Emerging Markets Digest: April 2024

Content table:

Read the publication below or click here to open the PDF.

Global Challenges Threaten Emerging Markets’ Goldilocks Era

Re-assessment of Fed policy changes conditions

Though a host of uncertainties and risks hangs over the global economy, emerging markets, perhaps surprisingly, have been in a relative sweet spot for the last several months. The story – as is often the case when looking at global economic trends – starts with the US and what initially appeared as the Fed’s success in engineering a so-called soft landing. Despite significant and rapid monetary policy tightening from early 2022 through late 2023, the US economy surprised to the upside in 2023, growing well above potential. At the same time, global inflationary pressures abated, and inflation continued its gradual (albeit occasionally interrupted) downward trend.

All this led to an initial expectation of imminent policy easing from the Fed, which would have loosened financial conditions and provided more room for emerging market central banks to (continue to) cut rates. Signs of still healthy growth and, more importantly, stickier-than-expected US inflation (particularly services inflation), however, have triggered a re-assessment of the timing and magnitude of US policy easing by markets, causing a sharp upward realignment of long-term interest rates. This doesn’t necessarily spell disaster for emerging markets, however. After all, the consensus remains, for now, that the tightening phase of the Fed’s monetary policy cycle is done, and the start of easing is only a matter of time (though even the tail risk of an additional rate hike is growing).

