Debt quality, not accumulation, threatens financial stability

In its latest financial stability report (October 2018), the IMF warns against continued debt accumulation. The global debt mountain has never been higher. However, a closer look at the data reveals that it is mainly emerging markets that experienced a debt explosion, with the problem concentrated in a number of countries. Moreover, despite substantial growth in non-financial corporate debt, productivity growth remains constrained in advanced economies. Apparently, credit is insufficiently used to boost future growth. Hence, rather than reducing credit provision to avoid financial instability, credit quality should be monitored more intensively. For several emerging markets, reducing absolute debt is essential to avoid an uncontrollable further debt accumulation.

Absolute versus relative

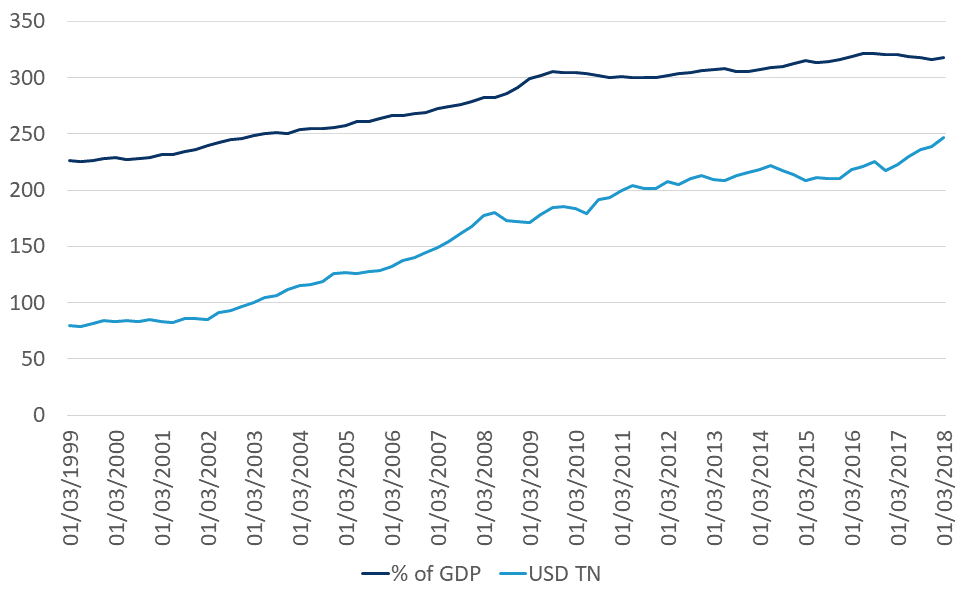

In absolute terms, aggregate global debt increased substantially in recent decades. However, when expressed in relative terms, namely as a percentage of global GDP, talking about a global debt explosion since the financial crisis is clearly exaggerated (Figure 1).

Figure 1 - Evolution of Global Debt (in % of GDP and TN USD)

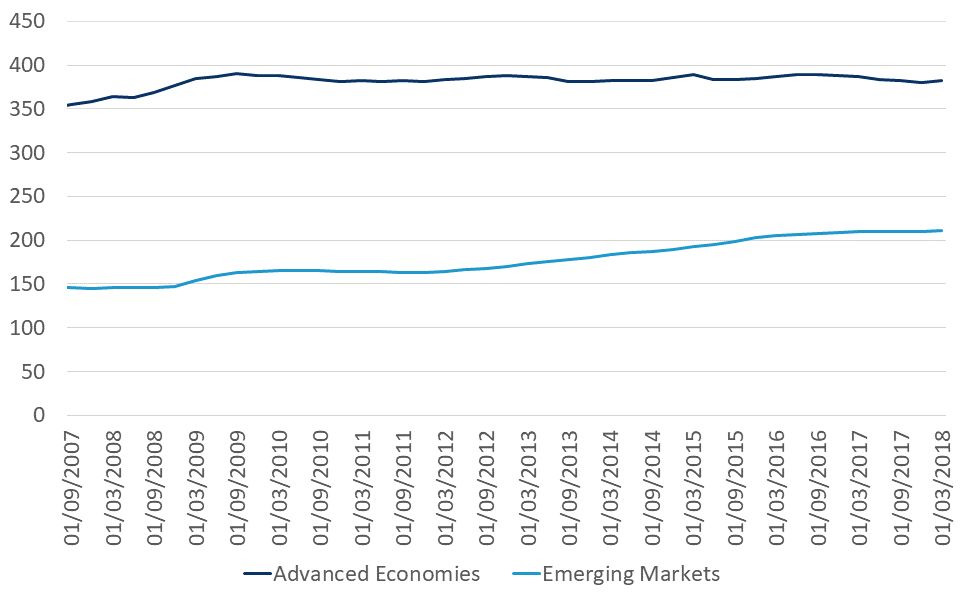

During the last decade, debt went hand in hand with economic growth. One can assume that credit growth contributed to economic growth by boosting consumption and in particular investments. Distinguishing between advanced and emerging economies teaches us that relative debt growth was particularly strong in emerging markets. Conversely, relative aggregated debt growth has actually been slightly negative after the financial crisis in advanced economies (Figure 2). Deleverage in the financial sector contributed substantially to this trend, whereas other economic agents in western countries still increased their indebtedness over the past 10 years.

