Bidding increases real estate prices more sharply

Selling your home through online or sealed bidding is an increasingly popular sales strategy these days in Belgium. These new sales trends, which work with a starting price instead of an asking price, can result in a bidding war which can push up the price of the house considerably. International research shows that the 'price premium' of a sale by (out)bidding compared to a negotiated sale can be large, especially in a tight market characterised by strong demand. It seems that the increasing importance of bid methods is partly responsible for the recent sharper price increases in the Belgian housing market.

New sales trends

In recent years, new online real estate sales techniques have emerged in which bidding by interested buyers plays a central role. There is no question of an asking price, but rather of a starting price from which interested parties in a particular property are invited to make an offer. An important player in this type of selling is the notary platform Biddit. It is the online version of the classic public sale, which used to often take place in a local hall or café (now less and less so). The bidding of buyers against each other is also supervised by a notary. This is to ensure that the online competitive bidding is conducted correctly and transparently. The new Biddit platform, which has been in operation since May 2018, has been a great success. Around four out of five public sales are now conducted via this online system.

Private individuals or real estate agencies are not allowed to set up such a public auction system. However, in the case of a private sale, they can invite interested parties to make separate bids, also based on a starting price. Real estate agents are increasingly using a physical bidding round under closed envelope (so-called sealed bidding). On a certain date, all envelopes are opened, and the highest bidder usually gets the first chance to buy the property. With this sales system, there is no direct competition among bidders and the seller is free to choose to whom he or she eventually sells. It is not necessarily the highest bidder. The seller may, for example, prefer a lower bid that does not have a suspensive condition attached, or even allow a personal preference to play a role.

Recently, an increasing number of commercial players have also been launching online bidding platforms that do not formally fall under the statute of a public sale but are very similar in practice. Examples are Bidimo, Soldandset and iBid. Candidate buyers can make an online bid on these platforms. The highest bidder is then invited to make a written offer to purchase. That bid only becomes final once the document has been counter-signed by the seller. This differs from the notary platform Biddit, where the bid is immediately binding on the buyer.

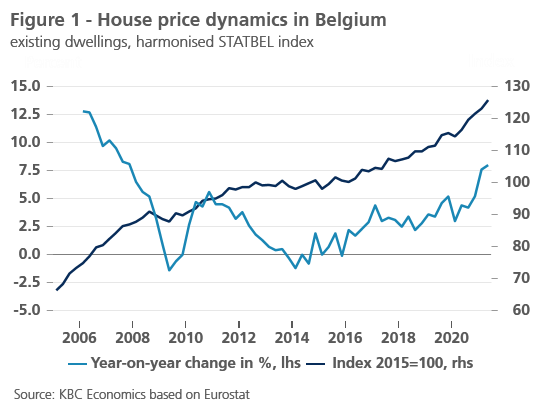

The way in which homes are sold can have a significant impact on price dynamics in the housing market. In a classic sale, the bids start below the (high) asking price and the final selling price is usually below or on this price. In a dynamic sale through a bidding system, the starting price is usually much lower than the desired asking price in order to generate as much interest as possible. The bids then increase and, in the seller's best case, rise above the desired selling price. An interesting question then is whether, and if so to what extent, the recent surge in property sales via bidding has contributed to the acceleration of price dynamics that has taken place in recent years (including during the pandemic crisis). By the second quarter of 2021 (the latest available figure), this had risen to as much as 8% year-on-year (see Figure 1).

A priori, one could argue that an increasing number of sales via bidding systems is a good thing, because it means that home prices are determined by the market. In practice, however, these systems mean that the seller assumes more power in the sales process. This is done by putting pressure on prospective buyers, for example by keeping the bidding period very short (with Biddit it is only eight days) or by reducing the transparency of the sales process (as with sealed bidding). Potential buyers, for their part, can simply follow the bidding process at home during a sale via an online platform and may therefore bid more enthusiastically. If the property offered for sale is in great demand on the market, there will be many bidders who will bid competitively against each other, which can drive the price up sharply. The fact that there is no upper limit to the price (which is de facto the case for a sale with an asking price) can reinforce this. Even in the case of a physical bidding under closed envelope, prospective buyers may be inclined to bid high for lack of guidance (there is no asking price) or out of fear of missing out.

Price premium

The empirical literature on the impact of different sales methods on property prices is rather scarce. Existing analyses are based on theories of auctions and negotiations, and generally find that a negotiated price is suboptimal for the seller compared to an auction price. Early research from the 1990s for the United States and Australia suggests that the so-called 'premium' for the seller of real estate in an auction sale can be 8 to 13%. More recent research on transactions in the Dutch Groningen housing market in the period 2009-2017 shows that sales transactions with bidding on average ended at 5% higher sales prices than comparable housing transactions with an asking price (see De la Hayze, 2019, “Het succes van een vanafprijs als verkoopmethode”).

Research also shows that the size of the seller's price premium depends on the concrete market conditions (see, e.g., Han and Strange, 2015, “The microstructure of housing markets”, in Handbook of Regional and Urban Economic). For example, the price premium is strongly determined by the stage the housing market is in: when demand is strong and supply is limited, the premium is higher. In a tight market, prospective buyers know that there is more competition and are therefore more likely to submit a higher bid to secure the house. Traditional price determinants, such as low interest rates, can therefore drive up the premium. Finally, the premium would be especially present in the sale of homogenous real estate (i.e. classic houses and flats) and smaller (possibly even negative) in the case of more expensive exclusive real estate.

Whether the increasing importance of bid methods, alongside other factors such as low interest rates, is partly responsible for the recent sharper price rise on the Belgian housing market, has not been proven here in this opinion. However, based on the above findings in the literature, such a price pushing effect is likely. The literature also shows that the sales prices resulting from a transaction with bidding are leading and guiding for negotiated sales prices, which tend to lag behind in the market. The new sales trends therefore entail the risk of an upward spiral of persistent strong price pressure that could overheat the Belgian market.