Growth remains a positive

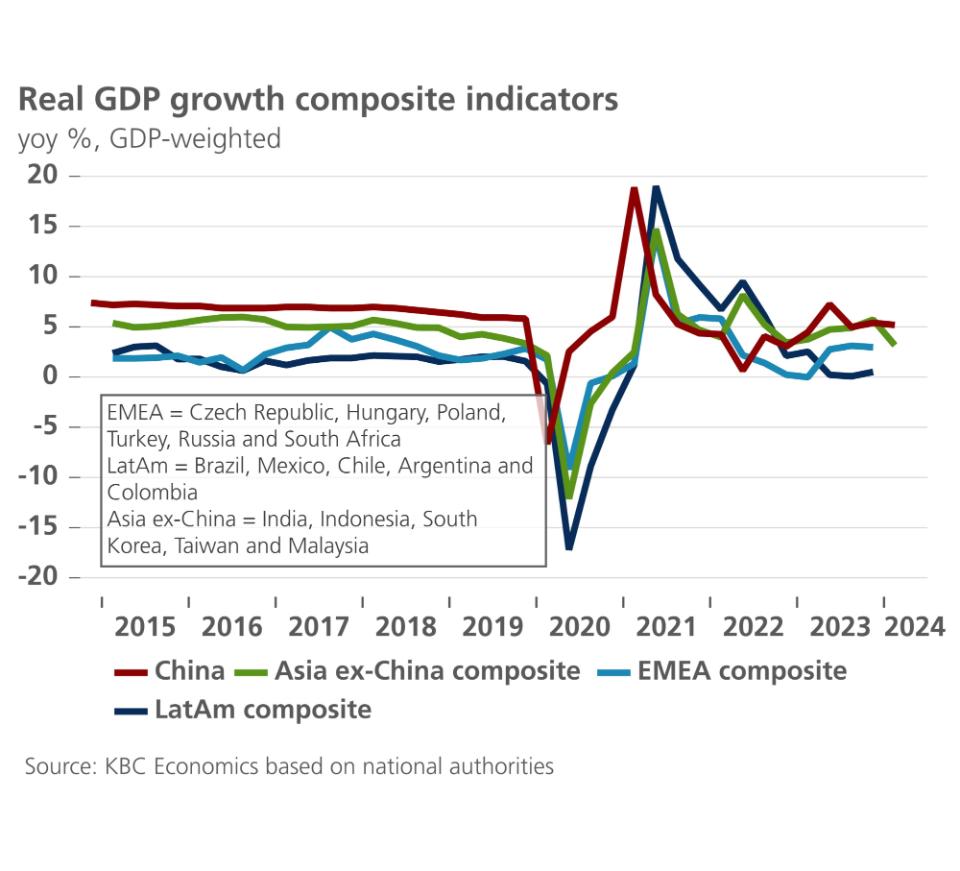

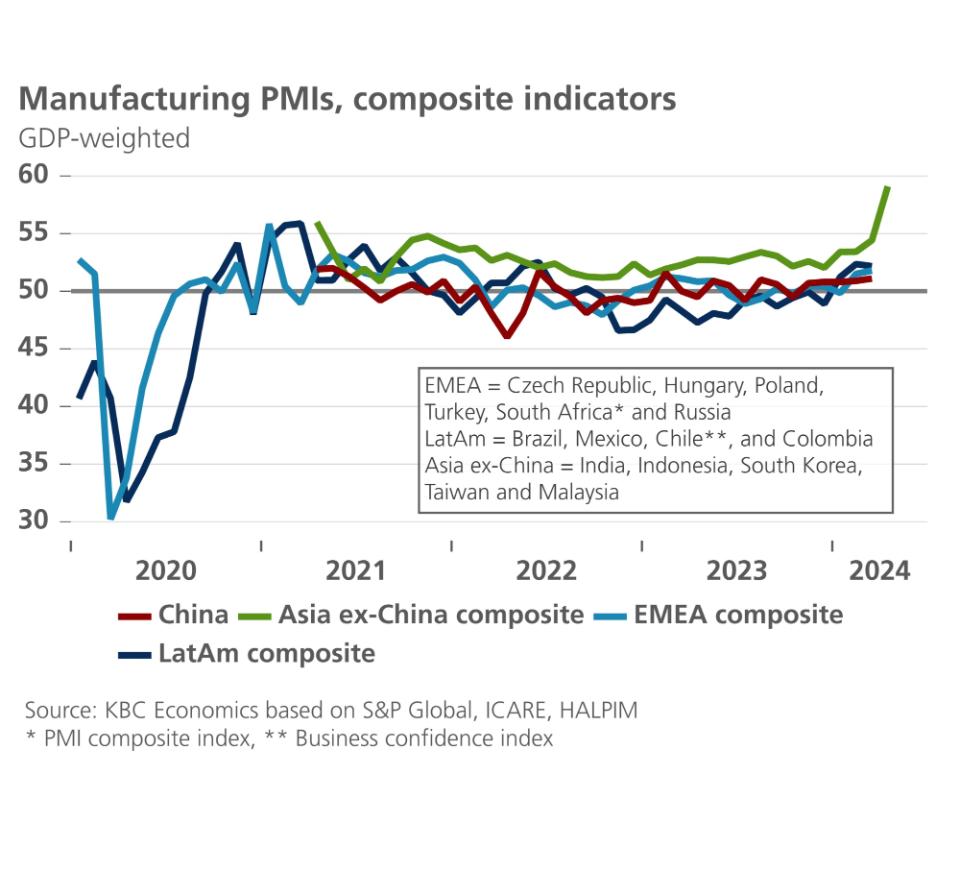

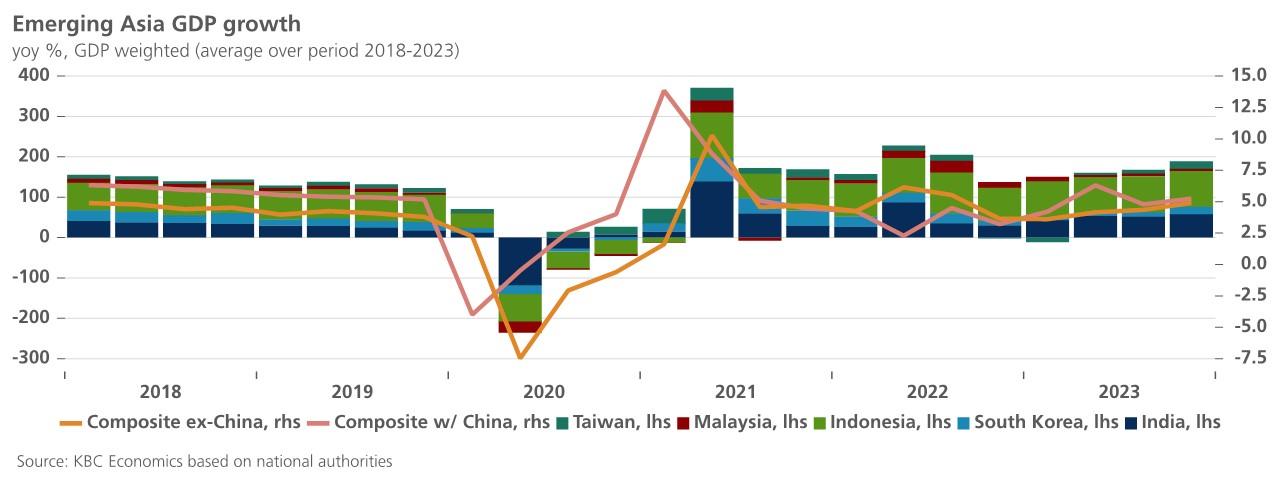

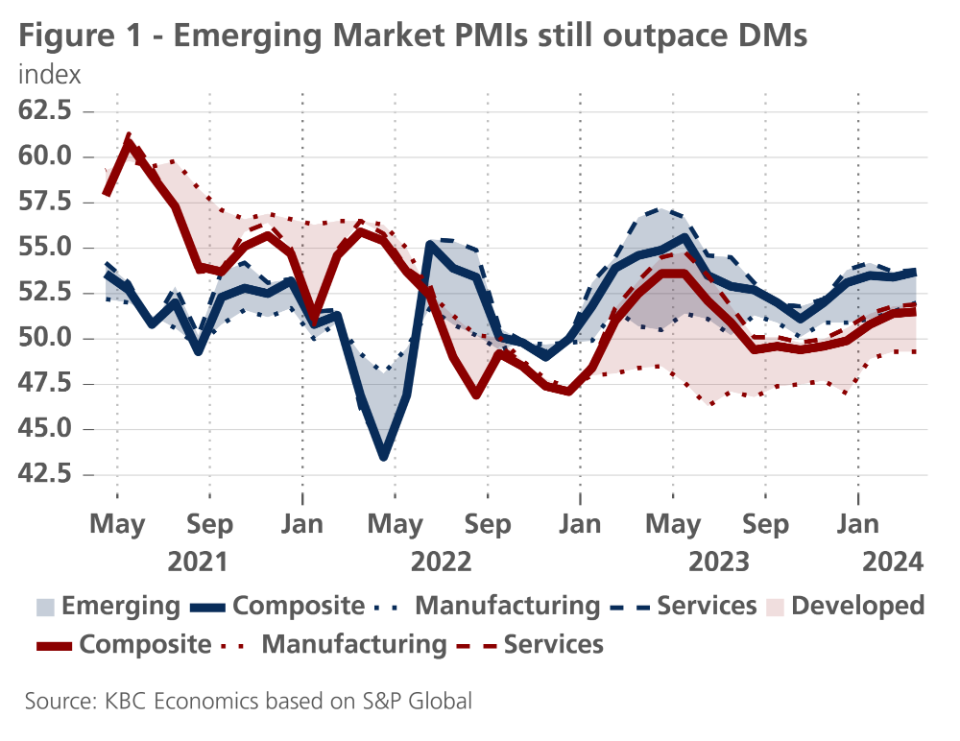

The US wasn’t the only economy where growth surprised to the upside despite global tightening. Business sentiment in emerging economies improved sharply in mid-2022, remained robust throughout 2023, and continues to outperform sentiment in developed markets (figure 1).

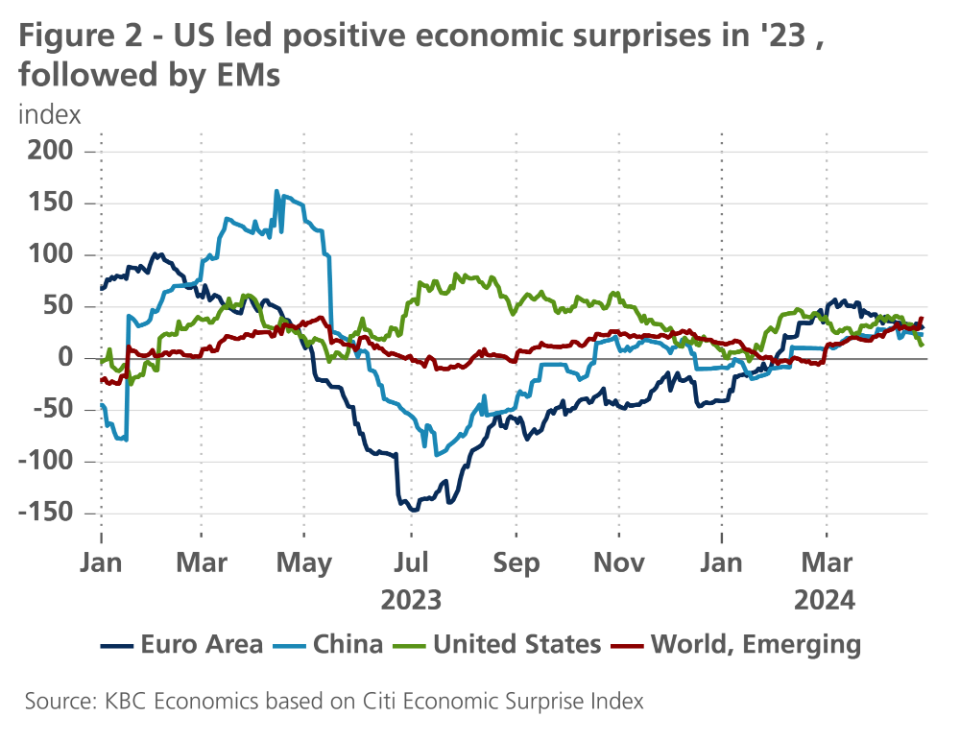

Furthermore, over 2023, economic news mostly surprised to the upside in emerging markets relative to market expectations, especially when compared to news in the euro area or China (figure 2).

