Economic Perspectives July-August 2020

Read the full publication below or click here to open the PDF.

- The enormous economic devastation caused by the Covid-19 pandemic became clear in the economic growth figures of the second quarter. However, the unprecedented downturn in the US and European economies in Q2 turned out to be slightly less severe than expected. Meanwhile, the Chinese economy recovered quickly after the sharp shock it experienced in the first quarter.

- The recovery in confidence indicators confirms our scenario of a gradual recovery after the temporary Covid-19 shock. However, the recent renewed flare-up of the pandemic in many countries points to the high risk of a ‘stop-and-go’ scenario. As a result, the downside risks remain substantial.

- On balance, the coronavirus shock will reduce inflation, although higher energy prices will temporarily contribute to higher inflation in 2021.

- Economic policy support is very important for the economic recovery. In this respect, the political agreement on a European Recovery Fund is encouraging. Moreover, policy rates of both the ECB and the Fed will remain at their current levels until the end of 2021. As a result, there is hardly any upward potential for government bond yields, especially as continued quantitative easing by both central banks will keep the yield curve relatively flat.

- The recent strengthening of the EUR against the USD mainly reflects general dollar weakness rather than euro strength. As a result, the dollar is expected to be around USD 1.17 per EUR at the end of 2020 and to weaken slightly to USD 1.18 per EUR in 2021.

Unseen economic downturn

The world economy remains under the spell of the Covid-19 pandemic. It has caused not only a historically unprecedented decline in economic activity, but also an exceptional degree of uncertainty about the economic recovery in the second half of 2020 and in 2021. The downside risks remain significant.

Globally, the trough of the economic downturn caused by Covid-19 was probably reached in the second quarter of 2020. Economic growth already fell in all major economies in the first quarter of 2020, but as expected, this downturn only foreshadowed a much more drastic economic downturn in the second quarter (Figure 1).

An important exception was China. As the first hotspot of the Covid-19 virus, China saw a relatively much weaker Q1, and then experienced a strong economic recovery in the second quarter of 2020, with real economic growth of 11.5% qoq. This wiped out the economic shock from the first quarter (-10% qoq). An entirely different picture can be seen in the large western economies. Compared to the first quarter, real GDP fell by 12.1% in the euro area and 9.5% in the US in the second quarter. Such economic shocks obviously leave their traces, also in the longer term. The V-shaped recovery pattern in China leads many to hope that such a rapid and strong recovery will occur globally. The quarterly figures do not reflect this for the time being. It is true that Western economies also started to recover strongly in the second half of the second quarter, following the lifting or easing of lockdown measures. But the contraction in the euro area was still substantial.

Moreover, there were notable differences within the euro area (Figure 2). In Germany, the contraction was limited to 10.1% qoq, but in Spain the economic contraction increased to 18.5% compared to the previous quarter. This is remarkably higher than the economic damage in Italy, which was also severely affected by the Covid-19 virus. Real GDP in the second quarter was 12.4% lower than in the first quarter. This is comparable to the economic downturn in Belgium (-12.2% qoq). Outside the euro area, the Czech economy held up surprisingly well with a contraction of ‘barely’ 8.4% qoq.

These are all economic contractions of unprecedented proportions. However, they were still less severe than even more pessimistic expectations. This is because in both the US and Europe, a number of health measures against Covid-19 were reduced faster than expected. For these reasons, we expect a less severe economic contraction in most industrialised countries for the whole of 2020 than predicted so far.

Our expectation for a continued economic recovery from the third quarter of 2020 through 2021 is based on the crucial assumption that the Covid-19 pandemic will remain more or less manageable. This should create room for a further reopening of the economy. The possible availability of a workable vaccine in the course of 2021 increases the plausibility of that assumption.

On the other hand, from an epidemiological point of view, the relatively rapid relaxation of the anti-Covid-19 measures was probably somewhat rushed. In a number of countries, we are already seeing a resurgence of the pandemic earlier than expected. This increases the risk of a ‘stop-and-go’ scenario, which would put the economic recovery under pressure. We are taking this into account in our growth outlook. We now expect the recovery to be somewhat more difficult in the second half of 2020, but in net terms we are slightly improving our growth outlook for the whole of 2020 for most countries. The growth recovery in 2021 will also be somewhat lower than expected so far, which is partly a technical reflection of the weaker economic contraction in 2020.

