Emerging Market Digest: October 2023

Content table:

Read the publication below or click here to open the PDF.

Fed uncertainty keeps emerging markets on their toes

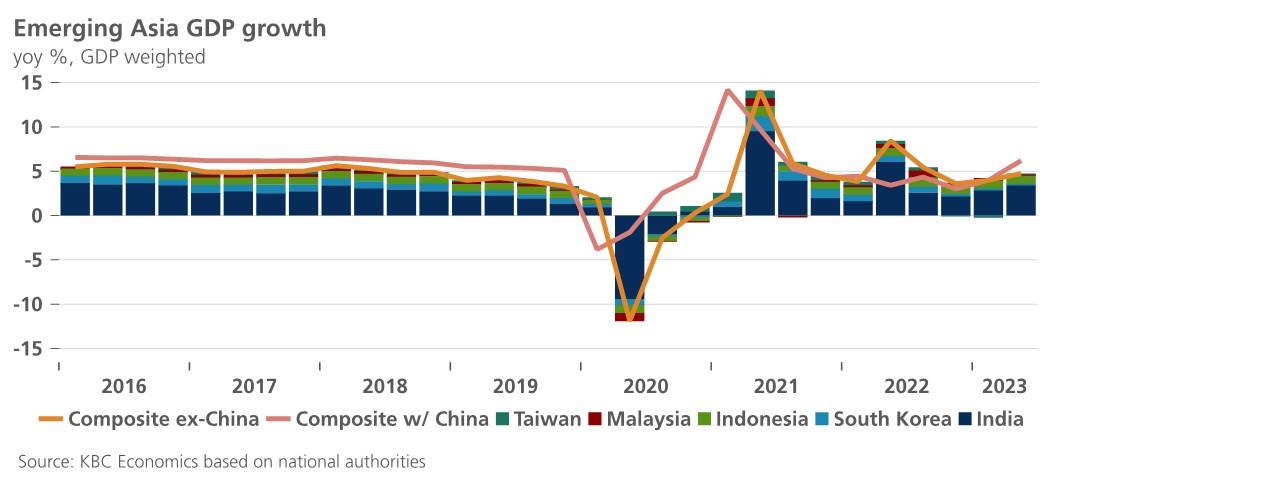

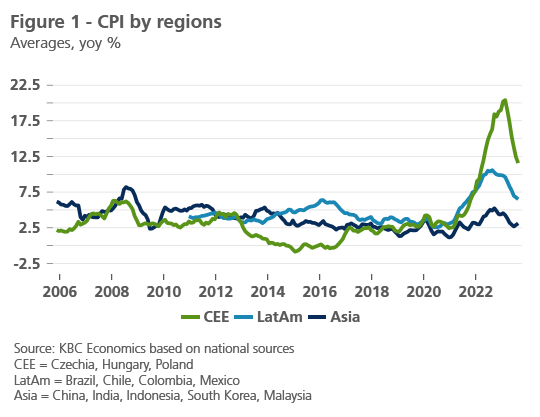

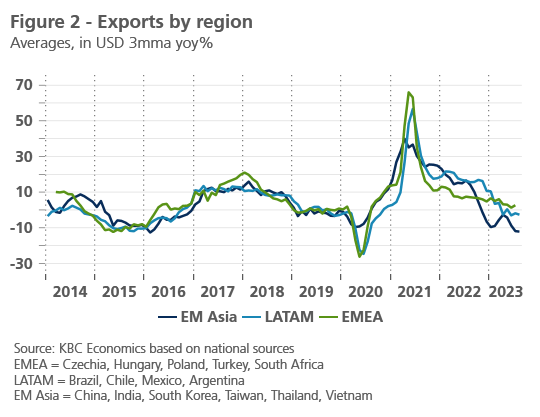

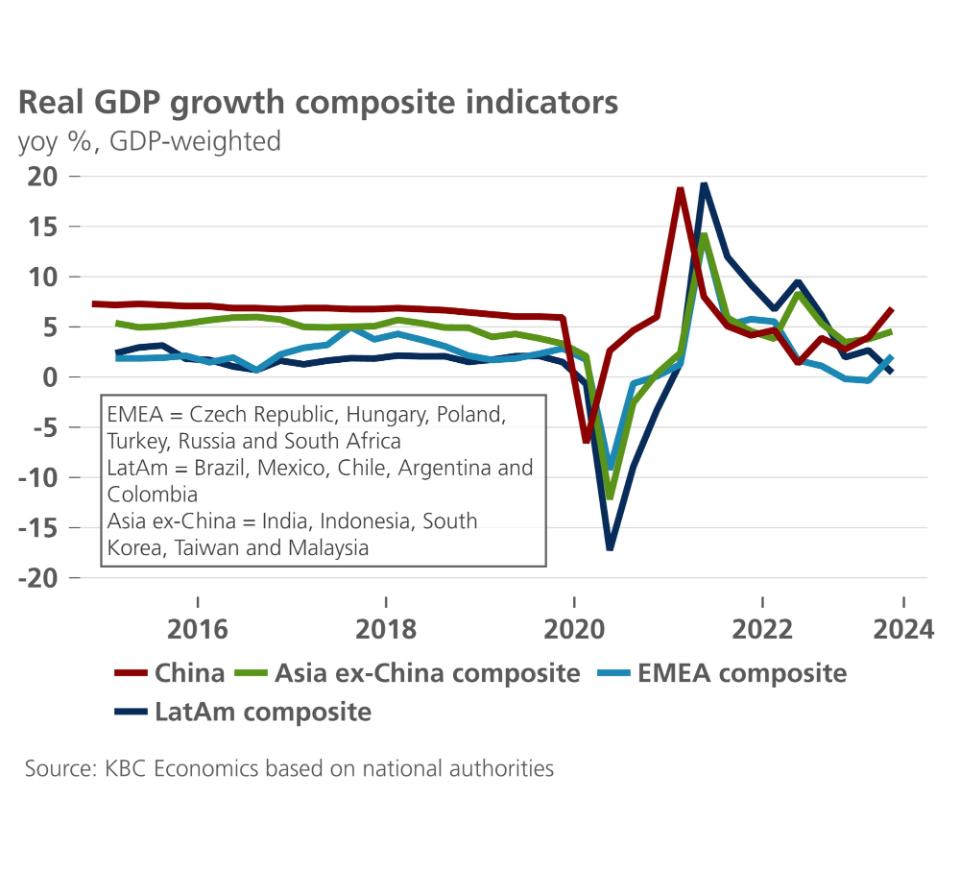

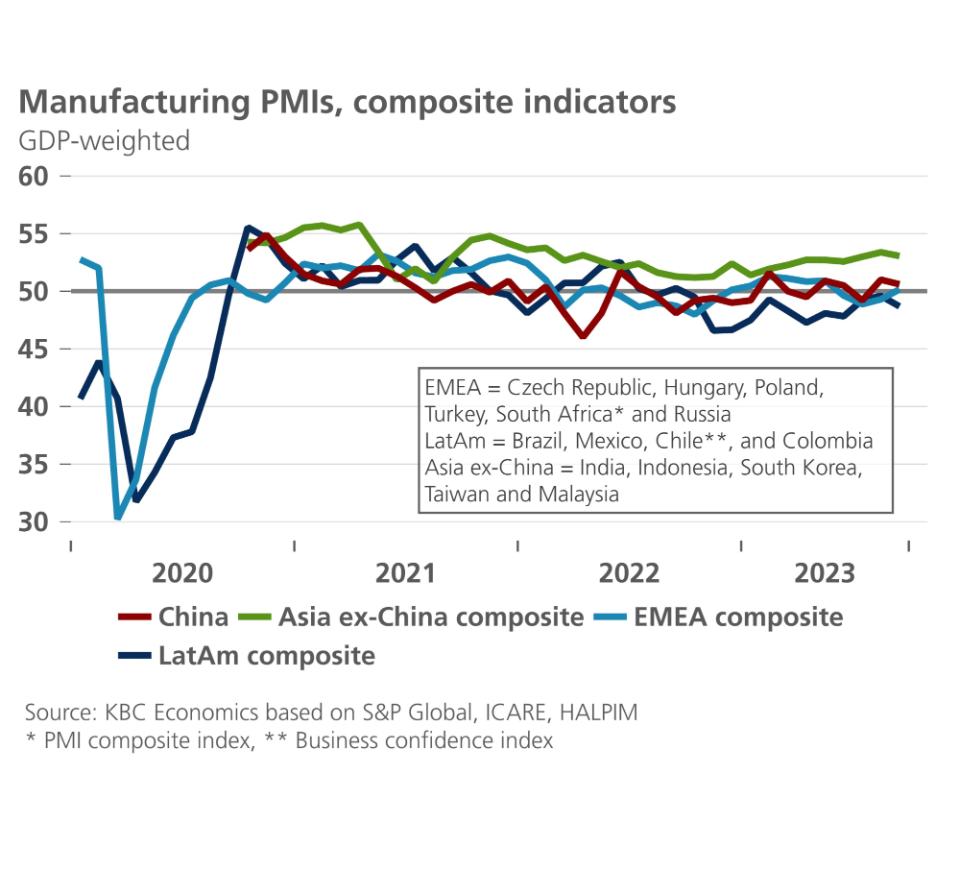

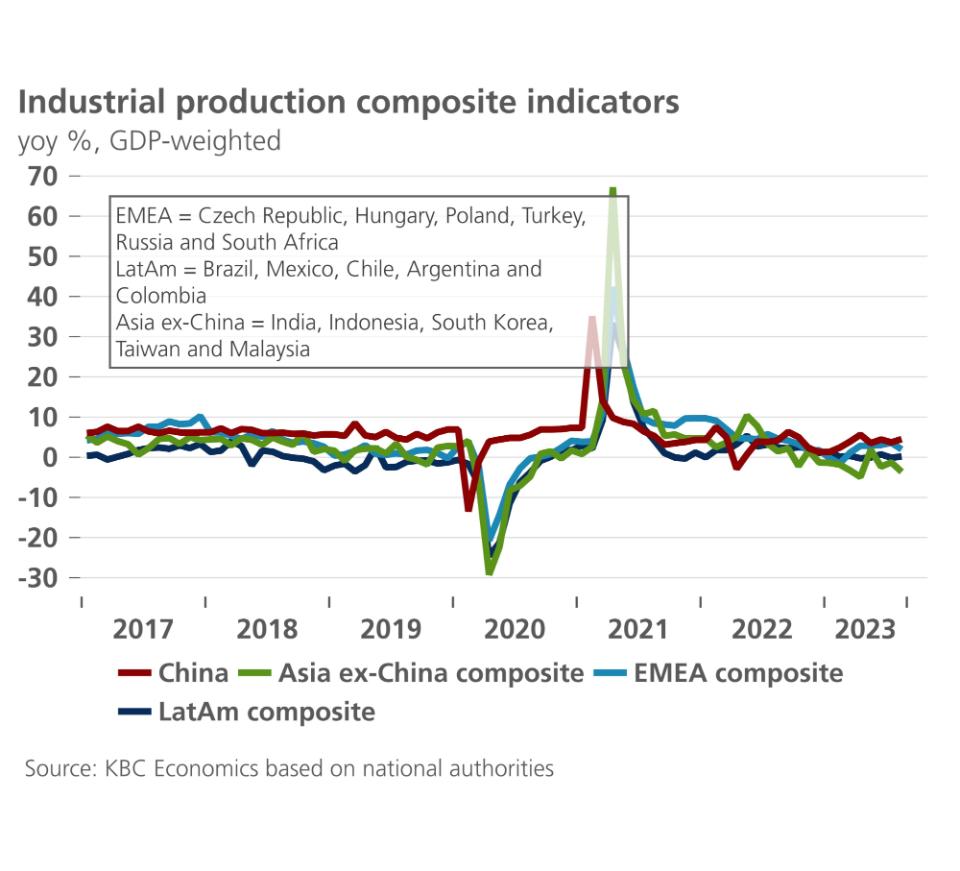

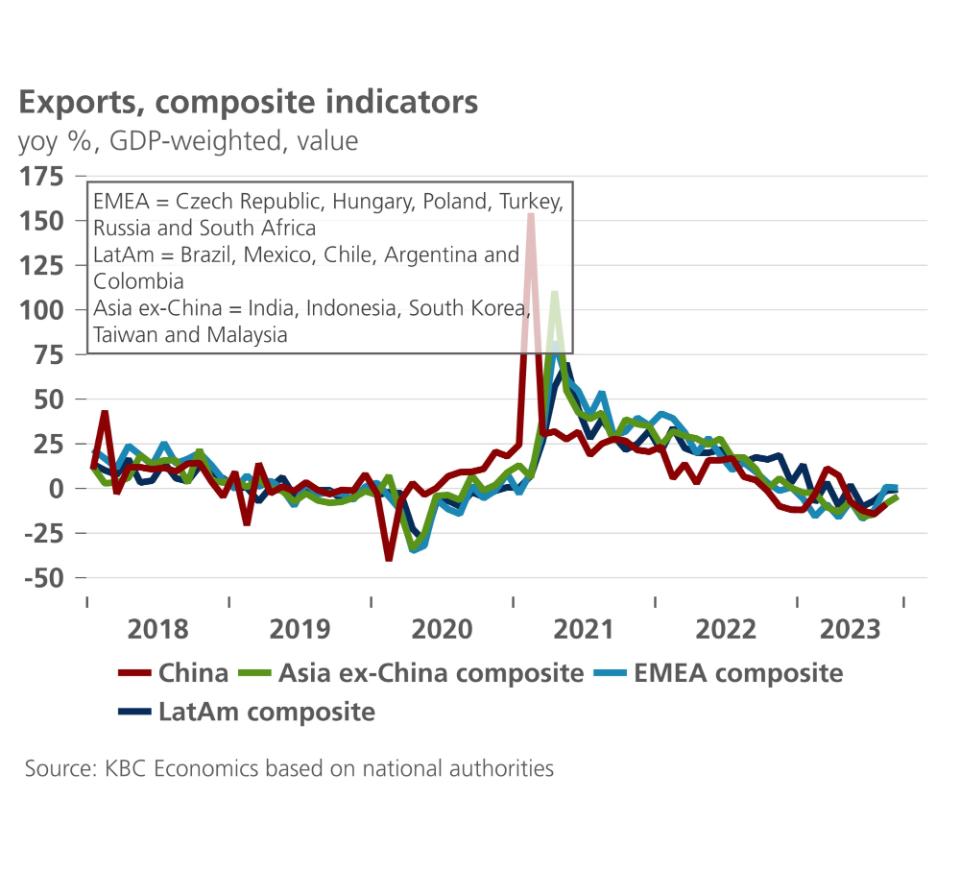

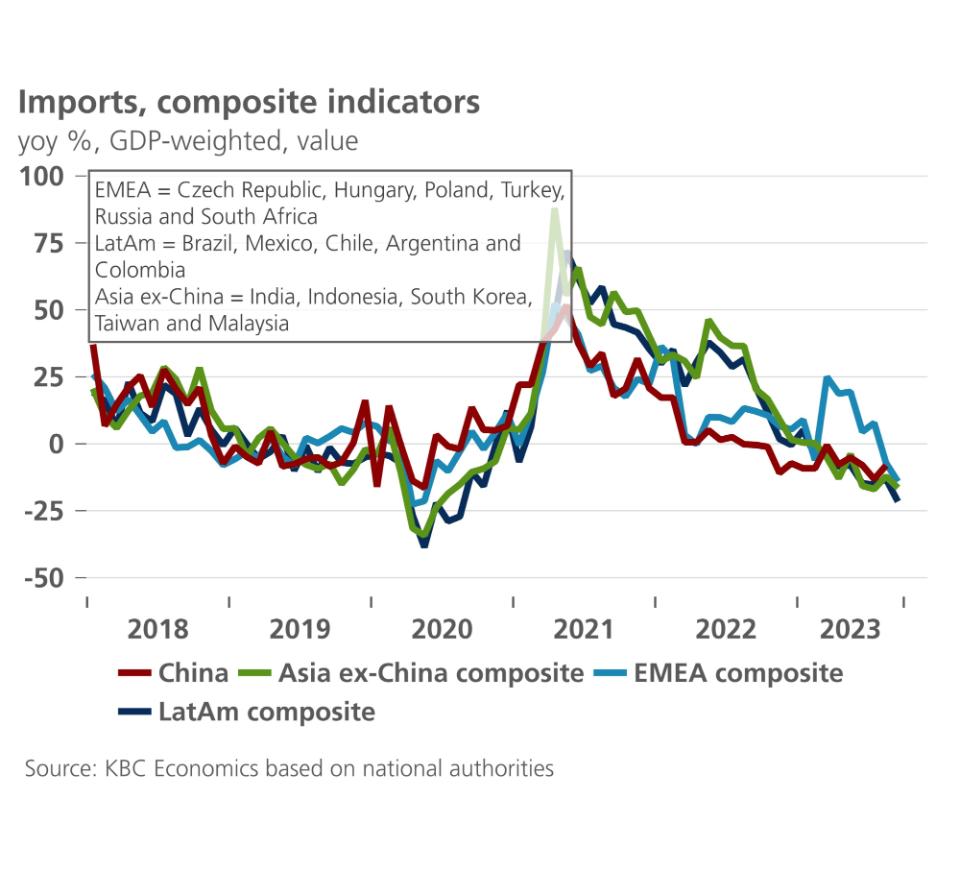

The global environment remains complicated for most emerging markets. Though inflation is generally and gradually trending down, increasing energy prices in recent months could put headline figures on a temporarily bumpy path (figure 