Dark clouds above the Belgian economy

We expect the current slowdown to be the prelude to lower economic growth in Belgium for the full year 2018. After all, many leading indicators point to a clear cooling off in the economy. In concrete terms, we are revising our GDP growth forecast for 2018 downwards from 1.9% to 1.6%. The potential growth rate for the Belgian economy, moreover, remains very weak. The reasons for the growth slowdown in 2018 are mainly international (in particular the weaker trade environment and more expensive oil), while the low growth potential is due to internal factors. The challenge of raising Belgium’s potential growth through structural reforms remains significant.

With 0.4% real economic growth in the first quarter of 2018, the Belgian economy was clearly disappointing. Belgium is thus following the general European trend after a strong 2017. In the same way, growth also slowed down in Belgium’s neighbouring countries compared to the last quarter of 2017. The growth decline at the beginning of 2018 came as a surprise to many. It was generally expected that GDP growth would continue to strengthen for some time in Belgium. Today, opinions are divided. Some see the weak first quarter as a temporary downturn. Others believe that the peak in the economic cycle is behind us. We are convinced of this second route, which is mainly due to the international context. What’s more, the Belgian economy is not only facing a weaker 2018. An expected slowdown in private investment and a lack of public investment also limit the future growth potential. Rapid and drastic reforms remain necessary in order to turn the tide in time. Otherwise, the Belgian economy is in danger of becoming a rudderless ship in turbulent international waters.

A first reason for the slowdown can be seen in falling export orders. Foreign demand for Belgian products and services is under pressure. This is partly due to increased protectionism - a trend that has been going on for several years - and the possible escalation of the various trade conflicts recently initiated by the United States. The strong focus of exports on the European market means that the Belgian economy is partly shielded from the international struggles. However, the country is indirectly affected because its main trading partners - Germany, France and the Netherlands - are more active in non-European markets. As suppliers to neighbouring countries, Belgian companies are often more affected as they themselves have less control over the entire export chain. The strong euro has also had a negative impact on European exports as a whole. Finally, Belgian labour costs are rising again after a period of wage moderation, once again jeopardising the country’s international competitive position. While Belgian exports are facing challenges, higher consumption demand is supporting imports thanks to increased job creation and rising disposable income. As a result, net exports will contribute negatively to growth.

A second factor that weighs on the outlook for the Belgian economy is the rise in the price of oil. Compared to other European economies, the Belgian economy is always relatively strongly influenced by oil price movements due to its large chemical sector and its relatively high energy intensity (e.g. because of relatively many older dwellings). The rise in the price of oil is due more to international tensions surrounding Iran than to a rise in the demand for oil. Such exogenous oil shocks typically have a downward effect on the Belgian economy.