Specifically, for the US and the euro area as a whole, we expect real GDP to contract by 5.5% and 8.3% respectively in 2020, followed by a recovery in 2021 of 4.5% and 5.2% respectively. For the Belgian and Irish economies, this means a fall in real GDP of 9% and 5% respectively for 2020, with a recovery in 2021 of 5.1% and 4% respectively. The Central European economies, including the Czech Republic, Slovakia, Hungary and Bulgaria are expected to contract by 7%, 8%, 6.2% and 8% respectively in 2020. For these countries, we expect a recovery in 2021 of 4.7%, 6.1%, 5% and 5% respectively. This is the most likely scenario at this point in time according to our analysis. However, the uncertainty surrounding this is exceptionally high, so we also take into account the possibility of a significantly more pessimistic scenario.

High uncertainty

The Covid-19 shock has caused a substantial increase in the unemployment rate worldwide (Figure 3). Government support measures mitigated this development in a number of countries, including systems of temporary unemployment, Kurzarbeit (reduced-time employment), and wage subsidies to employers. As a result, unemployment statistics currently give a distorted picture of the underlying economic reality and international comparisons are difficult. Nevertheless, it is likely that the unemployment rate in most European countries at the end of 2021 will still be above the pre-Corona level at the end of 2019.

This is an important fact, because the economic recovery from the Covid-19 shock is not only determined by the policy response, but also by the behaviour of consumers and producers. The increased unemployment rate and uncertainty about the final impact of the pandemic on employment may prevent private consumption from experiencing the hoped-for V-shaped recovery. Fears of contagion while shopping also play a role in this. Support measures such as temporary unemployment benefits cannot neutralise these fears. Even without a new formal lockdown, such consumer reluctance may weigh on the recovery.

The practical consequences of the restrictions imposed by the Covid-19 measures and the great uncertainty about the further development of the pandemic also weigh on business investment. It remains to be seen to what extent all these factors will lead to pent-up demand coming from consumption and investment as the pandemic becomes more manageable.

Encouraging confidence rebound

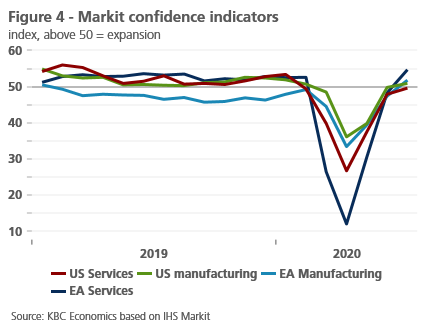

The development of confidence indicators for the global economy is already encouraging. Global producer confidence fell sharply during the outbreak of the Covid-19 pandemic (Figure 4). It reached a low point in April. For the services sector, the decline was historically sharp, while confidence in the manufacturing sector declined still significantly but to a lesser extent.

It is encouraging that producer confidence in both sectors started to rise again as early as May. In fact, confidence in the manufacturing sector reached 50.3 in July, i.e. above the threshold of 50, which indicates growth in economic activity. Based on the most recent figure for confidence in the services sector of 48 in June (a sharp jump after reaching only 35.1 in May), it is likely that the 50 threshold was also reached in July in the services sector as well.

The picture painted by these confidence indicators is consistent with our scenario of a gradual recovery, and with the assumption that the pandemic will be temporary. In that case, the impact of the virus on the growth potential of European economies is also likely to be rather limited. But here too, the uncertainty is extremely high at the moment.

On balance disinflationary

The Covid-19 pandemic and the policy measures taken to deal with it are both negative supply and demand shocks to the economy. In the short term, the demand-side effect is likely to prevail, leading to persistently low core inflation for the rest of 2020. This is particularly evident in the US, where core inflation has fallen sharply in recent months. In the euro area, the figures are less clear. After cooling from 1.2% yoy in February 2020 to 0.8% yoy in June, core inflation rebounded to 1.2% yoy in July. This may be due to the postponement of traditional sales periods or measurement problems, which could cloud the picture of real inflation dynamics. Food prices are also facing upward pressure in many countries.

The negative supply shock is likely to become more noticeable in 2021. However, we assume that the pandemic will remain manageable overall, and will therefore not require new drastic measures, as was the case in March 2020. As a result, these negative supply-side effects and their potential inflationary effect are likely to remain limited. In 2021, economic capacity will remain largely under-utilised, keeping underlying core inflation low.

