Emerging markets quarterly digest: Q2 2020

Read the publication below or click here to open the PDF.

Emerging markets quarterly digest: Q2 2020

A sharp shock for emerging markets

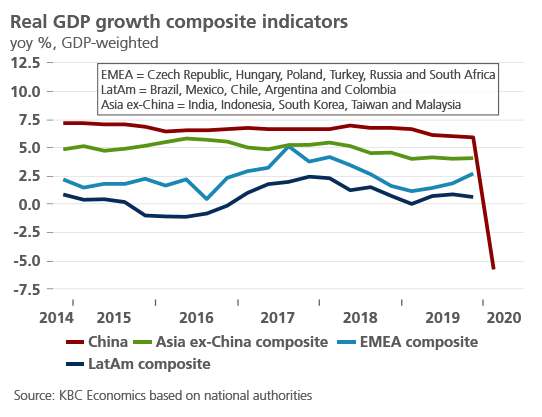

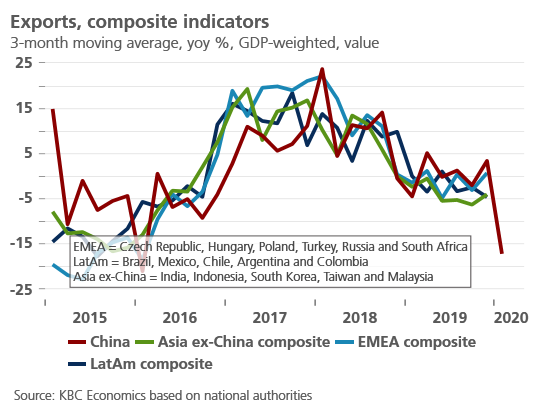

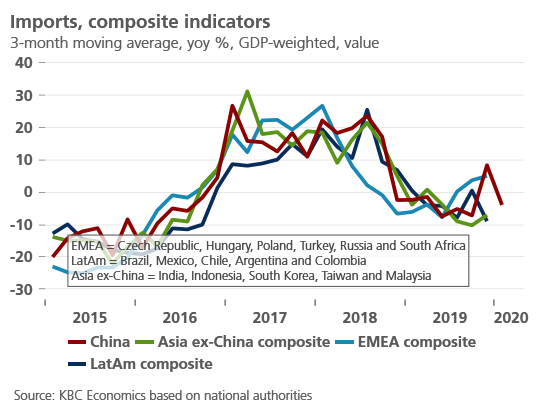

As is the case nearly everywhere in the world, the Covid-19 shock to emerging markets has been sharp, swift in its onset, and unprecedented. In many ways, however, the impact on emerging markets, from both a public health and economic perspective, may be even more severe and longer lasting than what’s expected in advanced economies. Weaker public health systems, higher inequality and poverty, more limited fiscal space, and external vulnerabilities are factors that may exacerbate the coronavirus shock for many emerging markets. The sharp reversal in capital flows seen since the beginning of the year will only amplify these problems. Not all emerging markets fit the same picture, however. Some have better macroeconomic fundamentals and fewer external vulnerabilities, which will allow them to experience a more pronounced and dynamic rebound after the health crisis subsides. In particular, emerging Asia appears to be in a much better condition to face the current shock compared to other emerging markets. Furthermore, while times ahead may be very turbulent, with smaller, more vulnerable countries likely facing funding pressures, we expect that international players such as the IMF, World Bank and major central banks will step in as needed to prevent a systemic crisis that would threaten to derail the post-coronavirus global economic recovery. Indeed, we are already seeing first signs of such international coordination as the G20 has agreed to a moratorium on debt payments for low income countries.

Vulnerable to the virus spread…

The spread of Covid-19 is first and foremost a public health crisis, but it is a public health crisis with a severe impact on the economy. Keeping infection rates down and containing the spread of the virus is a first and crucial step for being able to get an economy back on track. For this reason, the weaker state of public health systems in many emerging markets is concerning. India, Indonesia and Colombia stand out in particular in terms of having a very low count of hospital beds per person and low per capita expenditure on health according to the World Bank. What’s more, World Bank data also suggests that 35-40% of the population in those three countries do not have basic handwashing facilities available at home. This figure is even higher for South Africa at 56%. This will of course make it far more difficult for these countries to combat the spread of the virus.

