EU carbon border adjustment: with or without the others

Click here to open pdf

The EU recently launched its proposal to introduce a border tax on carbon emissions (Carbon Border Adjustment Mechanism or CBAM). For the implementation, the EU envisages a transition period starting in 2023 and a move to full implementation in 2026. In keeping with the goal of the CBAM, the proposal focuses on goods for which the risk of carbon leakage is high. Unsurprisingly, the proposal is facing headwinds from some of the EU’s major trading partners and there have even been threats to open a dispute at the World Trade Organization. But first the proposal must be negotiated and approved by the EU’s own policy-making bodies. In the meantime, the EU wants to start a dialogue with its trading partners. After all, there is room in the proposal for third countries to be exempted from the border adjustment, namely if they themselves introduce a carbon price mechanism. So cooperation is possible, but the EU is making it clear that it will fight climate change, with or without the other countries.

With its Fit for 55 plan, the EU makes a clear statement: it wants to be a pioneer in the field of climate regulation. And it has good reasons to do so. After all, the scientific community agrees: waiting to take action is not an option. This was reaffirmed in August when the IPCC published an ominous summary of the existing scientific literature on climate change.

For some time now, the EU has been one of the first big players on the world stage to stick its toes into the (rising) water. But being a frontrunner has its downsides too. A major drawback is that it increases the risk of carbon leakage. Carbon leakage is the relocation of carbon-intensive production from EU companies to countries where standards are more lax and the replacement of EU products with more carbon-intensive products from abroad. In this way, carbon leakage can negate the EU’s climate efforts and also jeopardizes the competitive position of EU firms.

Carbon Border Tax to avoid leakage

Therefore, the EU has proposed to set up a Carbon Border Adjustment Mechanism (CBAM) at the borders. This mechanism forces companies to buy carbon certificates for imported products to the amount that corresponds with the carbon price that would have been paid if the goods were produced under EU rules. If a producer can show that he has already paid a carbon price, this cost will be deducted. This way, the mechanism should ensure a leveling off between the carbon price of EU products and imported products. Initially, CBAM goods will be limited to those with a high risk of leakage. These goods include cement, iron and steel, aluminum, fertilizers, and electricity.

Who will pay?

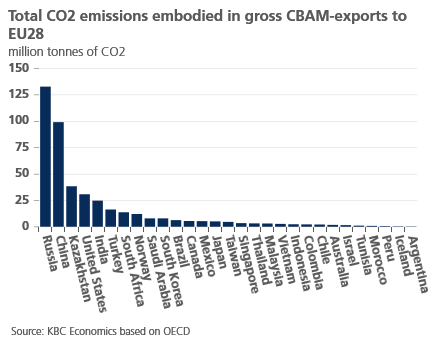

To get a rough estimate of which countries will be most affected by the CBAM, we look at OECD data showing the amount of CO2 in gross exports to the EU28. We then filter by the categories that include CBAM products1. This rough analysis shows that Russia and China are by far the largest exporters of CO2 in CBAM goods to the EU28. Consequently, they will be the most affected by the new regulations.

Path of cooperation

There are still many hurdles to overcome before the border adjustment can be effectively implemented. For one, the Fit for 55 proposal still needs to be extensively debated and voted on within the EU. It is very likely that the final approved agreement will still differ from the proposal. In addition, many of the EU’s trading partners have already spoken out against the CBAM. They accuse the EU of taking protectionist measures under the guise of climate policy. It is therefore likely that the scheme will be challenged at the World Trade Organization. Other retaliatory measures cannot be ruled out either. Just think of stopping containers at the border until the goods inside have expired, a tactic China used earlier as a bullying measure against foreign companies in response to political tensions.

To avoid bitter confrontations once the mechanism is implemented, the EU already started talking to other countries and regions about aligning carbon taxation initiatives. The CBAM proposal foresees possibilities to build alliances with third countries, provided that they establish similar carbon pricing mechanisms. Fortunately for the EU, introducing some type of mechanism makes sense for many third countries since the whole world is in the same climate boat. After all, emissions do not stop at national borders. Success in convincing other countries to cooperate is therefore not unlikely. But whatever the outcome of the talks, it is clear that the EU will push forward with its plans even if the others do not follow.

1 Mining and quarrying (D05T09), Chemicals and non-metallic mineral products (D19T23), Basic metals and fabricated metal products (D24T25) en Electricity, gas, water supply, sewerage, waste and remediation services (D35T39).