Looking Forward

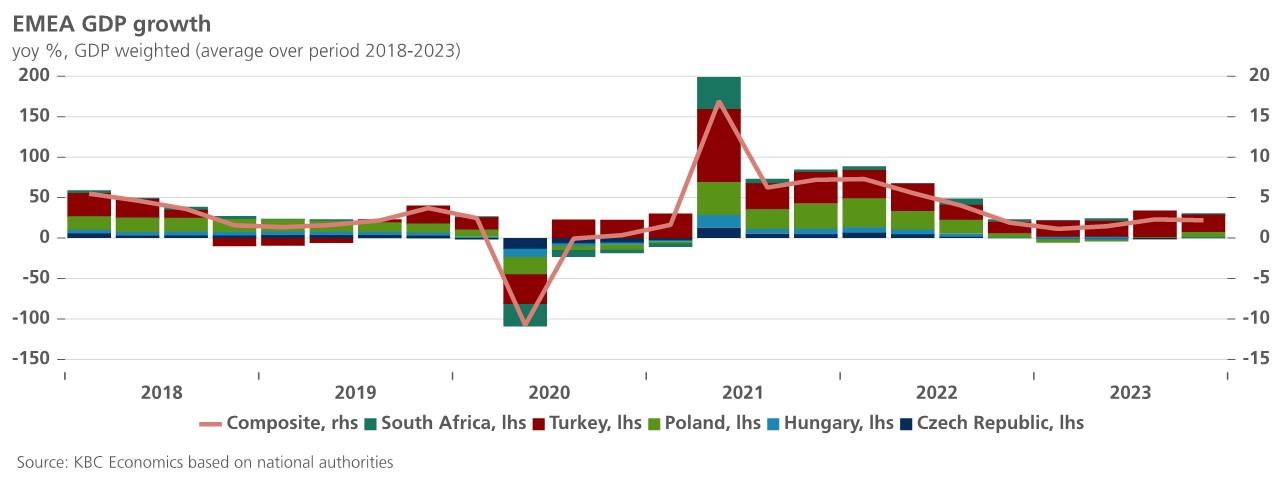

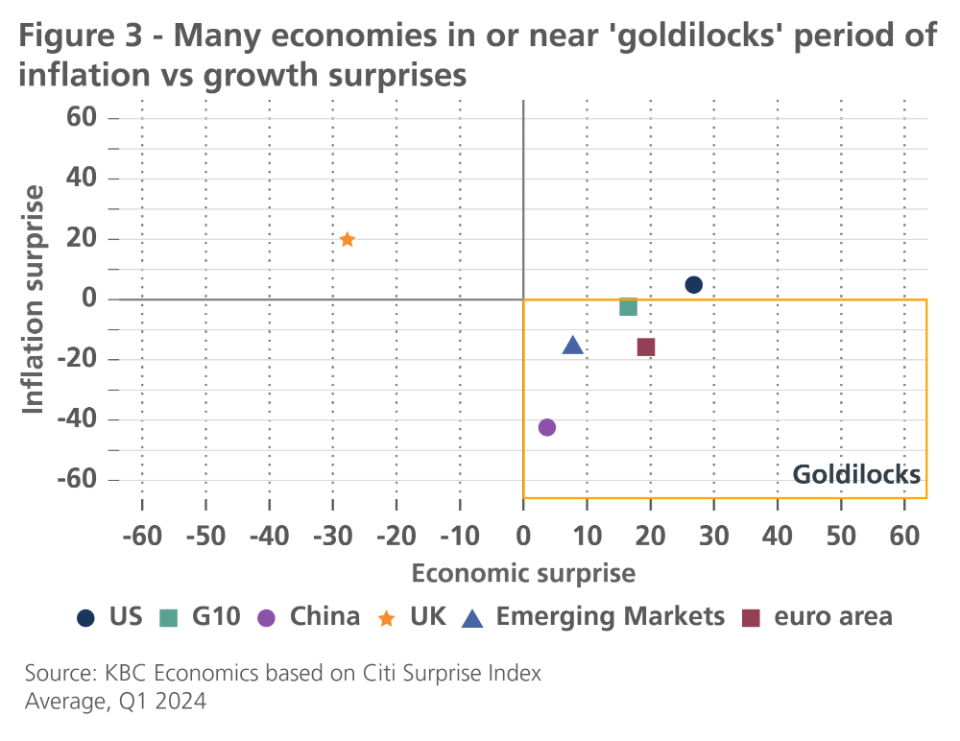

Furthermore, as figure 2 also shows, positive economic surprises have been on the rise in both emerging markets and elsewhere since the start of the year. While economic surprises are relative to expected growth, meaning an economy might have many upside surprises but still relatively weak growth, this puts many major economies in the goldilocks situation of improving growth and declining (if still sticky) inflation (figure 3). Of course, for emerging markets, there is significant heterogeneity, and while some economies are outperforming (e.g., India), others are still plodding along (e.g., South Africa). But in general terms, the question now is whether or not emerging markets will stay in this situation, or whether the many challenges looming over the global economy will derail the current path.

The trade-off between external demand and financial conditions

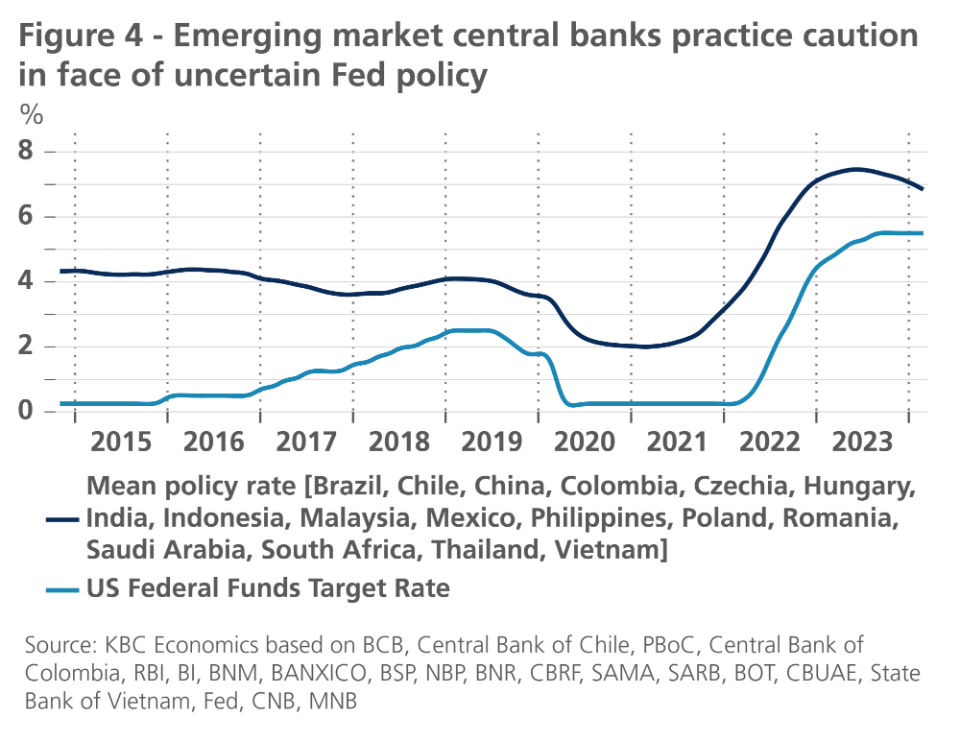

Fed rate cutting cycles can sometimes be a double-edge sword for emerging markets. Lower benchmark rates can attract international investment, supporting emerging market assets, and leaving room for smaller central banks to cut rates themselves, or for fiscal authorities to implement more expansionary fiscal policy when needed. But if US policy rates are being cut because of a substantial growth slowdown, this can hurt growth in emerging economies, especially those that are small, open and rely heavily on export industries and external demand. However, in the current cycle, the problem is almost the opposite. US activity remains solid and inflation remains robust, to the point that the expected timing of the first rate cut keeps being pushed back, keeping financial conditions tight and making emerging market central banks cautious with their own easing paths (figure 4).