1). Meanwhile, growth in the major economies is either slowing (Europe and China) or expected to slow (the US), which is weighing on some emerging markets’ export performances (figure 2).

And while many emerging market central banks that were leaders in the latest tightening cycle have now paused or are even already loosening policy, their path forward is complicated by recent events, specifically, the Fed’s so-called hawkish pause, in which it emphasised that there remain upside risks to its policy rate path and that the policy rate is expected to be higher for longer. Together with a string of positive data out of the US, this has led to a renewed surge in global yields and the strengthening of the US dollar. This puts pressure on smaller central banks that need to balance financial stability risks with supporting growth as inflation slowly subsides. The higher interest rate environment especially puts pressure on those emerging markets with already sizable external vulnerabilities such as a high (external) debt load.

However, the relatively complicated landscape also means that there is no overriding trend apparent in the current emerging market outlook. Some emerging markets are seeing resilient growth amid the global slowdown. On the policy front too, while some central banks have started or are soon hoping to start policy easing, others will likely remain on hold for quite some time still, suggesting macroeconomic and macro-financial divergence is increasingly becoming the theme of the day.

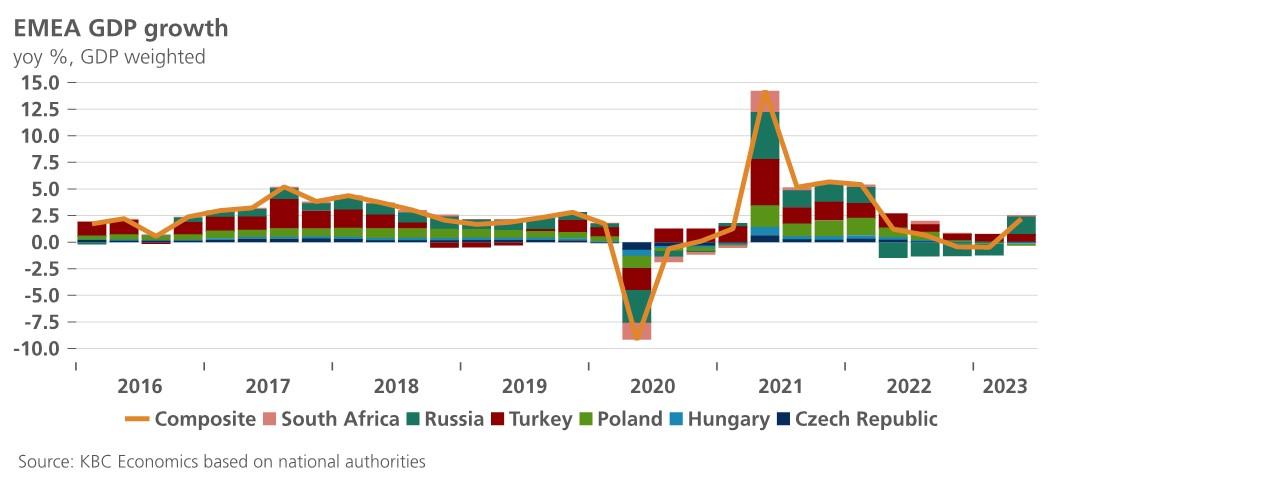

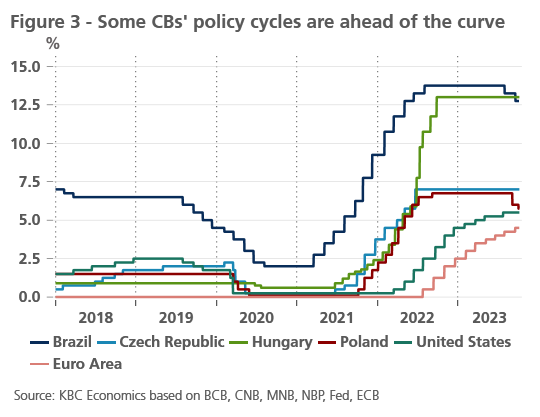

Diverging but difficult policy landscape

The general trend for most major economies since 2021 has been a tightening of monetary policy in order to counteract the past sharp rise in inflation. Hiking cycles have not been completely synched-up, however, with many emerging market central banks, such as in Brazil, Hungary, Poland and Czechia, hiking rates well before the Fed or ECB in the face of more binding market pressure. Those early leaders also reached their policy rate peaks much sooner than the Fed or ECB (figure 3). Some have already begun loosening policy once again and sometimes at an aggressive pace.