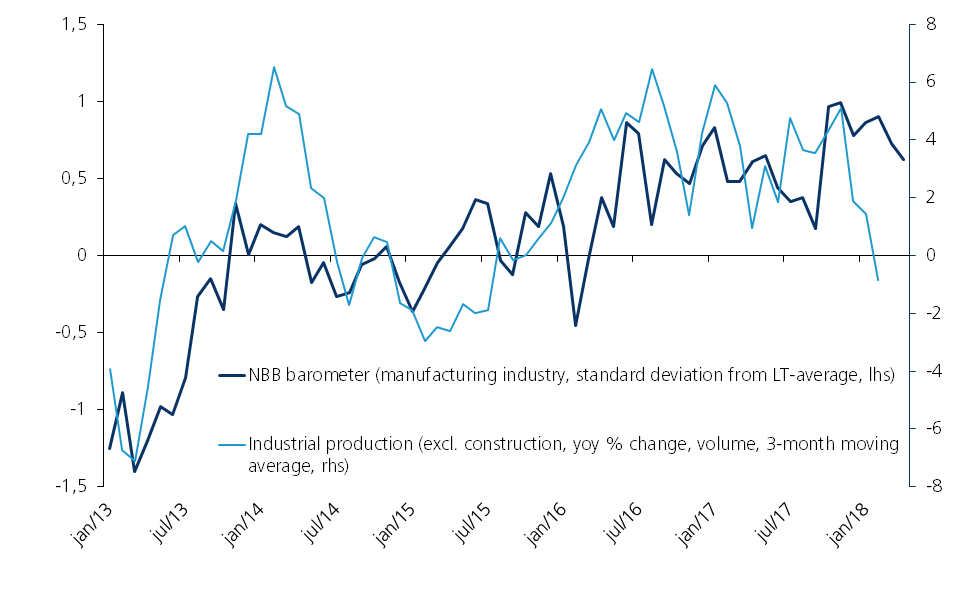

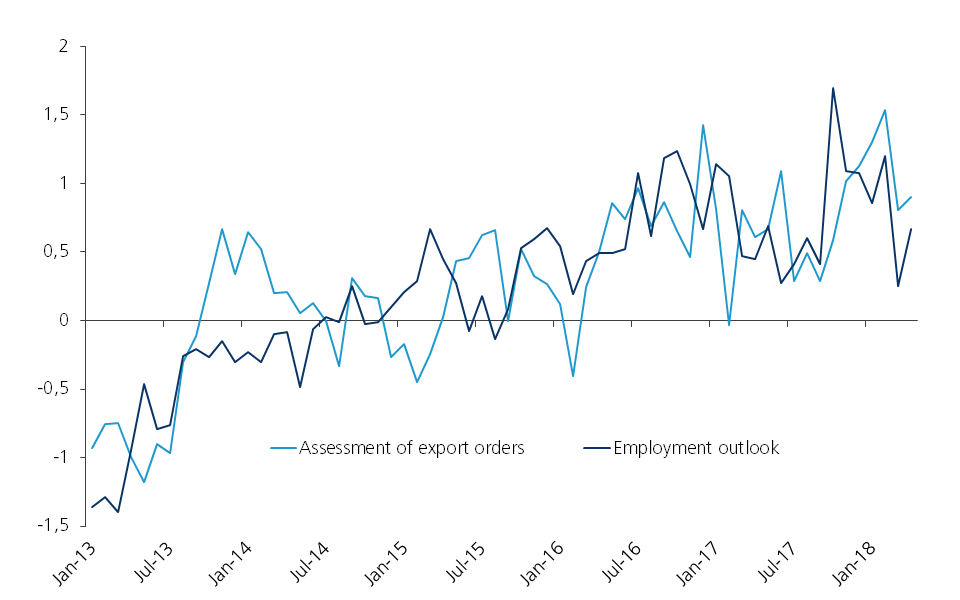

A third factor, which is related to the above, is the sentiment of Belgian companies. Confidence indicators point to a general weakening of sentiment, which nevertheless still remains relatively positive. The picture is fairly uniform across sectors, with the exception of the construction sector. The worsening international climate is particularly affecting indicators in the manufacturing industry (see Figures 1 and 2). Weaker sentiment is likely to continue to weigh on the economic situation in the rest of this calendar year.

Figure 1 - Indicators in the manufacturing industry are turning lower

Source: NBB.Stat

Figure 2 - Indicators in the manufacturing industry are turning lower (standard deviation from long term average)

Source: NBB.Stat

Despite these negative factors, we also still see positive elements for the Belgian economy. The fact that effective economic growth remains above potential is mainly due to relatively strong consumption and investment growth. Both components compensate to a certain extent for the more difficult international conditions. The importance of private investment as a growth engine has increased particularly sharply in recent years. Unfortunately, it seems difficult to maintain growth through new investments. One reason is that further expansion in private investment is hampered by the tightness of the Belgian labour market. Moreover, despite the economy still being in an expansionary phase and the favourable financing possibilities for long-term investments, many Belgian investments are often focused on the shorter term. This is evidenced by the strong growth in corporate loans in the relatively short term. In combination with exceptionally low public investment, due to the challenges of public finances, Belgium is therefore failing to substantially increase its future growth potential.

For these reasons, we expect the Belgian economy to weaken. The strong performance of 2017, with growth accelerating from 1.4% to 1.7%, may not be matched in 2018. Various national and international institutions recently published their growth outlook for the Belgian economy. Their figures (averaging at 1.8% real GDP growth for 2018) imply a further pick-up in growth compared to 2017 and are likely to be too optimistic. We expect a lower figure (1.6% for 2018) that is closer to Belgium’s potential growth (1.4% according to the European Commission). This may seem like just a slight slowdown in growth, but it does contribute to a further persistent growth deficit compared to most of the neighbouring countries. With a potential growth rate of only 1.4%, Belgium’s performance is also structurally worse. This indicates that the challenges for the Belgian economy remain considerable. As a small open economy, Belgium can do little to change global conditions, but it can provide an environment in which structural investment strengthens its economy through necessary reforms. There is still work to be done.