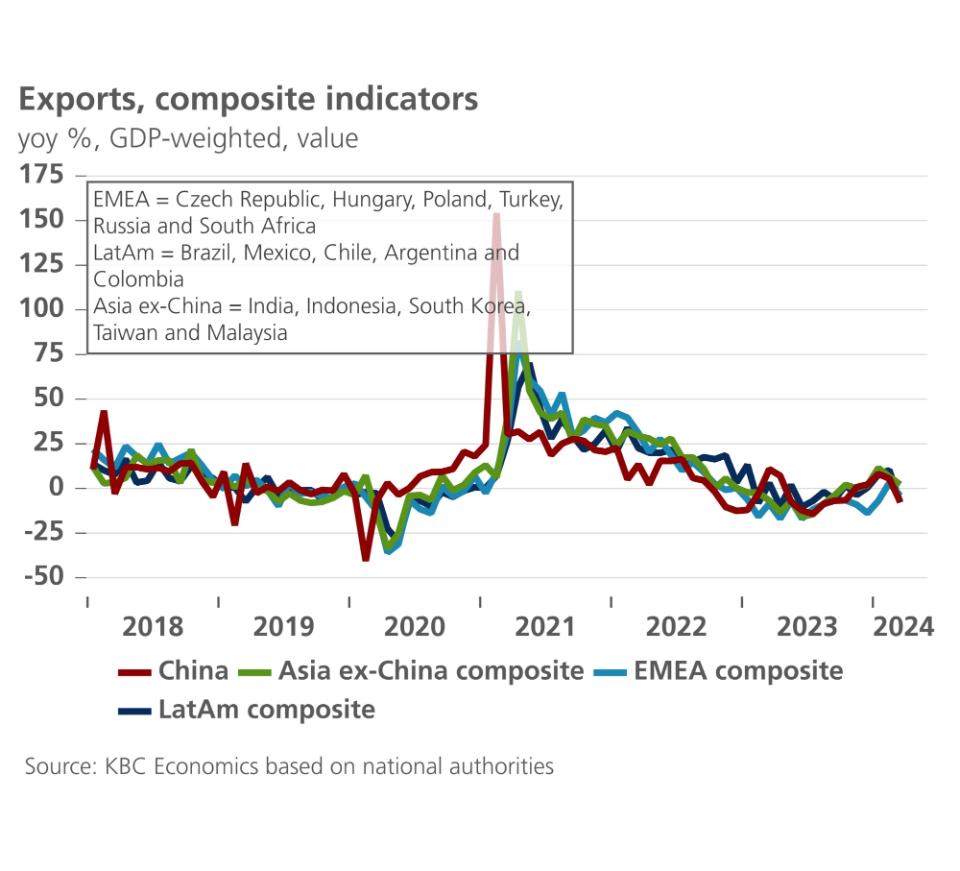

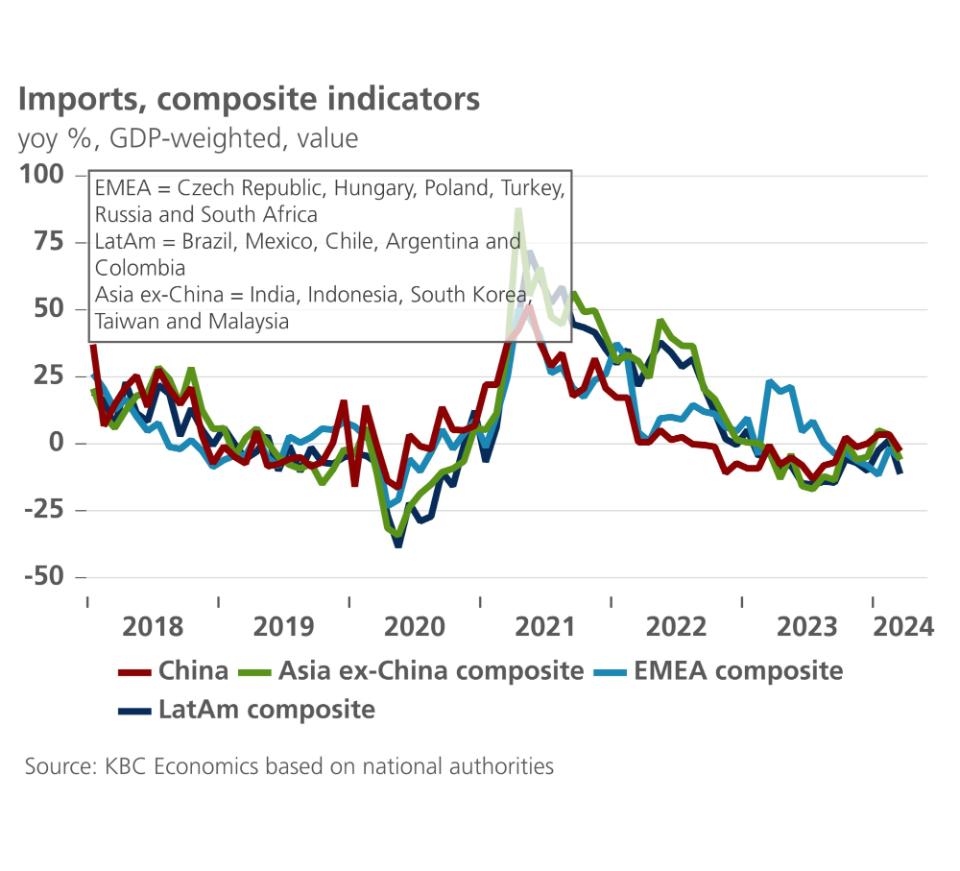

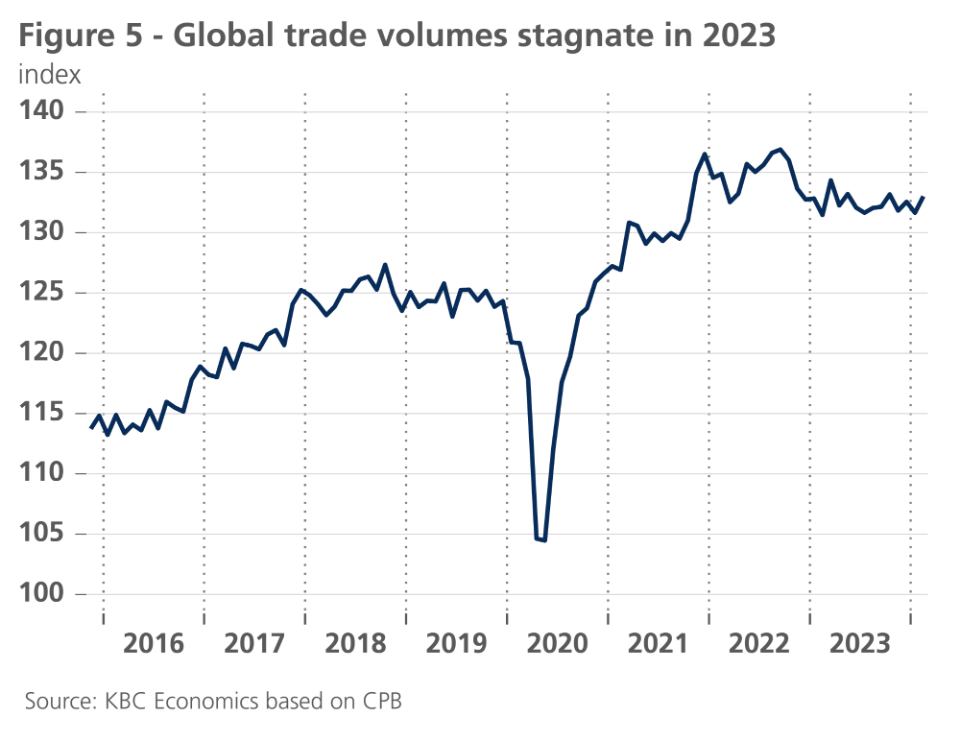

While it might keep financial conditions tighter for longer, stronger growth from the major economies (US, EU, and China) is often a positive for many emerging markets due to spillover impacts from strong external demand. Notably, however, global trade volumes have not been particularly strong since early 2023 (figure 5).

While we do expect US growth to slow in the coming quarters, the outlook remains decent, with growth dipping only slightly below potential in the second and third quarters (at 1.2% qoq annualized) and coming in above potential at 2.4% for 2024 as a whole. We have also recently marginally upgraded our outlook for euro area growth to 0.5% in 2024 and expect a more substantial recovery in 2025 of 1.3%. And while the outlook for China remains especially complicated (see below), the outlook was recently revised up from 4.7% to 5.1% in 2024 given a big upside surprise in Q1 GDP growth. These upgrades, together with our view that the Fed rate cutting cycle will still start this year (in September), suggests there’s room for the Goldilocks era to continue.