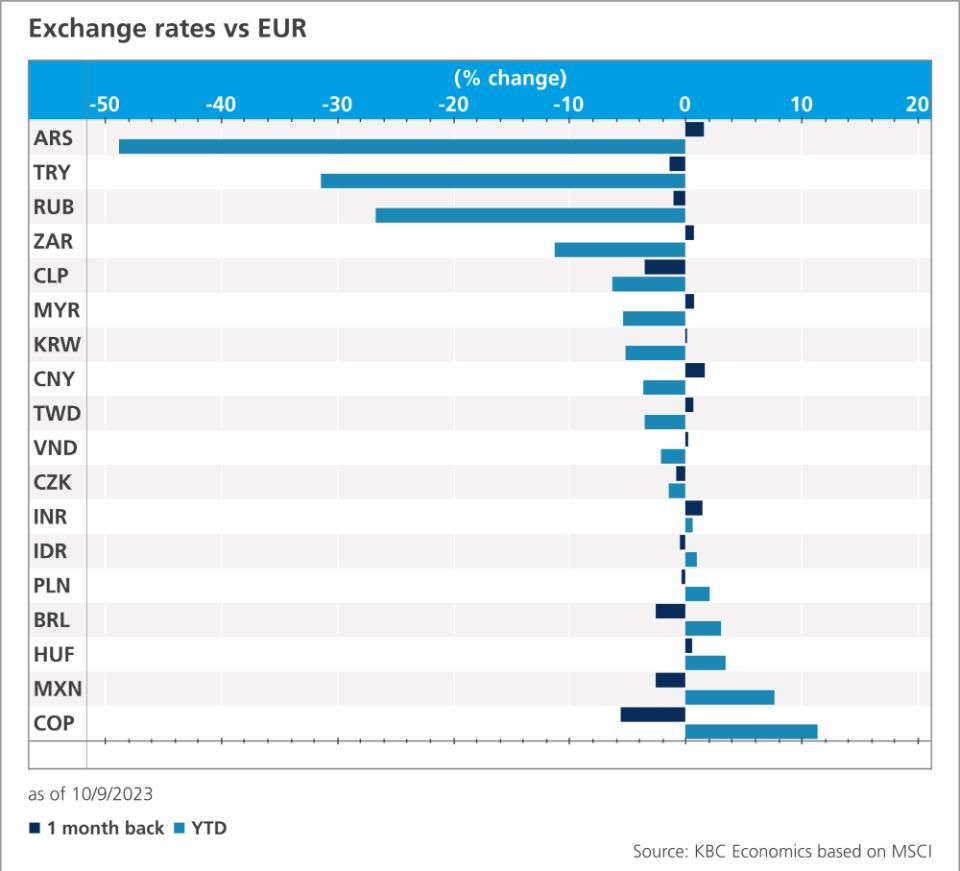

The Polish central bank, for example, surprised markets on 6 September with a 75-bps cut to the policy rate (to 6%), which sent the zloty 5% lower against the US dollar (as of 3 October) (for a detailed analysis on that rate cut see: The NBP fights a drop in demand, but the economy might say the opposite (kbc.com)).

Meanwhile, Brazil’s COPOM has lowered the SELIC rate by 100 basis points since 2 August to 12.75% (with two 50-bps cuts). The BRL depreciated roughly 3% against the USD in the week following the first rate cut and then appeared to stabilise, even though another 50-bps cut at the next meeting was widely anticipated by markets. That next COPOM meeting (and indeed another 50-bps cut) came, however, just a day after the Fed announced its ‘hawkish pause’. The BRL has since depreciated 5.5% against the USD as of 3 October (or 7% altogether since the first cut in early August). For now, the COPOM appears set to continue with additional sizable rate cuts, but Fed uncertainty could complicate the path for them, and for other emerging market central banks, going forward. With upward risks to the US policy rate still present, EM central bank developments will be dependent on the future path of global interest rates and inflation developments.

Elevated debt sustainability concerns

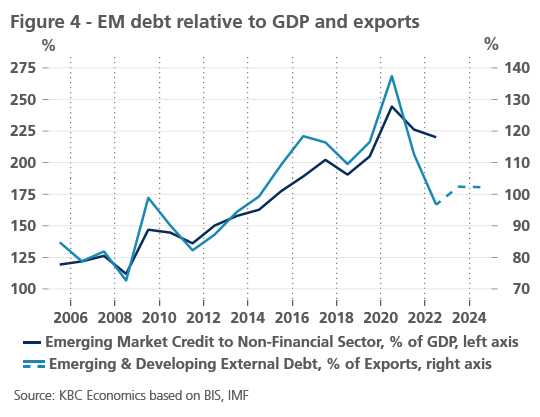

For many emerging markets however, monetary policy easing is a long way off. The global rise in interest rates and sharp appreciation of the US dollar over much of 2021 and 2022 weighed heavily on emerging market assets. Those with weaker fundamentals (higher external debt, higher current account deficits, and higher inflation) tended to face more pressure, and a number of frontier economies have run into debt sustainability problems, requiring assistance from the IMF (for further analysis see: Frontier versus major emerging markets; differences in definition and vulnerabilities (kbc.com)).