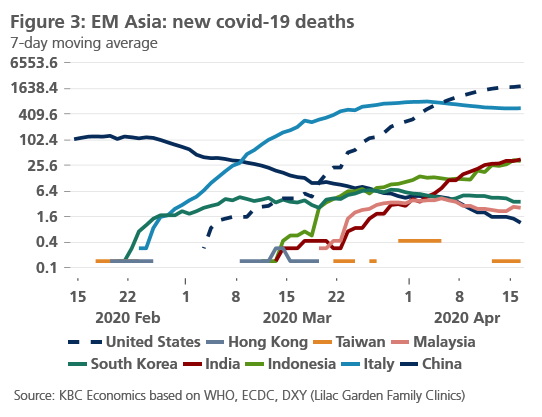

It is important to note, however, that not all economies can be painted with the same broad stroke. Many countries in Asia, such as Taiwan and South Korea, were clearly better prepared to address such a pandemic and have kept the spread of the virus relatively more contained compared to the rest of the world, at least in the short term. In China as well, the spread of the virus was mostly contained to the province of Hubei and has so far not spread rapidly elsewhere. In contrast, the trajectories in Latin America and countries like Turkey, Russia, India and Indonesia are more worrisome.

… and vulnerable to investor sentiment

Emerging markets are currently facing severe bond and equity outflows as investor sentiment has drastically soured since the beginning of the year. Data from the IIF suggests that the current capital flows squeeze is far more severe than during previous stress periods, including during the 2013 taper tantrum and the global financial crisis. While capital flows are expected to recover in the second half of the year, overall flows will likely end the year far lower than where they were in 2019.