Global challenges abound

But the path of Fed policy is not the only challenge facing emerging markets at the moment. The geopolitical landscape is particularly concerning, with the wars in Ukraine and Gaza threatening to spillover into larger conflicts. This is especially evident following direct confrontations between Iran and Israel in recent weeks. Commodity markets (particularly oil) have not reacted significantly following the latest attacks, suggesting markets are not pricing in further escalation. Higher energy prices would support some oil-exporting emerging markets but would hurt energy-dependent emerging markets. Furthermore, geopolitical risks are often a net-negative for global sentiment, which can dampen trade. Indeed, the Middle East conflict has already caused some disruptions to trade routes, which could worsen if the conflict expands.

Furthermore, tensions between China and the West loom large, with major potential impacts on the global economy. This isn’t only related to geopolitical tensions around Taiwan or in the South China Sea, but also the economic and technological tensions that have been mounting for some time. Biden’s chip war on China has made it more imperative that China develops its own high-tech industries, while the EU’s new inquiries into Chinese green tech exports signal that the US is not alone in targeting China’s state support for its industries. And of course, US elections loom on the horizon, with Trump threatening to impose a 60% import tariff on Chinese goods if re-elected and Biden recently announcing that he wants to further raise the tariff rate on Chinese steel and aluminum. While further decoupling and efforts to diversify supply chains away from China, could yield some benefits for other emerging markets that can capture some of this ‘diversification demand,’ increased uncertainty and trade frictions are also likely to drag on global trade.

Emerging Asia

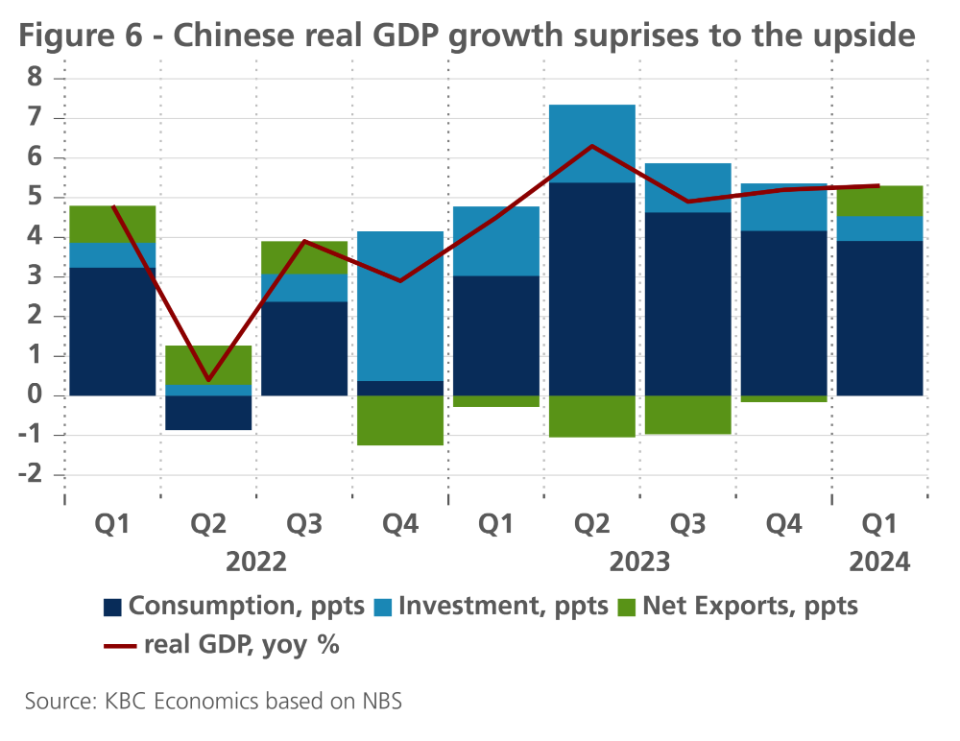

Chinese GDP growth surprised to the upside in Q1 2024 at 1.6% seasonally adjusted quarter-on-quarter or 5.3% year-on-year, setting the stage for the government to reach its 2024 growth target of 5%. But once again, reaching the headline growth figure doesn’t reveal much about the underlying health of the Chinese economy. Growth in the first quarter was supported especially by net exports (see figure 6). Exports grew on average 3.4% year-on-year in the first quarter (measured in CNY), but in March alone, exports declined 3.8% year-on-year, suggesting momentum may be slowing.