Debt sustainability concerns remain elevated in a higher-for-longer interest rate environment. A recent analysis by the St. Louis Fed suggests that debt distress among developing economies has increased markedly since the outbreak of the pandemic as measured by credit spreads and credit ratings. 1 Interestingly, measures of emerging market debt by the BIS and IMF show that debt ratios have actually fallen somewhat relative to GDP and exports since 2020 (figure 4). This suggests that differentiation when discussing emerging market debt sustainability is still crucial.

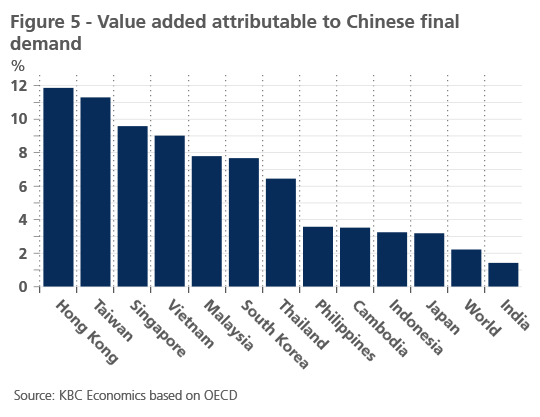

Developments in China at the moment tend to dominate the outlook for the region. The recovery there continues to disappoint as real estate troubles increasingly damage the wider economy. This has important spillover effects for trading partners, whether emerging or developed economies. Figure 5 highlights that several economies in the region are highly exposed to weaker final demand from China, including emerging economies like Vietnam, Malaysia and Thailand. This, together with domestic content requirements in new trade policies in the US (Inflation Reduction Act and CHIPS Act) that are weighing on export growth in the region, was behind the World Bank’s recent downgrade of the growth outlook for the region. However, the World Bank still forecasts East Asia & Pacific economies to grow 5% in 2023 and 4.5% in 2024, which is higher than for other emerging and developing economies.2

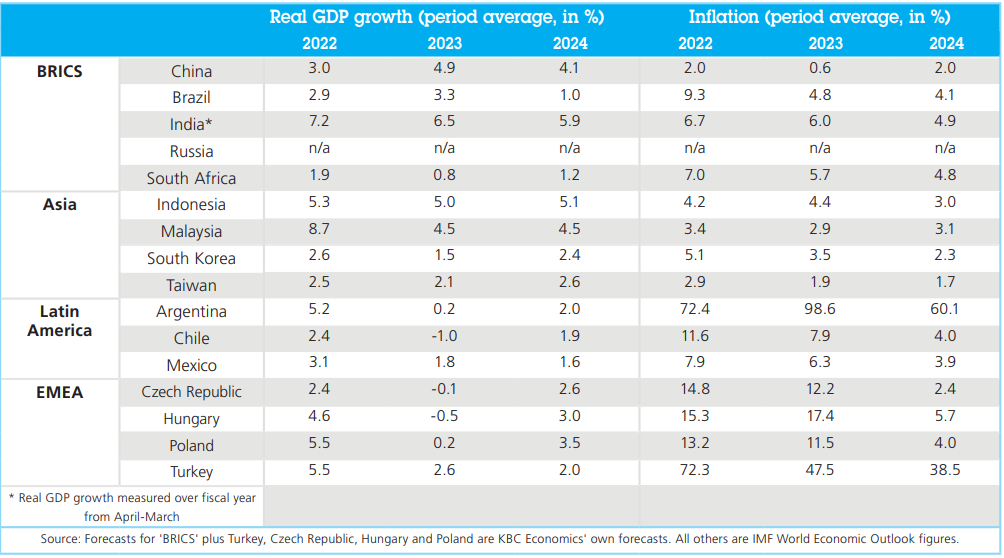

China

After several months of disappointing activity data in China, September data suggests some upward momentum to growth at the end of the third quarter. Industrial production grew 0.5% month-over-month while retail trade grew 0.31% month-over-month. Sentiment data was more of a mixed picture, with the Markit PMIs for both the manufacturing and service sectors declining (to 50.6 and 50.2, respectively) while the official (NBS) PMIs improved marginally (to 50.2 for the manufacturing sector and 51.7 for the non-manufacturing sector). The fact that both manufacturing PMIs are now in positive territory, however, is an encouraging signal for a pick-up in industrial activity. However, the long-standing structural challenges we’ve highlighted in the past (especially an over-indebtedness of the household and corporate sectors) remain an important drag on growth going forward, and the various policy initiatives introduced so far will likely be inadequate to provide a sustainable boost to growth. We therefore maintain our 2023 outlook for GDP growth at 4.9%, just below the government’s 5.0% target, and maintain our outlook for 2024 at 4.1%

India

India’s economy has maintained solid growth in the past four quarters (1.8% qoq or 7.8% yoy in Q2), supported especially by the domestic sector (private consumption and investment), while the contribution from exports has also improved. A deteriorating external outlook, however, may be a downside risk for third and fourth quarter growth, with exports declining 3.1% yoy in August. Sentiment indicators such as Markit PMIs, however, suggest strength in both manufacturing (58.6) and service sectors (60.1). Other surveys such as consumer confidence, the industrial outlook assessment, and business optimism index also point to improving confidence that should support domestic demand. Core CPI continues to trend down (4.8% yoy in August). However, a huge spike in food prices (driven by vegetables), caused the headline figure to shoot from 4.9% yoy in June to 7.4% in July, easing only marginally to 6.8% in August. While expected to correct, food prices remain an important source of inflation uncertainty in India.