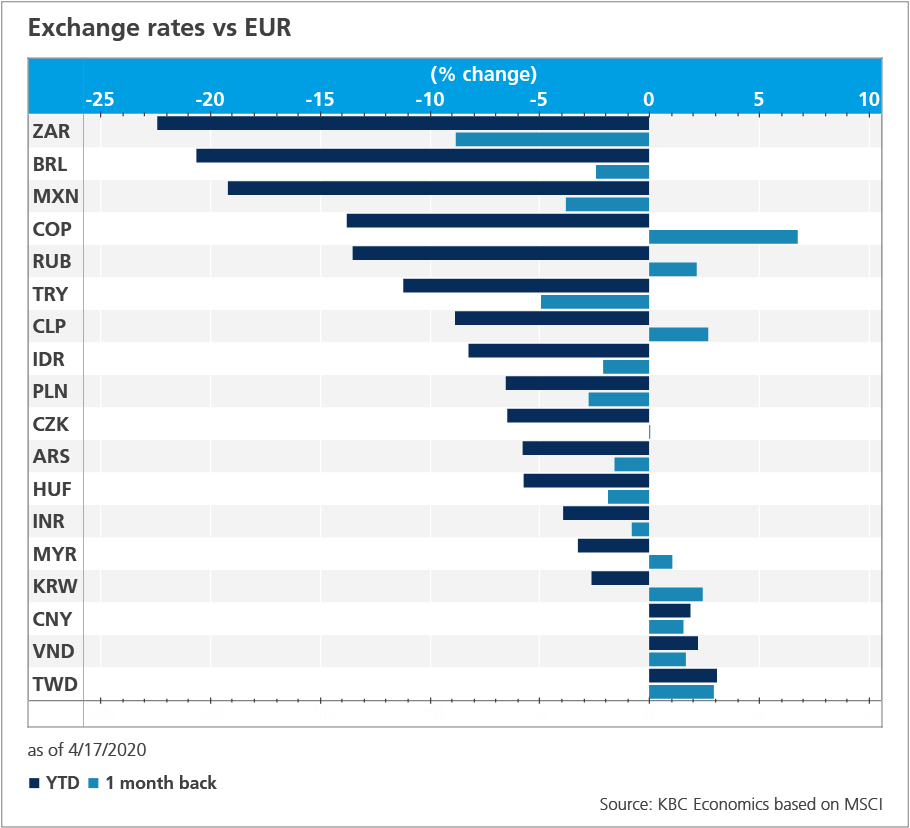

The sudden stop in capital flows is putting significant pressure on those economies with external vulnerabilities such as wide current account deficits relative to GDP (figure 1). Colombia, Chile, South Africa, Brazil and Indonesia stand out in this respect. Wide current account deficits will likely have to be closed abruptly, which often entails cutbacks in government spending, lower business investment, and therefore lower growth (if not a steep recession). Thus, financial market developments spill over into real economy problems, causing factories to close, unemployment to increase, and generally making it especially difficult for these countries to recover swiftly from the current economic downturn. But again, country specific differences are important. Brazil tends to have a more stable investor base compared to say, South Africa, while Chile has access to funding through the presence of multinationals. Furthermore, Taiwan, Vietnam, Thailand, South Korea and Malaysia all record comfortable current account surpluses. Their currencies, while still weaker compared to the start of the year relative to the US dollar, have so far fared far better throughout the coronavirus crisis.

It is for a similar reason that countries with limited fiscal space as measured either by an already wide public deficit or relatively high government debt, are also at higher risk of seeing steeper and more prolonged repercussions from the current crisis. This is particularly true in Latin America, but less the case in emerging Asia. Governments around the world are using what fiscal space they have to both fight the spread of the virus and to combat the negative economic consequences of lockdown measures. Such policy responses include substantial new funding for business, unemployment benefits and health systems. Countries like South Africa, Brazil and India, however, with fiscal deficits relative to GDP of 6.2%, 7.5% and 7.5% respectively (according to IMF estimates), have less space to implement sweeping supportive policy measures and thus face the risk of a more difficult recovery path.

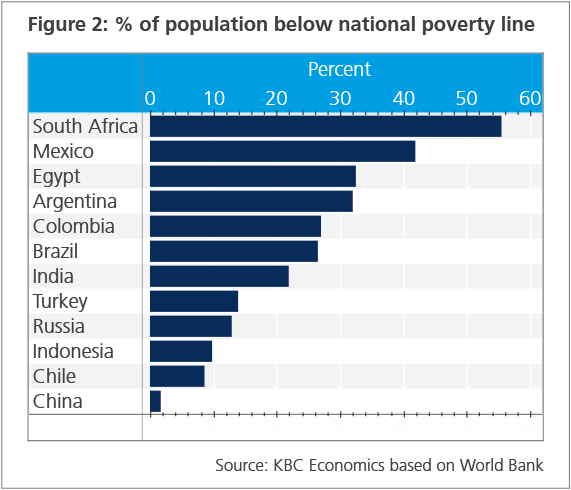

Relatedly, a number of structural issues facing certain emerging markets will also exacerbate the economic impact of the Covid-19 shock and could hamper the eventual recovery path. In particular, high poverty and inequality will hinder the actual fight against the virus. Furthermore, it will make it more difficult for businesses and individuals to weather the coronavirus storm, as the percent of the population with savings will be much lower, and the likelihood of second round economic impacts are higher. In this respect, South Africa, Mexico, Egypt, Argentina, Colombia and Brazil stand out (figure 2). These countries, as well as Indonesia, India, and Chile, also have a high share of employment that comes from the informal sector. This means a high share of the population lacks social protection and may find it harder to access unemployment benefits at a time when unemployment is skyrocketing. Businesses in the informal sector will also find it more difficult to access financing. On a more positive note, anchored inflation expectations in many emerging markets has given central banks space to ease policy rates. Inflation is expected to come down significantly in most emerging markets in 2020 given the precipitous fall in demand but should normalize in 2021.

An international response

Central banks and governments around the world and particularly in advanced economies have introduced substantial new policy to help fight the coronavirus, provide market liquidity and help position economies to rebound significantly once the government lockdowns are lifted. We think that this ‘whatever it takes’ approach will apply on an international level to prevent trouble in emerging markets from devolving into a systemic crisis. Specifically, we think that the IMF with the support of the international community will provide support as needed. In other words, governments and central banks have already gone to great lengths to support their respective economies, and it is unlikely that they will allow a crisis among emerging markets to derail the hoped-for recovery. Indeed, the G20 has already announced a moratorium for lower income countries on bilateral government debt payments. This will take some pressure off of lower income countries as cash flow can be prioritized towards fighting the health crisis rather than servicing debt.