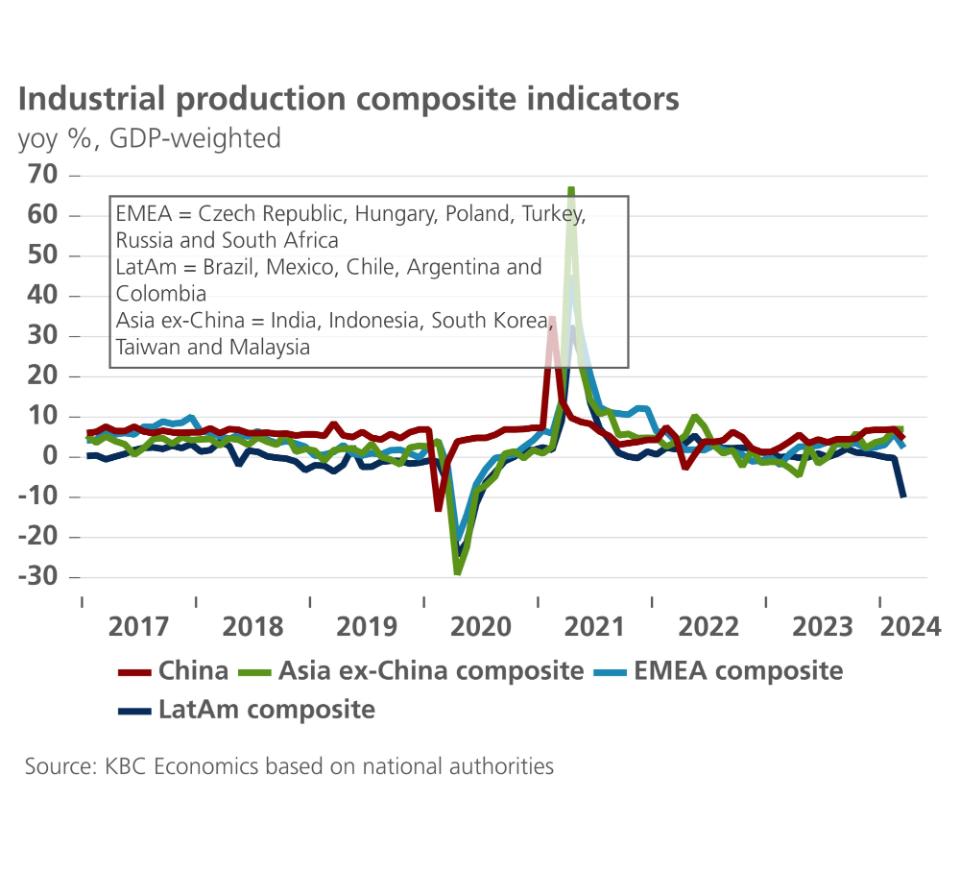

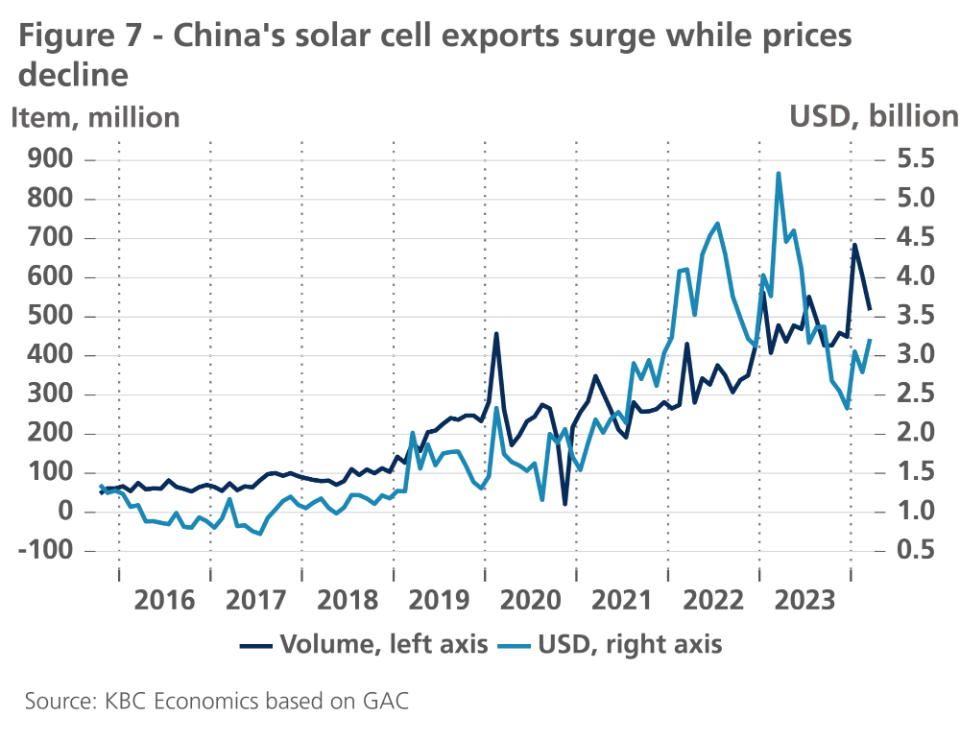

Furthermore, strength in China’s export-facing manufacturing sectors also reflects increased support from state-owned enterprises (SOEs) toward higher-tech and higher-value added industries as part of China’s long-term goal of industrial upgrading. In March 2024, for example, fixed asset investment by SOEs grew 7.8% year-to-date year-on-year, while private investment grew a meagre 0.5% year-to-date year-on-year. While industrial upgrading is a positive development in terms of China needing to find new drivers of growth, the ramp up in industrial activity, at a time when consumer sentiment remains extremely weak, is leading to supply-demand imbalances domestically and driving exports (including exports of green-tech) at lower prices (figure 7). The fact that the EU has opened a number of investigations into China’s state subsidy practices in recent months to determine whether state support is unfairly undercutting EU industries, particularly green industries, reveals that China’s trading partners may start pushing back against China’s exporting edge. This is also reflected in Trump’s plan to impose new tariffs on Chinese goods if he retakes the US presidency in November. China, therefore, still needs to improve domestic demand if it wants to get back on a more sustainably strong growth path.

This is not to say there’s no good news in the data. While private investment growth remains weak, especially compared to SOEs, it improved during the first quarter of the year, turning positive after contracting for all of H2 2023. Business sentiment indicators are also generally positive (above 50) and improving for the both the manufacturing and service industries. And although strong industrial production in previous months may be losing some momentum (contracting -0.8% month-over-month in March), retail sales picked up in March to 0.26% month-over-month after more-or-less flat growth in January and February. Therefore, given the overall upward surprise to Q1 GDP growth, we have upgraded our 2024 GDP outlook from 4.7% to 5.1%. However, we have downgraded, modestly, expectations for quarterly growth throughout the rest of the year, which due to carry-over leads to a downgrade of 2025 annual growth from 4.2% to 4.0%. Meanwhile, inflation still points to deflationary pressures in the economy, and we have slightly modified the 2024 average annual inflation forecast from 0.7% to 0.5%.

India

With global growth generally surprising to the upside in 2023 and early 2024, India has clearly led this trend. The economy is expected to have grown 7.7% in the fiscal year April 2023-March 2024. This follows already strong growth of 7.0% the year prior, and while activity should slow somewhat in FY 2024-2025, at an expected 6.3%, this would still position India as the fastest growing major economy in the world.

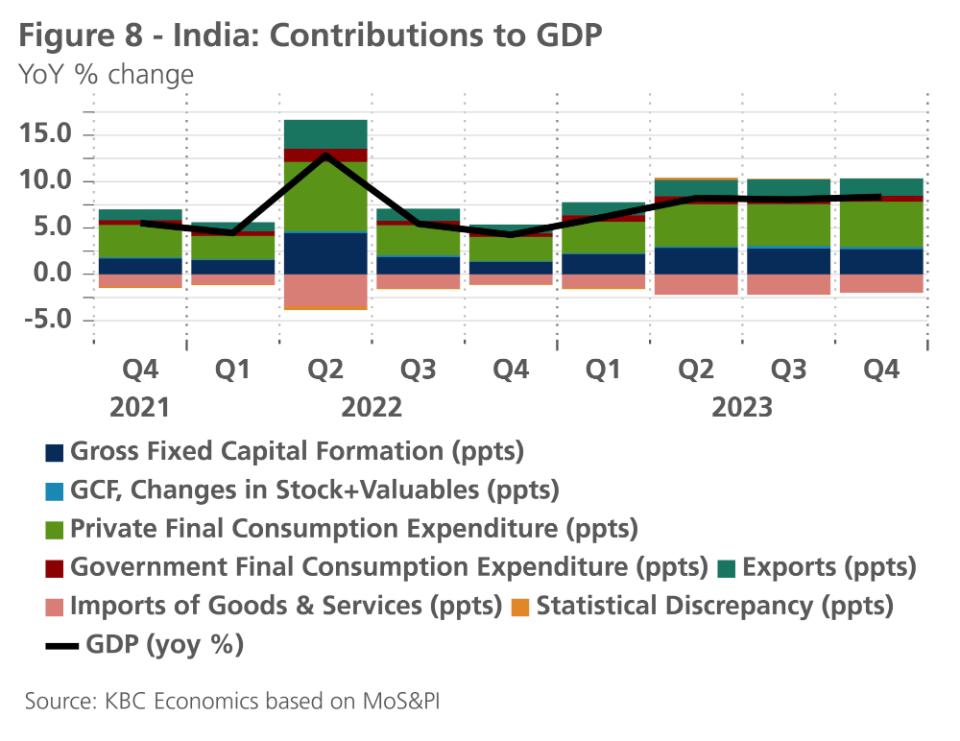

Robust GDP growth has been supported across the board by strong exports, investment, and consumption (figure 8). Sentiment indicators point to continued solid growth; Consumer confidence has been on a steady, upward climb since late 2021, and is well above its pre-pandemic level. Business sentiment has followed this path as well, with the composite PMI indicator (for manufacturing and services) reaching a near 14-year high of 62.2 in April—well above the 50-reading that signals expansion. Services underpinned this strength (at 61.7), but manufacturing sentiment remains strong as well at 59.1.

Despite the Indian economy barreling ahead, inflation continues its downward trend, though food prices have caused some volatility in the headline figure, which still remains above the Reserve Bank of India’s (RBI) 4% target at 4.85% as of March. Core inflation, however, has been steadily declining and is now below the target at 3.25%. We therefore expect the RBI to start an easing cycle in September, but given still strong growth, geopolitical risks (and adjacently commodity price risks), volatile food price inflation, and uncertainty related to the US policy path, we expect the path of easing to be cautious and gradual, with the RBI bringing the policy rate only from 6.5% to 6.0% by the end of the year, and to 5.75% by the first quarter of 2024.