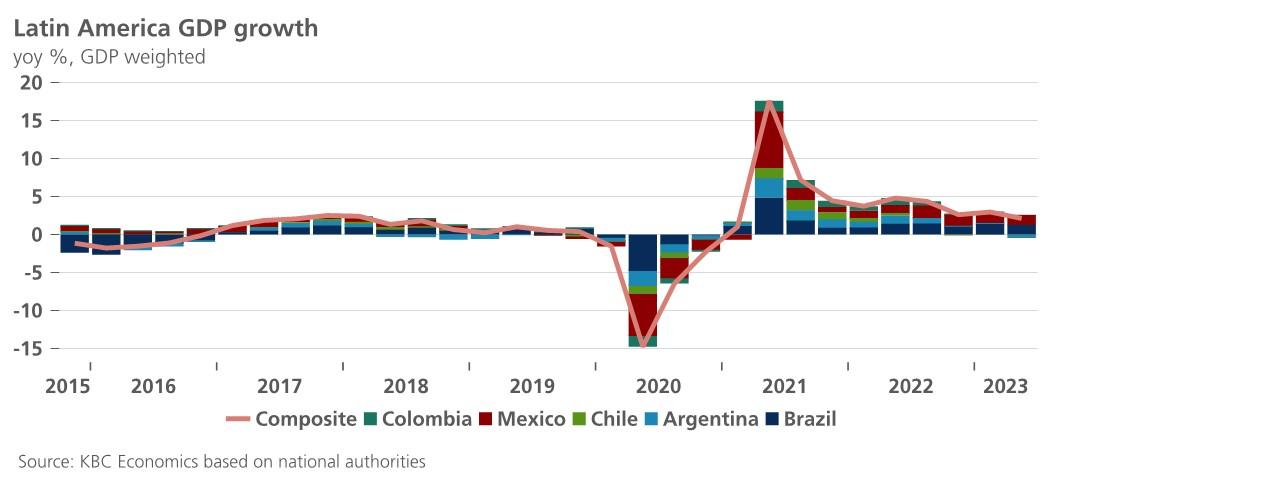

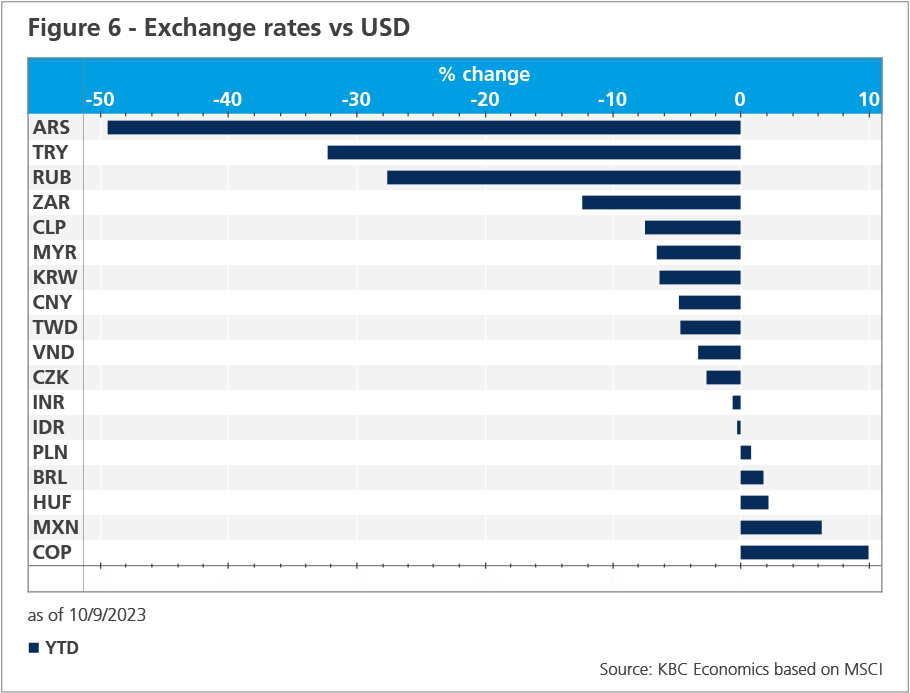

Divergence in macro and financial trends is especially evident in Latin America. While Argentina grapples with renewed economic turmoil (GDP contracting 2.8% qoq in Q2 2023 and inflation reaching 124% yoy in August), which has sent its currency plummeting 49% against the USD year-to-date, the currencies of Colombia, Brazil and Mexico have been some of the best performers against the dollar this year (figure 6). Despite the recent depreciation of the BRL mentioned above, it is still 2.9% stronger against the USD YTD, reflecting decent economic growth (2.6% yoy in Q3 2023) and, especially, sharply falling core inflation (from 10.8% yoy in August 2022 to 4.8% in August 2023). In Mexico, inflation has also dropped steadily from 8.8% in August 2022 to 4.6% in August 2023 and GDP growth has remained solid at 3.5% yoy in Q2. Colombia is a bit of a different story, as GDP growth slowed to 0.3% yoy in Q2 and inflation has been much slower to moderate (still at 11.4% yoy in August). However, the central bank continued hiking into 2023, and the policy rate is relatively high at 13.25%. In addition, the increase in oil prices in recent months has also supported the currency.

