Czech residential real estate market, a reason for concern.

- Read the publication below or click here to open the PDF.

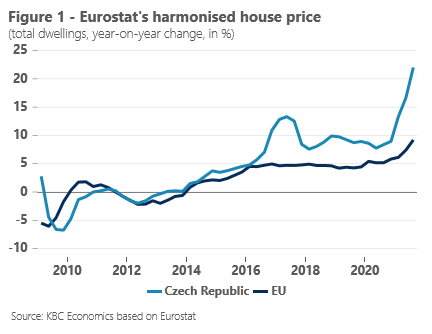

In 2021, house prices rose strongly in most European countries, but in the Czech Republic the increase was remarkably high (see figure 1). In the third quarter of last year, Czech house prices were 22% higher compared to the third quarter of 2020. Such price increases suggest some exuberance. The outcome of several valuation models is quite clear, the overvaluation of Czech residential real estate has increased significantly over the last year. The ECB reported a model-based overvaluation of 34% for the third quarter of 2021, compared to 5% before the outbreak of the pandemic. The KBC economics valuation model, based on fundamental drivers of the housing market such as population growth, economic growth and the current interest rate environment, estimates an overvaluation of 25% in the third quarter of last year (see figure 2), a number that requires an in-depth analysis.

Rising construction costs

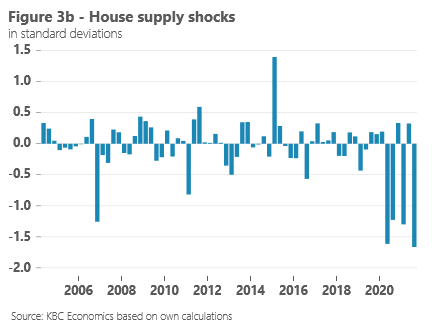

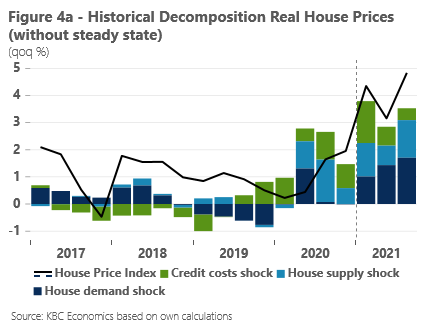

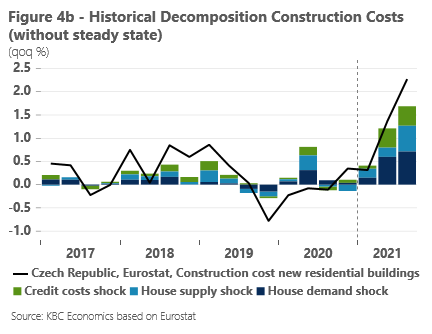

We cannot view the current price trends in European housing markets in isolation from supply-side issues caused by the covid pandemic. First, there are mobility constraints, due to lockdowns, which affected the construction sector mainly in the second quarter of 2020. Second, problems in global supply chains have made the supply of construction materials tighter and consequently increased their price. These ‘housing market’ supply shocks have played an important role in the recent increase of house prices. Such shocks cause negative effects on real investments combined with increasing house prices. This contrasts with the demand shock, which has a contemporaneous positive effect on both house prices and residential investment. Unlike more general demand supply shocks, we assume that such real estate shocks would not have an (important) immediate effect on overall economic activity and would only start affecting the economy with some delay. These real estate demand and supply shocks can be identified and estimated using standard BVAR models. Looking at Figure 3b, we indeed observe negative supply shocks in the housing market, both in the second and third quarter of 2020 and in the first and third quarter of last year. The cumulative effect on real house price growth of these shocks in 2020 and 2021 is 5.7% (median). Thus, house market specific supply shocks contributed to the rise in real house prices, but they are certainly not enough to fully account for the recent price surges in the Czech residential real estate market. Given the sharp increase in construction costs in the past year, the contribution of these supply shocks may seem limited. But as seen in Figure 4b, these construction costs are also driven by demand shocks in the housing market, among others. Thus, a rise in construction costs themselves is rather symptomatic of supply problems in the construction sector, while other factors (demand shocks specific to the housing sector in addition to general demand shocks in the economy) of course also contribute to a rise in construction costs.