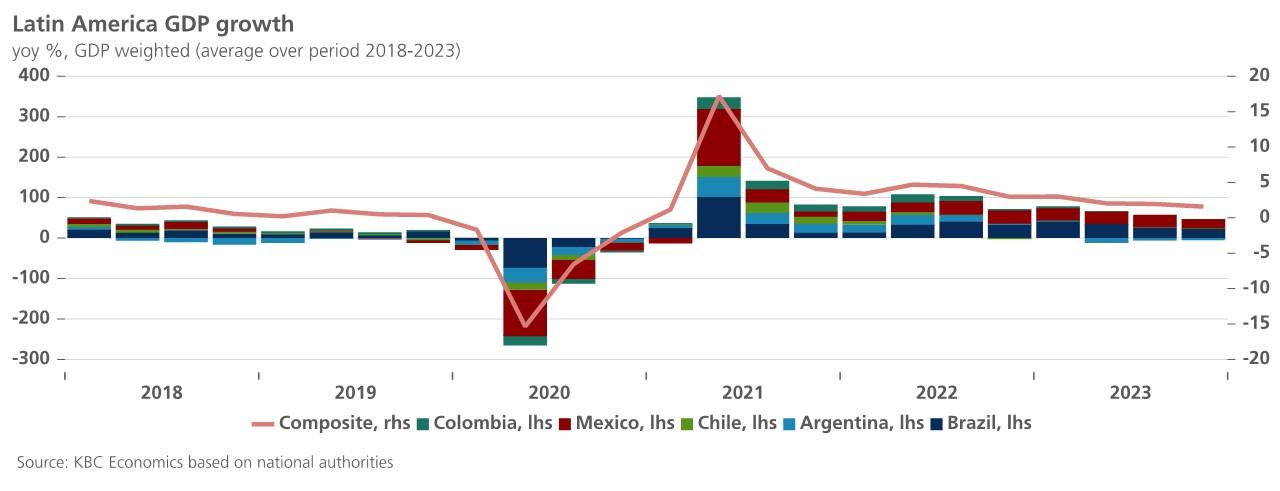

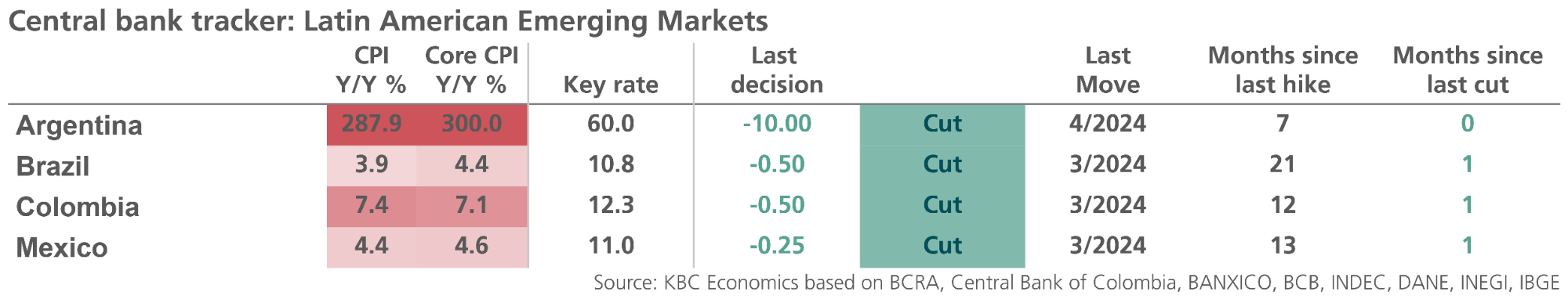

Latin America is one of the regions at the forefront of the global monetary easing cycle, with Mexico being the last major central bank in the region to start cutting interest rates (as of March 2024) while central banks in advanced economies have yet to loosen policy (see table). For most Latin American central banks, sharply lower inflation numbers and slowing growth dynamics made the choice to start their rate cutting cycles relatively straightforward. A notable exception to this is Argentina, where the central bank unexpectedly cut rates even though inflation remains sky-high (headline: 288% yoy and core: 300% yoy in March). Still, the central bank slashed its policy rate from a peak of 133% at the end of 2023 to 60% in April 2024, citing the rebuilding of depleted net foreign currency reserves, the reduced monetary base, the slowdown in month-on-month inflation and the peso strengthening against the US dollar in parallel markets.

Argentina is currently undergoing a ‘shock therapy’ plan set out by the country's new president, right-wing Javier Milei. The new plan could improve the country’s economic fundamentals in the years to come but also risks raising poverty and unemployment and has already led to plummeting purchasing power. The goal of the plan is to fix the country’s ailing economy by introducing a series of strict austerity measures to create a strong fiscal anchor, by tackling long-standing structural impediments to growth and by ending monetary financing. Early measures include devaluing the peso by just over 50%, slashing subsidies for energy and transport and cost-cuts at state-owned enterprises and ministries. If successful, the plan could potentially lift the country out of its seemingly endless economic crisis, but changes will be very painful, and the road ahead is paved with obstacles. Milei has recently struggled to implement the most far-reaching parts of his radical austerity agenda due to lack of support in both chambers of parliament and legal challenges. Meanwhile, social unrest is brewing. Overall, it is safe to say that the economic outlook for Argentina is subject to a high degree of uncertainty. In its April 2024 update, the IMF expects real GDP growth to be -2.8% this year and 5.0% next year. Inflation is expected to ease gradually but this move is conditional on the delivery of promises on fiscal consolidation and improvements in the monetary policy framework. The IMF predicts average annual headline inflation will average 250% in 2024 and 60% in 2025.