Central Eastern Europe

The National Bank of Hungary (NBH) was the first of the regional central banks to start easing its monetary policy. Since May, it brought down its exceptional deposit rate (used to stem the forint’s depreciation) from 18% to 13%. It was then able to take a first step toward simplifying its policy framework, such that there is once again a traditional policy rate (13%) on the reserve account for banks, with a 100-bps corridor around that base rate. As headline and core inflation are expected to moderate further in the coming months (our baseline for headline inflation is a further easing to around 7% by end-2023), we suspect that the Hungarian central bank will cut the policy rate by 50 basis points to 12.5% in October. If this is done without accidents and if the international context (risk aversion – higher market volatility) allows it, additional steps may follow in November (50 basis points) and December (100 basis points). However, some concerns remain about a continued disinflation path through 2024, and the NBH has said it will remain fully data driven. For further details, please see: New Phase for Hungarian monetary policy will be a difficult balancing act.

In contrast, the Czech National Bank (CNB) has kept its key interest rate stable at 7.0% since mid-2022. The members of the central bank remain cautious given still relatively high core inflation, even though some inflation risks have been perceived as less intense. The assessment of the Bank Board is that “the risks of the forecast and the uncertainty of the outlook are significant and in both directions”. This is in contrast to the August statement, when it was “tilted to the upside” instead of “in both directions”. At the press conference after the Bank Board meeting, Governor Michl did not rule out a rate cut before the end of the year. This supports our expectation for a first rate cut in the fourth quarter to 6.50%, though there remains a risk of a later start of policy easing. This would for example materialize if inflation remains higher than expected, which could be caused by higher energy prices and a weaker exchange rate of the koruna versus the US dollar and the euro. For further details, please see: Perspectives Central and Eastern Europe (kbc.com)).

South Africa

South Africa is one major emerging market more affected by the higher interest rate environment, including the most recent surge in US yields. The ZAR is currently 12% weaker versus the USD year-to-date reflecting South Africa’s many macro-financial vulnerabilities, including structural challenges to stronger GDP growth (forecast to reach 0.8% in 2023), and a structurally high public debt ratio and fiscal deficit (estimated to be 72% and 5.9% of GDP, respectively, at end-2023). Though South Africa’s core inflation remains relatively contained and is only marginally above the SARB’s 4.5% inflation target at 4.8% year-over-year, the SARB has kept the policy rate at a relatively elevated 8.25% since May 2023, reflecting these vulnerabilities. We currently forecast the SARB to remain on hold until 2024, but there is an elevated risk of a further interest rate increase in Q4 2023.

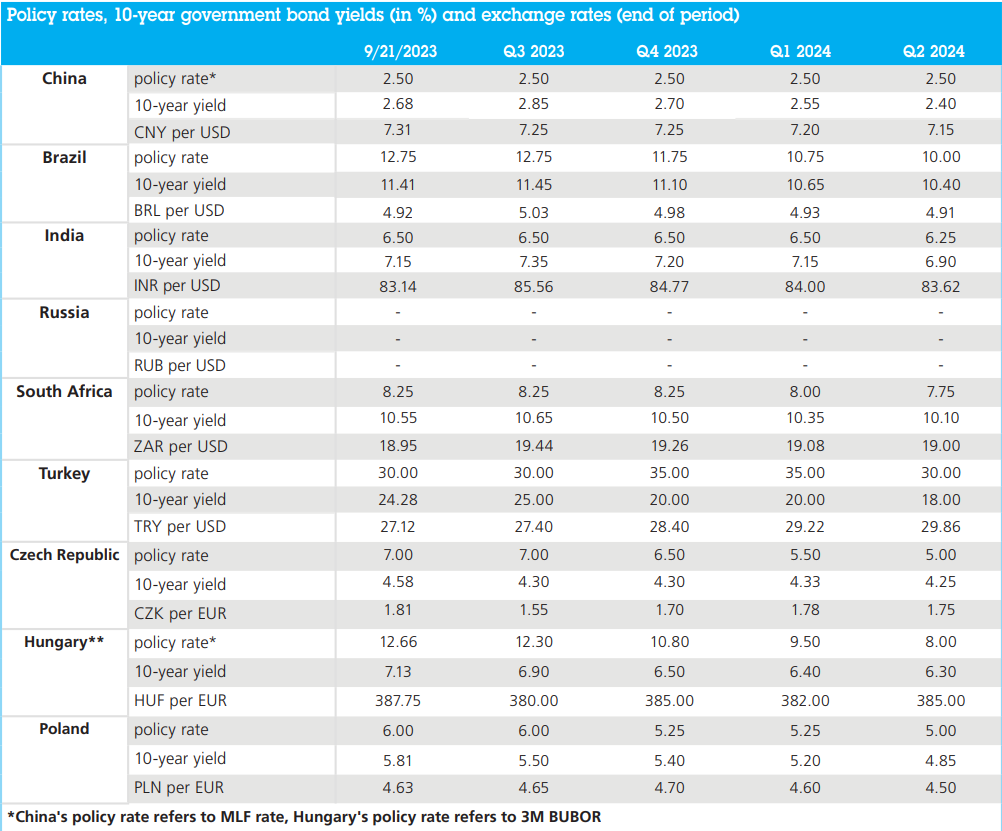

TABLES AND FIGURES

Outlook emerging market economies NOTE:

Forecasts are those prevailing on 18 September 2023

There are currently no forecasts provided for Russia

Composite Growth Indicators