Demand from abroad continues to pose a risk to the German economy

A weak end to 2023

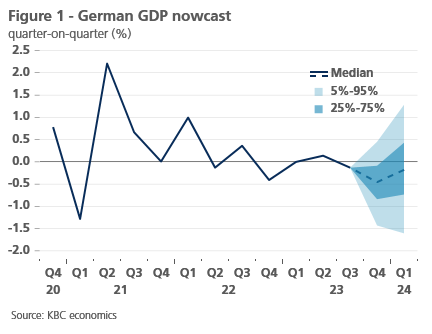

The German economy has had a weak year, with the first figures for the fourth quarter showing little improvement: confidence indicators remain low and industrial production fell by 0.7% in November (production in the construction sector dropped by 2.9%), continuing its downward trend. Following the release of these figures, the KBC nowcast for the German economy in the fourth quarter is -0.45% (see figure 1). A first look at the first quarter of 2024 based on leading indicators is unconvincing, with expected growth currently slightly below zero.

Negative demand shocks after supply chain problems and energy crisis

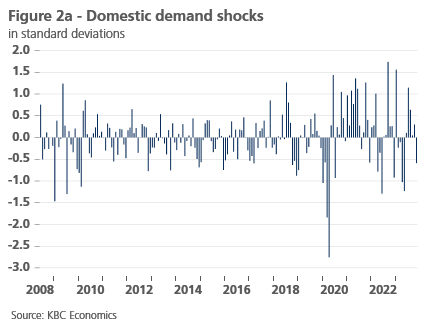

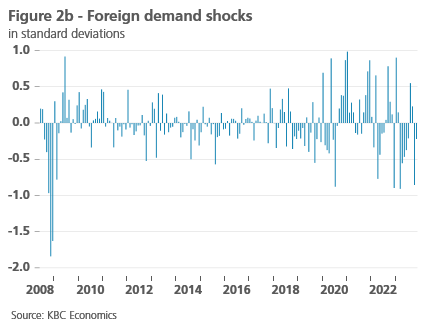

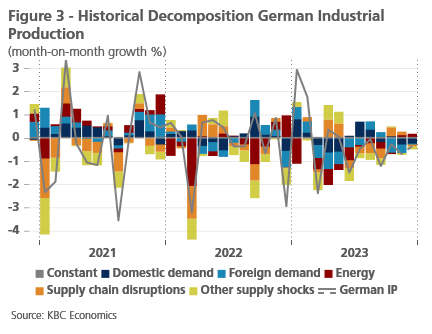

German industry, already on a downward trajectory since the regulatory issues in the automotive sector in the second half of 2018, has been hit hard in recent years by global supply chain issues and the energy crisis following Russia's invasion of Ukraine. To illustrate the impact, we describe three supply shocks1 (a supply chain disruption shock, an energy shock and other supply shocks). Despite the magnitude of these supply shocks, the economy held up reasonably well, but did not recover when the energy and supply chain shocks subsided. To explain this, we describe two demand shocks2 (a domestic and foreign demand shock) to which the industrial sector is exposed in addition to the supply shocks. Indeed, in Figure 2 we observe negative demand shocks for 2023, which are not negligible compared to past shocks. In Figure 3, which shows the cumulative impact of the different shocks on industrial production, we see that the foreign demand shocks contributed most to the decline in industrial production, but domestic demand was also underwhelming in 2023.

This makes the industrial-intensive German economy an exception within the euro area. The measured negative demand shocks for the euro area as a whole were, in contrast with Germany, rather limited in 2023 and thus did not trigger a broad-based motive for an accelerated monetary easing by the ECB.

Despite falling energy prices, we still see a negative impact from energy shocks. This suggests that the energy market has not yet normalised and that, given the fall in demand, we should expect lower energy prices under normal circumstances.

Among other things, foreign demand remains uncertain

The underperformance of both the European and Chinese economies in 2023 is a logical (partial) explanation for the disappointing performance of German manufacturing. European growth will be weighed down by high interest rates in 2024, but we take confidence from the rising economic sentiment indicators in December, which lift forecasts for the first quarter. Although the manufacturing component of the ESI has stopped falling, it continues to lag. As for China, the risks remain high. Our baseline scenario remains cautious, with an expected growth rate of 4.3% in 2024, concerns about the real estate sector remain high, with increasing spillover risks to the financial sector and local governments. In addition to further foreign demand shocks, a prolongation or escalation of the Middle East conflict could lead to negative energy shocks, to which Germany's energy-intensive industry is exposed.

The start of the year has already been complicated by the attacks against merchant ships in the Red Sea and by German farmers protesting against the announced abolition of some tax breaks for their sector. Roads, border crossings and access to some factories have been blocked.

Despite the risks and the false start to 2024, our baseline scenario is for a gradual recovery in German manufacturing, and by extension the wider economy, after negative growth in 2023, although we remain cautious at 0.2% annual growth.

1Supply shocks are identified, inspired by Chiacchio, Francesco, et al. "How have higher energy prices affected industrial production and imports?". Economic Bulletin Boxes 1 (2023). PMI suppliers’ delivery times are replaced by DG ECFIN, Industrial Confidence Indicator, Factors Limiting the Production in a mixed-frequency model.

2The foreign demand shock is distinguished from the domestic one based on the strategy described in Consolo, Agostino, Claudia Foroni, and Catalina Martınez-Hernández. "A mixed frequency model for the euro area labour market." (2020). Using the Economic Sentiment Indicator instead of the Purchasing Managers' Index.