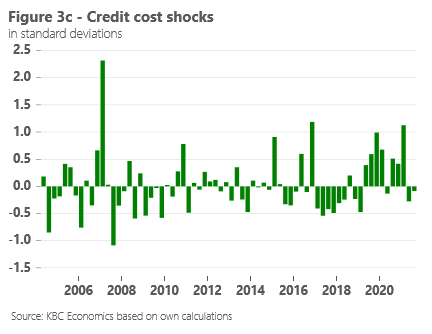

Easy access to credit

In Figure 4a we see that in addition to supply and demand shocks in the housing market, shocks to credit costs also play a role in the price formation of residential real estate. After all, when mortgages become cheaper, people can spend more on a house, which leads to higher house prices. To the extent that these mortgage rate shocks can be considered permanent, they can be considered to affect the fundamental house prices. Figure 3c shows that there were positive shocks to credit costs, partly because of fierce competition in the market for mortgage loans in recent years.

A positive demand shock in the housing market?

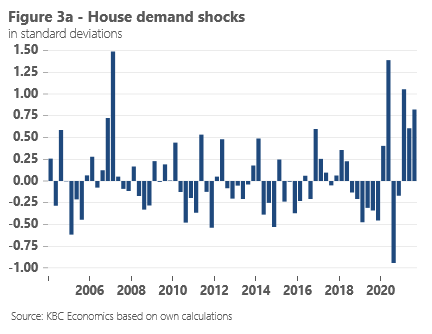

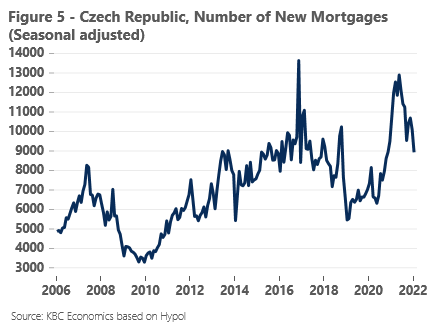

But independent of credit costs, supply-side problems, or the general state of the economy, strong and positive demand shocks have also played an important role in the build-up of prices (Figure 3a). The last correction in the Czech housing market (Global Financial Crisis period) was (also) preceded by a cumulation of such positive shocks. Part of the explanation for these shocks may be related to future homeowners being eager to lock in low interest rates and anticipating future real estate purchases or construction. The strong growth in mortgages during the first half of last year supports this view (see Figure 5). However, the search for yield demand by foreign investors in a generally low yield environment certainly contributed to the observed price surge.

If these are the important drivers behind these demand shocks, then we may expect some cooling down of the housing market in coming quarters. Although regional differences exist and - based on estimates of the Czech National Bank (CNB) - in certain parts of the country around 50% of houses are purchased without a mortgage (e.g., Prague) the number of new mortgages has been decreasing in the last few months. This is a necessity, as current price growth – if it was to continue without a similar dynamic in households' earnings – would effectively prohibit a large share of households from accessing mortgages. Especially in an environment of tightening regulation.

Debt-Service-To-Income (DSTI) ratio

Although part of recent house price increases can be explained by fundamentals, one must be aware that according to CNB reports, more than 40% of new mortgage loans granted by banks in the recent quarters showed a Debt-Service-To-Income (DSTI) ratio higher than 40% (CNB 2021), i.e. a level that the CNB considers risky (Malovaná et al., 2018). Also, there has been a clear pattern of rising DSTI, DTI (Debt-To-Income), LTV (Loan-To-Value) and mortgage term.

Accelerating overvaluation and relatively easy credit conditions therefore prompted the Czech National Bank (CNB) to tighten lending conditions. Moreover, the average mortgage rates have been rising and hence a refixing of a typical mortgage after 5 years (i.e. refixing in 2022 a loan taken in 2017) will lead to a significantly higher monthly payments for households (unless the original term is extended). On the other hand, the financial conditions of Czech households are on average still favourable, and growth in disposable income recorded over the past few years and the generally positive situation in the labour market can in many cases compensate for the increased lending costs after refixing.

In conclusion, we can say that certain fundamental drivers have contributed to the sharp rise in house prices over the past year. However, these fundamentals are not sufficient to fully explain the price increase. We expect, also thanks to intervention by the Czech National Bank, a cooling of the housing market in the short and medium term.

References

- Simona Malovaná, Michal Hlaváček, Kamil Galuščák (2018). Sensitivity of Czech Households to Interest Rate and Income Shock. Applications on Microdata. Politická ekonomie, 2018, 66(5), 531–549, https://doi.org/10.18267/j.polek.1204 (in Czech only)

- CNB (2021). Rizika pro finanční stabilitu a jejich indikátory. https://www.cnb.cz/cs/financni-stabilita/publikace-o-financni-stabilite/Rizika-pro-financni-stabilitu-a-jejich-indikatory-prosinec-2021/ (in Czech only)