Emerging Asia

As mentioned above, several countries in Asia have managed to keep the spread of the coronavirus relatively contained compared to, for example, the US and certain countries in Europe (figure 3). This is not to say that these countries are unaffected by the Covid-19 crisis. Even in Taiwan, where the official response has been widely lauded as among the best in the world, a sharp recession is expected in 2020 (the IMF estimates growth will contract by 4%). Furthermore, countries that were able to hold off on full economic lockdowns by implementing widespread testing and tracing programmes have also eventually turned towards stricter confinement measures. Still, the apparently more proactive and effective health responses in these countries should help their economies better weather the storm and should help restore confidence faster once the storm has passed.

Furthermore, several Asian emerging markets are in a significantly better position when it comes to external vulnerabilities. In Thailand, Malaysia, South Korea, China, Vietnam and Taiwan, the current account is in surplus. Government debt levels are also in fairly good shape, with debt-to-GDP ratios at or below 55% in most cases. China may be the exception to this, for although its public debt ratio is only 55% of GDP, contingent liabilities in the form of the debt of state-owned enterprises and local governments brings this figure much higher. Altogether, however, emerging Asia appears to be in a much better condition to face the Covid-19 crisis compared to other emerging markets.

China

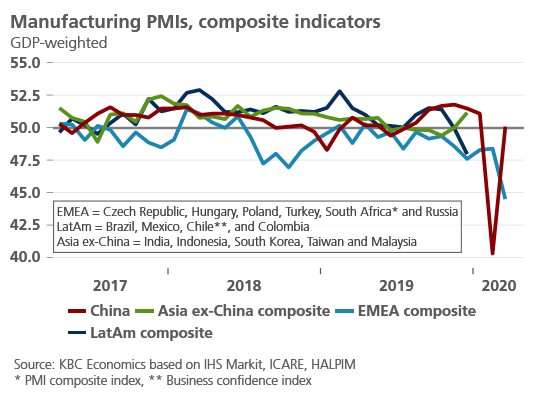

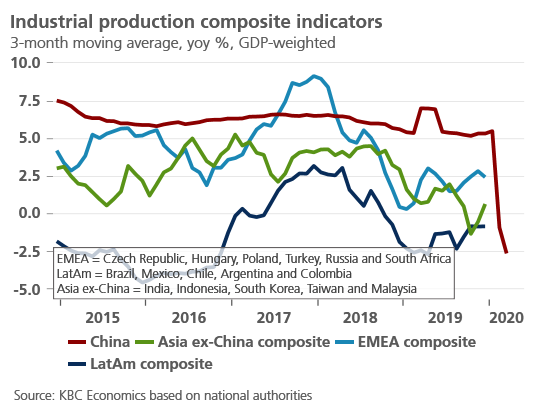

China can be thought of as the ‘first in, first out,’ economy in terms of dealing with the Covid-19 crisis. It implemented major lockdowns throughout most of the country in late January. While many of those lockdowns were lifted in mid-February, in Wuhan, the epicentre of the virus for China, the strict travel ban on the city was not lifted until early April. February indicators for industrial production (-13.5% yoy), investment (-24.5% ytd yoy), vehicle sales (-79% yoy) and retail sales (-20.5% ytd yoy) all suggest that the economic hit during the lockdown was severe. The economy has since started to reopen, and though confidence in the services sector remains weak, March data suggests that a gradual recovery is already underway, particularly on the industrial side. Vehicle sales, for example, still contracted -43% in March compared to a year earlier, but in month-over-month terms this constituted a growth rate of 361% compared to February (vs -83% mom in January and -27% mom in January). What these figures suggest is that while the relative bounce-back after the lockdown can be strong, in terms of output levels, it will take more time to return to the pre-covid-19 scenario. Further March data also reflect the fact that while businesses and factories have reopened, consumers are still very cautious. Retail trade, for example, contracted sharply again in March (-19% ytd yoy).