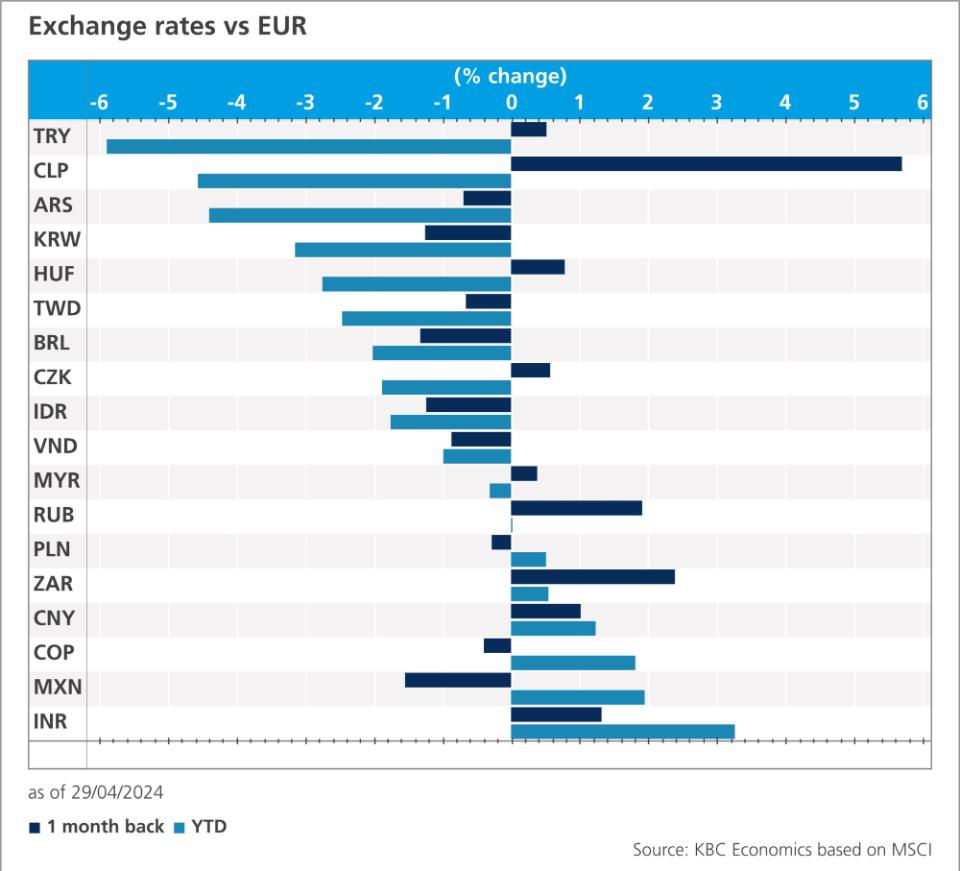

Overall, economic growth in Latin American economies is expected to moderate in 2024 on the back of the weakening external environment while inflationary pressure are forecast to ease further. Safe haven flows, linked to geopolitical uncertainty and dollar strength following the pushback of the start of monetary easing by the Fed, have been weighing on the currencies in the region recently. As a result, the appreciation of the Colombian and Mexican peso that occurred in the first months of the year, has now been reversed. Both currencies are however still at much higher levels than in 2023.

Whereas many economies registered upside surprises to growth in 2023, South Africa’s economy has continued to underperform, growing only 0.06% qoq in Q4 2023 following a contraction of 0.18% qoq in Q3. This brought full-year 2023 growth to 0.6%. In its March monetary policy committee statement, the South African Reserve Bank (SARB) pointed to supply side issues, especially electricity shortages which lead to significant power cuts, as one of the main reasons behind the disappointing growth outcome. Electricity loadshedding has long been a structural problem facing the economy, and reform of the state-owned energy provider, Eskom, remains a key challenge for ensuring stronger growth going forward.

Headline inflation, meanwhile, has been rather sticky since mid-2023, halting its previous steady decline as transport and utility prices increased. The latest headline figure remains about the SARB’s 4.5% target at 5.3% yoy in March. Core inflation did dip below the SARB’s target late last year but has risen during the first quarter of the year on stronger service prices and is currently at 4.9% yoy. A slower disinflation path, along with uncertainty surrounding the path of Fed policy means the SARB is also likely to be cautious with its easing cycle, despite disappointing growth. We currently pencil in a first 25 basis point cut to the policy interest rate (currently 8.25%) in September, but risks of a later start date remain elevated.

Tables and Figures

Forecast Tables (Forecasts are those prevailing on 18 April 2024)

| Real GDP growth (period average, in %) | Inflation (period average, in %) | ||||||

|---|---|---|---|---|---|---|---|

| 2023 | 2024 | 2025 | 2023 | 2024 | 2025 | ||

| BRICS | China | 5.2 | 5.1 | 4.0 | 0.3 | 0.5 | 2.0 |

| Brazil | 2.9 | 2.1 | 2.0 | 4.6 | 4.1 | 3.6 | |

| India* | 7.7 | 6.3 | 6.3 | 5.4 | 4.4 | 4.6 | |

| Russia | n/a | n/a | n/a | n/a | n/a | n/a | |

| South Africa | 0.6 | 1.0 | 1.6 | 6.1 | 4.9 | 4.7 | |

| Asia | Indonesia | 5.0 | 5.0 | 5.1 | 3.7 | 2.6 | 2.6 |

| Malaysia | 3.7 | 4.4 | 4.4 | 2.5 | 2.8 | 2.5 | |

| South Korea | 1.4 | 2.3 | 2.3 | 3.6 | 2.5 | 2.0 | |

| Taiwan | 1.4 | 3.1 | 2.7 | 2.5 | 1.9 | 1.6 | |

| Latin America | Argentina | -1.6 | -2.8 | 5.0 | 133.5 | 249.8 | 59.6 |

| Chile | 0.2 | 2.0 | 2.5 | 7.6 | 3.2 | 3.0 | |

| Mexico | 3.2 | 2.4 | 1.4 | 5.5 | 4.0 | 3.3 | |

| EMEA | Czech Republic | -0.2 | 1.5 | 3.1 | 12.1 | 2.3 | 2.6 |

| Hungary | -0.7 | 2.2 | 3.6 | 17.0 | 4.3 | 4.0 | |

| Poland | 0.1 | 3.0 | 3.8 | 10.9 | 4.5 | 3.3 | |

| Turkey | 4.5 | 2.5 | 3.1 | 53.9 | 55.4 | 28.6 | |

| * Real GDP growth measured over fiscal year from April-March | 18-Apr-24 | ||||||

| Source: Forecasts for 'BRICS' plus Turkey, Czech Republic, Hungary and Poland are KBC Economics' own forecasts. All others are IMF World Economic Outlook figures. | |||||||

| Policy rates, 10-year government bond yields (in %) and exchange rates (end of period) | ||||||

|---|---|---|---|---|---|---|

| 18/04/2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | ||

| China | policy rate* | 2.50 | 2.50 | 2.40 | 2.30 | 2.30 |

| 10-year yield | 2.26 | 2.25 | 2.25 | 2.25 | 2.30 | |

| CNY per USD | 7.24 | 7.27 | 7.30 | 7.30 | 7.30 | |

| Brazil | policy rate | 10.75 | 10.00 | 9.50 | 9.25 | 9.25 |

| 10-year yield | 11.72 | 11.65 | 11.50 | 11.40 | 11.40 | |

| BRL per USD | 5.23 | 5.28 | 5.25 | 5.23 | 5.20 | |

| India | policy rate | 6.50 | 6.50 | 6.25 | 6.00 | 5.75 |

| 10-year yield | 7.17 | 7.15 | 7.10 | 7.10 | 7.10 | |

| INR per USD | 83.53 | 84.19 | 83.80 | 83.40 | 83.02 | |

| Russia | policy rate | - | - | - | - | - |

| 10-year yield | - | - | - | - | - | |

| RUB per USD | - | - | - | - | - | |

| South Africa | policy rate | 8.25 | 8.25 | 8.00 | 7.75 | 7.50 |

| 10-year yield | 10.62 | 10.50 | 10.35 | 10.25 | 10.25 | |

| ZAR per USD | 19.03 | 19.16 | 19.07 | 18.98 | 18.90 | |

| Turkey | policy rate | 50.00 | 50.00 | 50.00 | 45.00 | 45.00 |

| 10-year yield | 26.34 | 27.00 | 27.00 | 25.00 | 24.00 | |

| TRY per USD | 32.50 | 34.04 | 36.00 | 37.76 | 39.50 | |

| Czech Republic | policy rate | 5.75 | 4.75 | 4.00 | 3.50 | 3.50 |

| 10-year yield | 4.39 | 4.40 | 4.20 | 4.00 | 4.00 | |

| CZK per EUR | 1.93 | 1.95 | 1.80 | 1.65 | 1.70 | |

| Hungary | policy rate* | 8.25 | 6.75 | 6.50 | 6.25 | 6.00 |

| 10-year yield | 7.23 | 6.70 | 6.50 | 6.20 | 6.10 | |

| HUF per EUR | 394.04 | 390.00 | 395.00 | 398.00 | 400.00 | |

| Poland | policy rate | 5.75 | 5.75 | 5.75 | 5.50 | 5.00 |

| 10-year yield | 5.73 | 5.40 | 5.10 | 5.00 | 4.80 | |

| PLN per EUR | 4.33 | 4.37 | 4.32 | 4.29 | 4.27 | |

| *China's policy rate refers to MLF rate, Hungary's policy rate refers to the base rate | ||||||

| There are currently no forecasts provided for Russia | ||||||

Economic Graphs