Could a post-Covid world see a digital boost to productivity?

Even asking such a question might seem rather incongruous or even inappropriate while people across the world are still suffering as a result of the pandemic. But it can’t be denied that the Covid-19 crisis has accelerated the transition towards digitalisation and automation, particularly when it comes to online business and telework. What’s more, a reversal of these trends is not only unlikely, it’s actually possible these changes may have a positive impact on productivity.

From one crisis to the next

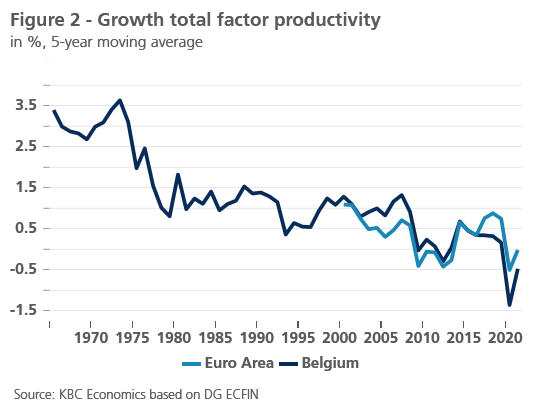

This question is all the more provocative in light of the situation following the previous big crisis, that being the financial crisis of 2007-2009. The figures show that in the advanced economies of the G20, the average growth of total factor productivity (TFP) sank from 0.7% before the global financial crisis down to 0.3% after that crisis.

As always, there is no single factor which can explain this decline in productivity. Rather, there were certainly several factors at play, particularly given that this phenomenon of falling productivity had already been observed prior to the financial crisis. It also became clear during those years that new digital technologies did not have an immediate effect on productivity, which meant that businesses were all the more likely to slow their investments, and this declining productivity was then exacerbated by the financial crisis.

Beyond that, it is absolutely worth highlighting both the slow rate of adoption for these new technologies and the difficulty of measuring their effect on productivity considering the lack of instruments capable of sufficiently measuring such effects.

So what’s changed?

Backed into a corner, businesses have made huge investments into digital tools during the lockdowns and in a context of other restrictions. These developments, which may have otherwise taken several years, instead took a few months as businesses began using video conferencing platforms, file-sharing applications and data extraction tools.According to IMF calculations, in a sample of 15 countries over the period 1995-2016, a 10% increase in investment in intangible capital (i.e. digital tools) led to an increase of about 4.5% in labour productivity. On the other hand, investment in tangible capital led to a smaller increase in productivity.

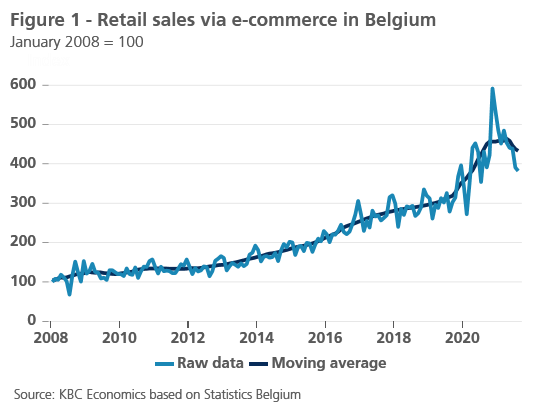

The second consequence of the health crisis is that we have seen a clear reallocation of resources to businesses which operate more efficiently, both within and across sectors, as a result of falling demand. Consequently, we have observed a progressive decline in services to individuals, where the level of production per employee tends to be relatively low (restaurants, tourism, retail, etc.) in favour of digital services and sectors where the level of production per employee is higher (e-business and telework in particular).

These two factors therefore have the potential to increase productivity in the long term because they clearly mark a radical and lasting change in a number of cases. We cannot ignore certain obstacles which may counteract this trend, however.

What are the obstacles?

The first obstacle is that of ‘zombie’ businesses, or weak businesses kept on life support through low interest rates and measures implemented by governments. Lacking the tools for targeted intervention, governments have offered blanket support for businesses, which meant that bankruptcy rates in 2020 were largely lower than in previous years. There is now considerable risk that these businesses will pull productivity back down.

In addition to the risk of ‘zombie’ businesses, there is also a risk of increased market concentration resulting in a slowdown of innovation and therefore productivity. That being said, it is absolutely clear that in certain sectors, the dominant businesses were able to use the crisis to cement their position even further, particularly in the case of digital services.

The last obstacle is linked to the loss of productivity caused by workers moving from one sector to another, or who have experienced a period of inactivity or unemployment. What’s more, these workers typically have fewer qualifications, meaning that they require new skills and therefore time if they are to achieve the same productivity as workers who have remained professionally active.

Moreover, there is the question of the long-term impact of school closures on apprenticeships and therefore productivity, given the knowledge gaps and backlogs that arose during the pandemic.

Training as a major concern

Despite numerous obstacles, businesses seem determined to favour telework and continue to make huge investments into digitalisation and automation. This trend is being further encouraged by changing consumer habits as more and more spending goes towards e-business.

This indicates that the factors explaining lower productivity before the health crisis could fade while reduced costs (smaller office spaces, downsizing, etc.) could contribute to a reversal of that trend. All of this signifies, however, that training absolutely must become a central focus for businesses, while workers must also be taught how to adapt and benefit from this increased productivity by way of an increased salary.