Overall, the Chinese economy contracted 6.8% yoy in the first quarter, down from 6% yoy growth in the last quarter of 2019. Given the reopening of the economy and some hopeful signals, particularly from the industrial sector, we expect Chinese real GDP growth to start to recover already in Q2. But growth in year-over-year terms will remain weak compared to China’s previous growth path. This reflects technical dynamics after a steep plunge in Q1, but also the fact that there are reasons to be cautious; the threat of a new wave of Covid-19 cases is still a risk, the very weak growth we expect globally in Q2 will weigh on China’s growth, and confidence will likely be slow to fully recover, which will weigh on the ever more important consumer sector. Overall, we expect China to grow only 1.6% in 2020 with risks to the downside, but we expect a strong growth recovery to follow in 2021.

India

In India, a country-wide lockdown has been extended until 3 May, as the spread of the virus remains on a worrisome trajectory. The recovery that was underway at the end of 2019, after several quarters of slowing growth is now completely off the table. India’s composite PMI dropped from 57.6 in February to 50.6 in March and can be expected to drop even further for April, especially since the initial lockdown was only announced on March 24th. The Indian government has announced a stimulus package worth 0.8% of GDP, which will add to India’s already substantial public deficit, but even more support may be necessary. Meanwhile the central bank (Reserve Bank of India) has reduced the repo rate from 5.15% to 4.4%. These efforts won’t be enough to stop the economy from contracting sharply in Q2, but we expect a strong recovery thereafter. Overall, we expect India to grow only 0.6% in 2020 before recovering to 11.9% growth in 2021.

Latin America

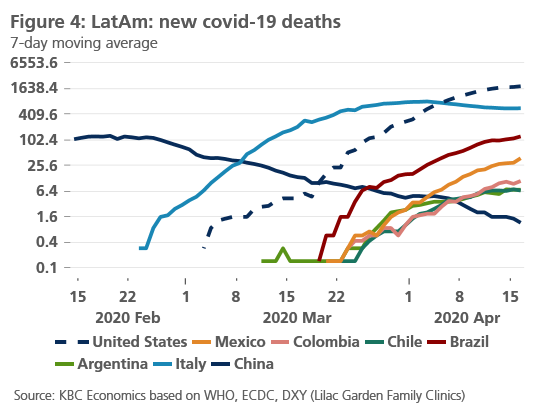

The trajectory of the spread of Covid-19 is particularly worrisome in Latin America (figure 4). Several countries such as Brazil, Mexico and Chile were on the slower side in terms of implementing shut down measures. But most governments have now introduced some form of a lockdown or state of emergency, and many economies in the region are suffering the double hit of the Covid-19 crisis and very low oil prices.

Across the region, monetary policy rates have been lowered and new fiscal support has been passed. However, the many vulnerabilities mentioned above apply especially to Latin America, and it will be difficult for the region to recover as swiftly as we expect elsewhere. Current account deficits are wide, fiscal space is low and several structural issues have led to lower potential growth in a number of countries. Indeed, the region has been struggling to regain growth momentum for several quarters. In 2019 growth in Mexico was flat, in Chile and Brazil it was a paltry 1%, and in Argentina the economy continued to contract 2.2%. Small signals of more steady growth at the end of 2019 are now completely off the table. In general, all countries in the region are expected to enter a deep recession this year before recovering next year. However, the recovery is likely to be stronger in countries with stronger macroeconomic fundamentals like Chile and Colombia compared to countries like Mexico, Brazil or Argentina.