On the other hand, headline inflation, which also takes into account more volatile energy prices, will face temporary upward pressure in 2021. This is because the expected oil price in 2021 will be higher than in 2020, when during the first phase of the pandemic, the price of a barrel of Brent oil temporarily collapsed. However, this upward oil price effect on inflation will gradually fade out in the course of 2021.

Nevertheless, a number of potentially inflationary trends, already visible before the pandemic, are still present. This is particularly true for protectionism and deglobalisation. The Covid-19 pandemic and the lack of sufficient protective health material, for example, further fuelled the debate on the desirability of global production chains. Moreover, US-China relations have deteriorated further in recent weeks. One of the direct reasons has been political developments in Hong Kong, which have prompted the US to remove Hong Kong’s favourable trading conditions with the US. The conflict between the US, the EU and the UK, on the one hand, and China, on the other, over the activities of the Chinese company Huawei, also came to the fore again.

Economic policy plays an important role

The strength and speed of economic recovery depends not only on purely epidemiological developments. The macroeconomic policy response also plays a role. In the first phase of the crisis, it was mainly the economic shock that had to be absorbed. After that, support for the recovery will take centre stage. After all, we assume that the Covid-19 shock is temporary. As a result, it is important for policy measures to prevent temporary liquidity problems from leading to bankruptcies or credit repayment problems for private individuals in the first instance. Such measures exist in many, but not all, European countries, such as the system of temporary unemployment and moratoria on mortgage payments for private individuals, the postponement of deadlines to pay taxes, and temporary subsidies for businesses and the self-employed. The question is, however, how long these measures can be extended, given their cost and their possible market distorting impact.

The political agreement between the European heads of state and government for an EU recovery fund of EUR 750 billion to tackle the effects of the pandemic is encouraging in this respect. According to current plans, 390 billion will be effective transfers, i.e. non-repayable, from the European policy level to affected member states. The remaining EUR 360 billion will be loans. The fund thus creates a precedent for European solidarity based on European funding. It must now be approved by the national parliaments and the European Parliament. This means that its effective economic boost will not come until 2021 at the earliest.

In the US, on the other hand, the protracted political debate on the specifics of extending temporary budgetary support measures creates considerable uncertainty. Some of these measures, such as those related to temporary unemployment benefits, have in principle expired at the end of July.

In addition to the fiscal authorities, the major central banks are also contributing to the recovery. In other words, there is enhanced coordination between fiscal and monetary policies. Such tandem efforts are essential for tackling a crisis of this magnitude. On the basis of central bankers’ forward guidance, we assume that this will continue to be the case for a long time to come. For example, the ECB extended the announced duration of its Pandemic Emergency Purchase Programme (PEPP) and increased its volume to EUR 1350 billion. In particular, the fact that the ECB’s purchases for the PEPP do not respect the capital key proportions of Member States indicates that, in practice, the ECB is also facilitating the financing of fiscal measures taken by national governments. The Fed is already taking their quantitative easing a step further. It announced in March 2020 that it is prepared, if necessary, to buy government bonds without restriction in order to safeguard the functioning of the financial markets and to provide the necessary stimulus to the real economy.

Policy rates of both the ECB and the Fed will therefore remain around their current levels until the end of 2021. As a result, there is hardly any upward potential for government bond yields especially as continued quantitative easing by both central banks will keep the yield curve relatively flat.

Against this background, the EUR strengthened relatively strongly against the USD in recent weeks. This mainly reflects general dollar weakness rather than euro strength. Indeed, the US dollar also weakened against most other currencies. An important driver for this is the market expectation that the Fed, unlike the other major central banks, will announce an additional concrete stimulus plan in the near future. Political uncertainties in the US, both about the Covid-19 support measures and the approaching presidential elections, also weigh on the USD. Moreover, the US dollar remains overvalued against the euro at its current rate from a fundamental economic perspective. Hence, we expect the dollar to trade around USD 1.17 per EUR at the end of 2020 and to weaken slightly further to USD 1.18 per EUR in 2021.

All historical quotes/prices, statistics and charts are up-to-date, up to and including 4 August 2020, unless stated otherwise. The positions and forecasts provided are those of 4 August 2020.