Figure 2 - Evolution of Debt, Emerging Market vs Advanced Economies (% of GDP, GDP weighted averages)

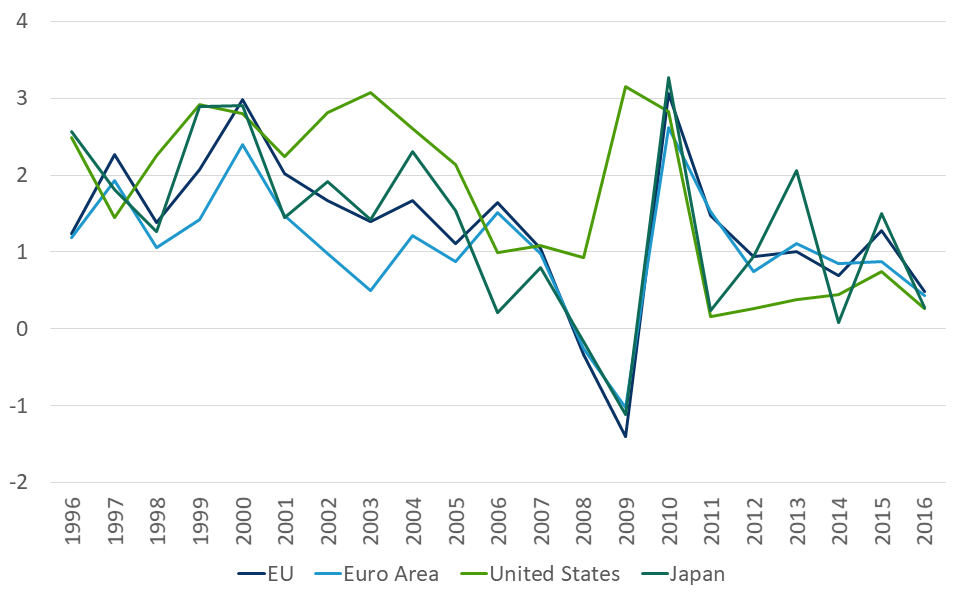

In particular, non-financial corporate debt increased substantially. In a period of gradual recovery after an economic downturn, growing credit provision is no surprise. Corporate credit played a substantial role in growing out of the financial crisis. As such, this trend is not worrying, but rather reassuring. The corporate sector invested in the future. However, debt accumulation should lead to improved growth potential in the longer run. Otherwise, debt levels may become unsustainable, in particular when the economy cools down or interest rates rise. For advanced economies, productivity growth is an essential driver of future potential growth. If one looks at the evolution in productivity growth in advanced economies, the recent evolution is very disappointing (Figure 3). Annual productivity growth dropped to about 1%, far less than in the recent past and insufficient to give a strong boost to economic growth. This is surprising in an era of radical innovation in artificial intelligence and digitalization. The latest technological trends have not translated into higher productivity growth yet. This discrepancy between credit growth and declining productivity growth raises questions about the quality of credit provision from a macroeconomic perspective. Credit provision is insufficiently focused on productivity enhancing investments which is a crucial condition for debt sustainability in the longer run. Hence, rather than calling for debt reduction in advanced economies, it seems more appropriate to call for improved credit quality. This may not be an easy task. Financial institutions and their regulators do watch credit quality, because of its importance for macroeconomic financial stability. However, the credit quality control is based on financial parameters rather than on the economic rationale of new investment projects. Ultimately what counts for the financial sector is that loans are reimbursed. Hence the macroeconomic perspective stands far away from the micro-level reality. Bringing in a macroeconomic perspective in credit provision policies would be economically wise, but practically hard to implement. Nevertheless, it can and should become the focus in prudential policies.

Figure 3 - Productivity Growth (GDP per hour worked) (USD, 2010 PPPs, % change yoy)

Vigilance for emerging markets

While low productivity growth is a concern in advanced economies, other debt quality features matter for emerging markets. In particular, emerging markets’ vulnerability to foreign currencies and foreign interest rates are worrying. Various emerging markets are exposed to developments in the US economy. The combination of USD appreciation and increasing US long-term interest rates risks causing an upward pressure on the most indebted emerging markets. It is no surprise that Argentina and Turkey have been among the first victims, but undoubtedly more emerging economies will be affected as roughly a third of all debt maturing through 2021 is USD denominated. Despite growth enhancing effects of credit provision in emerging markets, these financial challenges call for a clear debt reduction in the most indebted emerging markets.

In sum, the global debt story is more nuanced than suggested by the latest IMF report. Debt levels are at all-time highs but relative to GDP, debt in advanced economies has slightly declined since the financial crisis while that of emerging markets continues to increase. The appropriate respective responses, therefore, should also be nuanced. In advanced economies, the focus going forward should be on credit quality and whether or not leverage is boosting future potential growth. In emerging markets, as financial conditions tighten, countries will need to focus on reducing macroeconomic imbalances, including reducing their debt burdens.