EMEA

Central and Eastern Europe

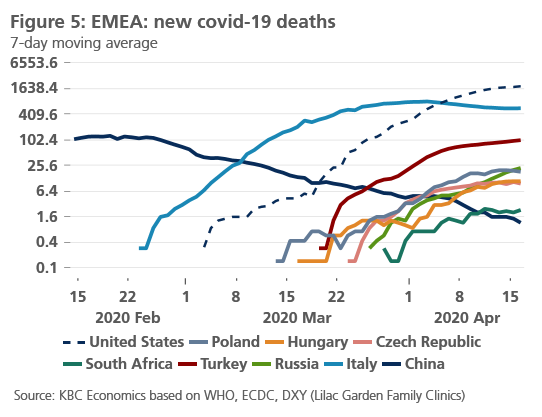

Central and Eastern Europe has been hit hard by the corona crisis too. Although the figures concerning the spread of the virus in the Central and Eastern European region are not as dramatic as in Western Europe (figure 5), it is clear that the region will suffer from an unprecedented growth decline due to hits to the domestic economies in combination with negative international spillovers. We expect the region to follow a similar growth decline and recovery path as the euro area, although the recovery is likely to be somewhat slower. We’re confident that policy initiatives will boost the recovery. However, some specific features of the region’s economy are likely to slow down the recovery. In particular, the strong dependence on multinationals, which may favour recoveries in their headquarter markets first, may lead to a slower recovery in the region. In addition, the relatively strong focus on the automotive industry, which is confronted with structural issues like declining global demand and technological transitions, is also expected to cause a slower recovery path. In our base scenario we still believe that the substantial growth decline in 2020 will be substantially compensated by the recovery in 2021.

In Central and Eastern European countries with their own floating currencies and independent monetary policy, the first logical step was reducing the official interest rates. Comparing across the region, the Hungarian and Polish central banks are the most aggressive and creative ones in their fight against the economic downturn. In particular, both central banks introduced schemes targeting, directly or indirectly, domestic private companies. Whether monetary stimulus will be further expanded will depend on the development of the pandemic, which seems to be quite hopeful in particular in Central Europe. Nevertheless, as the region is yet to be fully hit by the corona crisis, central banks are ready to use their remaining ammunition for further monetary easing if necessary.

Russia

Russia is currently experiencing one of the sharpest increases of Covid-19 confirmed cases across the globe, which prompted an extension of a nation-wide shutdown until end-April. Strict quarantine measures are taking a heavy toll on domestic economic activity as shown by the March PMI readings' crash to an all-time low. While Russia has relatively limited exposure to the global economy through trade and services links, the collapse of oil prices and sharply lower oil output under the new OPEC+ deal is causing another blow to the economy.

On the positive note, Russian authorities have spent the last couple of years rebuilding buffers and the economy is now more resilient to external shocks than during the 2015-2016 downturn. With low government debt and more than 10% of GDP liquid assets in the National Welfare Fund, Russia has significant policy space. Still, the government response to the corona crisis has been so far relatively modest compared to international standards with fiscal stimulus accounting for only around 1% of GDP. This might be a limiting factor in post-coronavirus recovery. Overall, in 2020 we expect the Russian economy to contract by 4.9%, followed by a rebound of 2.9% in 2021.

Turkey

Turkey has followed a relatively gradual and mostly partial lockdown strategy to combat the spread of coronavirus. Given that Turkey’s economic activity was hit much later than in other countries, real GDP growth in the first quarter is still expected to be strong. The major disruption in economic activity should be concentrated in the second quarter in the face of a substantial hit to both domestic and external demand, followed by a gradual recovery during the second half of 2020 and 2021. This should bring the annual real GDP growth to -6.5% this year and 4.7% in 2021.

Although both fiscal and monetary policy have been expansionary already since the 2018 currency crisis, the recovery is set to be supported by further loosening of the macroeconomic policy mix. This will include tax relief, direct cash support or wage support to companies on the fiscal front; on the monetary policy front, the Turkish central bank already reacted by lowering its key interest rate and more importantly decided to embark on a quantitative easing programme to support government financing.

South Africa

South Africa faces a severely deteriorated outlook in the face of the Covid-19 crisis. The economy barely grew in 2019 (0.2%) and was expected to post a modest recovery in 2020. However, the spread of the coronavirus and the subsequent economic consequences have put all hopes for growth off the table. Instead South Africa is likely facing a very steep recession in 2020 and a less robust recovery compared to what is expected elsewhere in 2021. The several structural issues and vulnerabilities mentioned earlier are the reason for this pessimistic outlook. South Africa has a very wide current account deficit, limited fiscal space, high inequality and poverty, infrastructure bottlenecks, unreliable electricity supply, and significant contingent liabilities related to state owned enterprises like ESKOM. Prior to the crisis, South Africa faced a deterioration in its debt sustainability outlook, and its recent loss of investment grade status will hinder the recovery in capital flows in the second half of the year. All of these issues weigh on South Africa’s potential growth during normal times and will make it even more difficult for the country to recover from the Covid-19 shock.