Currencies as economic weapons

The western sanctions freezing large parts of Russian foreign reserves explicitly used currencies as economic weapons. In the short term, this is unlikely to affect the dominant role of the US dollar as an international reserve currency. Compared to other currencies, the US dollar is still most in line with the requirements that a reserve currency must meet. It is based on a large economy, with well-developed and liquid financial markets and a strong geopolitical status. The fundamental trust in the protection of investors’ property may have experienced a setback by the sanctions, but that also applies to the currencies of other sanctioning Western countries. Cryptocurrencies, gold and the IMF’s Special Drawing Rights are no satisfactory alternatives either, each for their specific reasons. Therefore, in the short term, the most likely evolution is a continuation of the current status quo. In the longer run, changes may well occur and are unlikely to happen in an orderly way.

Increasing weaponisation of the dollar

After the start of the Russian invasion, the US, EU, UK and Canada froze substantial parts of the foreign exchange reserves of the Russian central bank under their jurisdictions. These sanctions effectively made about half of the total Russian foreign reserves unusable. It is not the first time that the US and its allies are using their currencies as economic weapons. This also happened after the US reinstated economic and financial sanctions on Iran from 2018 on, in the context of the Iranian nuclear programme.

The economic power to impose such sanctions, and their severe extraterritorial effectiveness, is derived from the unique position of the US dollar as the world’s dominant international currency. Transactions in many markets, such as commodity markets, are settled in US dollars. Any firm engaging in transactions with a country under sanctions, is likely to be involved in a financial transaction in US dollars. Since all of these financial transactions and build-up of foreign reserves in US dollar sooner or later have to be settled via accounts in the US banking system, the economic agents involved, including foreign central banks, directly or indirectly face an exposure to US legislation.

Dollar remains immune for now

This raises the question why most countries, including those that could be potential future targets of currency-based sanctions, continue to use the USD as an international reference currency. Part of the answer is that there are high hurdles for such a monetary regime shift towards other (possibly co-existing) international reserve currencies.

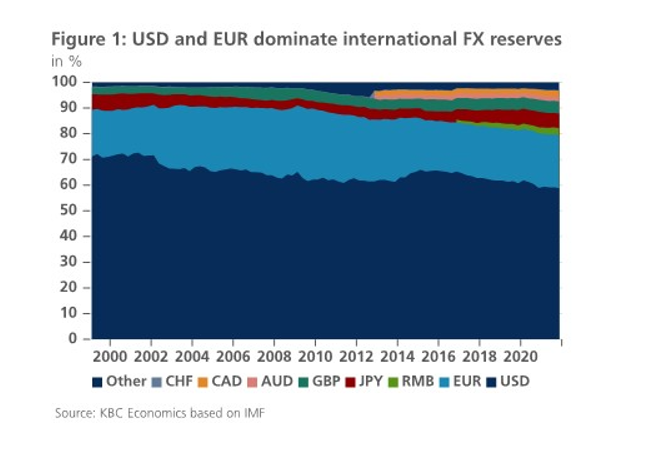

China is promoting the use of its national currency in international financial transactions and FX reserves accumulation, but so far with only limited success on a global scale (Figure 1). There are a number of characteristics that a currency must have in order to play a significant international role. First of all, the currency must be supported by a (very) large economy, because fiat money is essentially a claim to goods and services of the issuing country. The size of the economy also means that there are more (domestic) users from the outset, which reduces transaction costs for potential new users. This phenomenon is referred to as ‘network effects’ or economies of scale on the demand side. These effects help to explain the persistence of the status of an international currency once it has acquired such a status. This was the case for the British Pound in the 19th and early 20th century, and it has been the case for the US dollar since the end of the Second World War.

A second condition is the presence of liquid and easily accessible financial markets. International investors should have at their disposal an adequate amount of safe financial assets issued in the international currency of their choice.

Thirdly, a sound and stable political, legal and macroeconomic framework plays an equally critical role. This refers in particular to the enforceability of the law by independent courts, which guarantees international investors the protection of their investment property.

Finally, in the long term, the combination of geopolitical status and political stability of a country plays a decisive role. A country with hegemonic power can gain major economic advantages by stimulating the international use of its currency. This includes in particular the ‘exorbitant privilege’ of being able to issue debt and settle import bills in one’s own currency. This reduces borrowing costs, insulates the domestic economic from exchange rate volatility and allows to extract seignorage internationally.

No alternatives in sight (yet)

The freezing of substantial parts of Russian reserve assets is in contradiction to the third condition for a reserve currency to guarantee property rights. In the long run, this precedent may indeed undermine the trust in the US dollar’s role as an international safe heaven, and therefore strengthen the trend for the some countries to promote their own currencies as alternatives. In the short to medium term, however, this precedent will probably not have any tangible impact. The sanctions on Russian FX reserves are not only imposed on reserves held in the US, but in most Western currencies. In other words, they are not dollar-specific, limiting the relative damage to the trust in holdings in US dollars.

Despite this gradual weaponisation of the dollar, it still comes closest of all potential candidates to fulfilling the necessary conditions for an international reserve currency. Despite the initial ambitions, financial markets in the euro area are still not integrated and liquid enough for the euro to challenge the dollar. Meanwhile, the Renminbi is still not a fully convertible currency for capital transaction. Moreover, there is a risk that the Chinese government would use its currency as a political weapon as well if necessary, offering no more security to international investors than the status quo.

Other assets offer no satisfying alternative for the US dollar either. Cryptocurrencies are no legal tender anywhere and hence lack the necessary backing of a large economy. Gold assets are not liquid enough to efficiently carry out international payments. The IMF’s Special Drawing Rights (SDRs) are no potential candidate either. SDRs are not really a currency by themselves, but represent claims on a currency basket of USD, EUR, GBP, JPY and RMB. Therefore, any FX reserve held in SDRs is effectively a reserve held in these underlying currencies. Finally, Central Bank Digital Currencies (CBDCs) are being examined by most major central banks worldwide. One of the most appealing features of CBDCs is the potential scalability and hence positive network effects (see the first condition mentioned above). However, since CBDCs are still national currencies, the third condition of national economic and political stability applies, with currently no better alternative for the dollar in sight. Moreover, there may be limits on the amounts transacted or held.

To sum up, in the short term, a continuation of the status quo is the most likely outcome, since there is no alternative of equivalent scale. In the longer term, however, many economic and geopolitical events can affect the current state of play. These events are by definition hard to predict. The experience of the past suggests however that if they occur, such a transition is unlikely to happen in a smooth and orderly way.