Confidence indicators do not rule out an economic contraction in the euro zone

Last week, PMI indicators already informed us about business confidence in the eurozone. That confidence is falling, although the index remains just above 50, the limit that distinguishes economic growth from a contraction. For months, confidence in the manufacturing sector has been below that limit, with the PMI reading for this sector in June at 43.6. Over the past two months, confidence in the services sector also made a downward move, although a value of 52.4 for this sub-index still indicates growth. Confidence indicators such as the ifo and ESI, released this week, confirm the negative trend.

German ifo

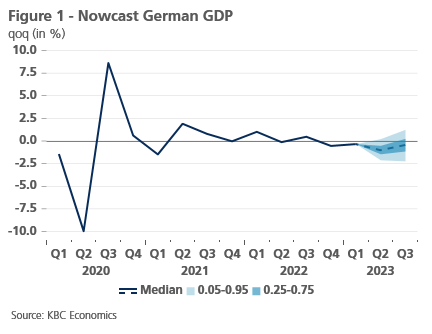

On Monday, attention turned to Germany. The ifo Business Climate Index (from 91.5 in May to 88.5 in June) lowered the nowcast for German GDP in the second quarter from -0.8% to -1.0% (see Figure 1). Other variables that help predict this negative growth rate include new orders in German manufacturing and job openings. Both hard indiators have been showing negative growth for several months and confirm the signal coming from deteriorating confidence indicators. Being a leading indicator, the ifo also lowered the model outcome for the third quarter from -0.1% to -0.4%. Thus, the growth outlook for Germany for the second half of the year also appears meager, although there is greater uncertainty surrounding this forecast, which is mainly based on confidence indicators.

Economic sentiment indicator (ESI)

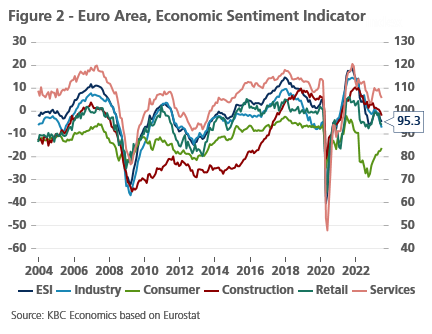

Yesterday, Eurostat published the economic sentiment indicators for the month. Of the major eurozone economies, Germany is the country with the biggest drop in ESI. However, the figure for the Eurozone as a whole is also falling (see Figure 2). As with the PMI indicator, manufacturing is the main culprit. Although the indicator still points to growth in the service sector, sentiment in this sector is also deteriorating.

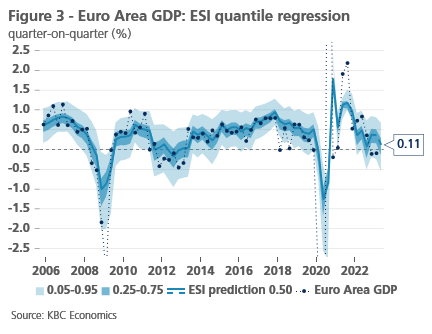

What does this European figure mean for economic growth? Based on a quantile regression, as described in "The ESIs: a finger on the pulse of the European economy?", we calculate the growth forecast for the second quarter. The median estimate of growth in the Eurozone is 0.11% (see Figure 3). However, the probability of negative growth is increasing, the GDP-at-risk (the fifth percentile of the forecast distribution) is -0.55%.

Conclusion

Sentiment indicators in the euro zone are slowing down across the board, suggesting economic growth close to zero or even negative. The leading nature of these indicators, leads us to conclude the same for the third quarter, although this is only a first rough estimate. For the time being, a deep recession is not visible in the data; we speak of a limited slowdown in growth in the euro zone.