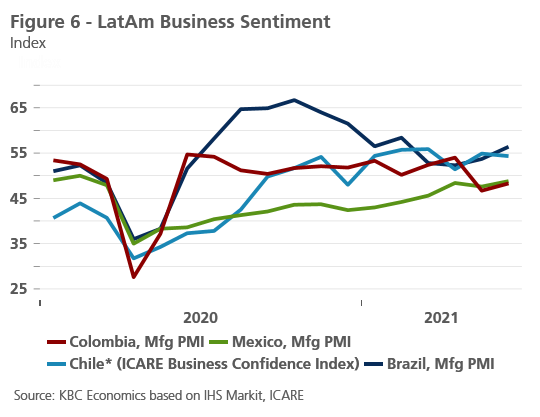

On the economic front, however, the region remained relatively resilient through Q1, with GDP growth supported by industrial production and international trade. This partly reflects that restrictive measures, where implemented, were focused more on contact-intensive sectors and social gatherings. While export growth appears to have moderated somewhat in Q2, it likely remained a supportive factor, especially given important trade linkages between the fast-growing US and several economies in the region. The brightening outlook is evidenced by recent strength, or at least stabilization in business sentiment surveys for the manufacturing industry in the region (Figure 6). In Brazil, this improvement can also be seen in the services sentiment indicator, which rose from a low of 42.9 in April (signaling contraction) to 53.9 in June (signaling expansion).

Though the economic outlook is improving, there are still many risks to the downside. Apart from the pandemic, rising inflation pressures are a key point of concern. As mentioned above, Brazil and Mexico both recently increased rates in response to inflation increasing above their respective inflation targets (Brazil: 8.4% yoy in June vs. a target upper-bound of 5.25%, Mexico: 5.9% yoy in June vs a target of 2.0%). However, whereas Mexico’s year-over-year inflation has somewhat stabilized in recent months, Brazil’s continues to rise. This is one of the main reasons the Brazilian central bank has initiated a full hiking cycle (with already 225 basis points of hikes so far this year), while the Mexican central bank raised rates by only 25 basis points and did not give a clear indication that further rate hikes would follow.

EMEA

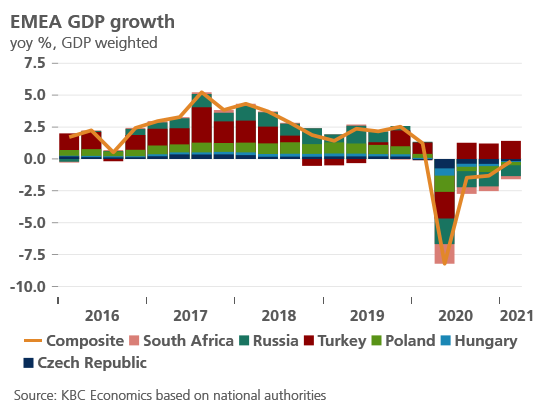

Central and Eastern Europe

The Central Eastern European (CEE) region saw a rapid slowdown of the Covid-19 pandemic in Q2 2021, highlighted by sharply falling infections, hospital admissions and deaths. Against the background of the improving virus situation, containment measures have been gradually relaxed across the CEE countries despite the emergence of new virus variants. That said, the authorities believe that quickly advancing vaccination rates (together with a sizable share of the population that has already contracted the virus) will allow them to manage another possible spike in Covid-19 cases with much less damage inflicted on both human health and economic performance compared to the past year.

A resilient industrial sector, a gradual reopening of the services sector, ongoing fiscal support and the recovery in external demand have all led to strengthening underlying economic activity across the CEE region. As a consequence, we expect that the second-quarter real GDP data will show some improvement compared to the lockdown-dominated first quarter of 2021. According to our forecasts, 2021 real GDP growth in the region should range between 3.5% in the Czech Republic and 6.7% in Hungary. We expect that the regional economies will maintain similar momentum also in 2022.

A rapid recovery of both domestic and external demand conditions, combined with the limited capability of suppliers to meet the upsurge, help – next to the observed energy inflation - explain the recent acceleration of inflation in the whole CEE. The central banks’ responses to stronger inflationary pressures has, however, not been uniform. The National Bank of Poland has not announced any policy tightening yet, although headline inflation picked up to 4.7% yoy in May. The Hungarian central bank commenced a tightening cycle (with a rate hike) at the end of June. Finally, the Czech National Bank also started a tightening cycle with a 25-bps rate hike in June with particularly hawkish forward guidance, despite the fact that the build-up in inflationary pressures has been relatively moderate by regional standards.

Russia

Economic activity in Russia strengthened in the second quarter of 2021, indicated by strong momentum in both retail sales and industrial production. Following a 1.3% yoy decline in real GDP in the first quarter, the Russian economy is on track to recover to the pre-pandemic level already in the second quarter of 2021. Overall, the economic recovery from the pandemic has so far proved more robust than initially envisaged. A renewed infection wave combined with a sluggish vaccination rate nonetheless poses a notable downside risk to the post-pandemic recovery.

Stronger-than-expected domestic activity, coupled with external price pressures (reflecting mainly global commodity and FX factors) has led to strong inflationary pressures with headline inflation jumping to 6.5% yoy in June, well above the Central Bank of Russia’s 4% inflation target. Moreover, the upside surprises in inflation prints are accompanied by a spike in inflationary expectations by households and corporates, reinforcing the CBR's hawkish stance. Since early 2021, the central bank has delivered a front-loaded tightening cycle, bringing its key rate up by 125 bps to 5.5%. Furthermore, the CBR has given guidance for further rate hikes, implying the level of interest rates moving above the long-term neutral range of 5-6% estimated by the CBR. All in all, we see 6.5% as the end-2021 target for the key rate, however, the risk to our interest rate forecast is significantly tilted to the upside.

Turkey

In Turkey, the economy expanded 1.7% qoq in the first quarter of 2021, maintaining strong momentum from the previous quarter despite lockdown measures in place. Activity remained on a solid footing heading to the summer months, aided by the easing of some containment measures and the progress on the vaccination front. Still, we expect some slowdown in growth performance in the remainder of the year, in large part due to the delayed effect of the tighter financial conditions.

Meanwhile, headline inflation continues to exceed expectations, surging to 17.5% in June, following two consecutive months of downside surprises. Strong inflationary pressures are fueled by higher import prices, reflecting a weaker lira and higher energy prices, and the strong domestic demand conditions, helped by the reopening of the economy. Against this background, the Central Bank of Turkey (CBRT) maintains a tight monetary policy stance with its key interest rate at 19.0%. While there remain significant macroeconomic and political uncertainties, we maintain the view that the CBRT will start its easing cycle in late Q3/early Q4 2021 with the help of a base effect-driven fall in headline inflation.

South Africa

Following a relatively resilent Q1 2021 (1.1% quarter-over-quarter growth), South Africa likely saw a strong start to Q2 before a new wave of the pandemic disrupted momentum. The composite business sentiment survey indicator reached a peak of 53.7 (strong expansion) in April, and has since declined to 51 in June (still an expansion, but less strong). Over the same period, daily Covid-19 cases have risen sharply, surpassing their previous peak and not yet showing any signs of slowing. Meanwhile, South Africa has one of the lowest vaccination rates among major emerging markets (less than 7% of the population has recieved one shot as of 10 July). Mobility has subsequently declined since the beginning of June. Hence, it is likely that Q2 was somewhat weaker, and the economy is facing further headwinds going into Q3.

Tables and Figures

Outlook emerging market economies

NOTE: Forecasts are those prevailing on 14 June 2021