Be careful what type of inflation you wish for

Recent economic events, such as the temporary spike in oil prices and the ongoing trade conflicts, reminded us of the possibility that the next growth slowdown may come with higher rather than lower inflation. This would, however, not be the kind of inflation central banks wish for. It would reflect an impoverishment of the economy as a whole via the double loss of wealth due to lower growth and higher inflation. In such circumstances, the ECB may well have to tighten monetary policy in order to preserve price stability, its primary objective, and thus making it unable to help stabilise economic output. In recent days, however, oil prices have rapidly declined again, confirming the temporary nature of the shock. Meanwhile, the stagflationary risks of ongoing trade conflicts remain prominently on the radar.

A hot topic of debate in 2020 is the review of the policy framework of both the Federal Reserve (Fed) and the ECB. A main purpose of this review is to evaluate the way central banks addressed the financial crisis in the past decade and to assess whether they are sufficiently well-positioned to address a new recession or even financial crisis.

A common feature of this debate is the underlying assumption that the next economic slowdown will go hand in hand with falling inflation and the need for central banks to lower interest rates (again). Within this line of thinking, there is no general consensus on whether central banks have enough ‘ammunition’ or policy scope in their toolbox to ease their policy stance if needed. Recent ECB communication, calling for an increased role of fiscal policy, suggests that this may be a challenge. Former Fed President Bernanke, on the other hand, argued in early January that the Fed could effectively provide enough support to an economy entering a recession via the policy mix of quantitative easing, forward guidance and outright policy rate cuts.

The next recession might be different...

Regardless of whether the monetary policy toolbox is half full or half empty, this approach looks a bit one-sided. The next recession, both in the US and the euro area, might not be triggered by a sustained weakening of aggregate demand, but rather by deteriorating conditions on the supply side of the economy. These so-called ‘negative supply shocks’ have occurred before, with the most notorious example being the double negative oil price shocks in the 1970s. In today’s global economy, such adverse shocks may be triggered again by a sustained spike in oil prices if the crisis in the Middle East causes permanent and sizeable oil supply disruptions. Moreover, the rising trend of global protectionism, which has been accelerating the past two years, is another candidate.

The distinction between demand and supply driven economic downturns is important because they have different characteristics and hence also require a different monetary policy response. In contrast with negative demand shocks, an economic slowdown triggered by a sustained negative supply shock is associated with higher rather lower inflation. This occurs because economic (growth) potential is negatively affected through higher production costs and the distortion to the efficient allocation of productive resources. In response, inflation rises and, if the adverse shock is persistent, inflation expectations are likely to rise as well.

... as might central banks’ reactions

The different inflation path following a persistent negative supply shock also implies a different monetary policy response. The relevant question would no longer be whether the central banks have enough left in their toolboxes to ease monetary conditions, but rather whether central banks would be prepared to tighten monetary policy, as the Bundesbank did when it faced adverse supply shocks in the 1970s (sharp oil price rise) and the early 1990s (German monetary union). Rising inflation expectations could indeed become self-fulfilling by feeding through into nominal wage negotiations (the second round effects). If left unchecked, this effect would exacerbate the impact of the original shock on economic growth (downward) and inflation (upward). In order to prevent inflation expectations from spiralling up, central banks would therefore need to respond by tightening monetary policy, dampening economic growth even further.

Wrong type of inflation

At first sight, higher inflation, in particular in the euro area, may appear welcome for two related reasons. First, inflation would move closer to the ECB’s medium term policy target of below but close to 2%. Second, higher inflation would give the ECB scope for policy normalisation, moving away from negative interest rates and towards a steeper interest rate curve. This in turn would ease some of the negative side-effects of monetary policy on the real economy and the financial sector.

On second thoughts, these steps towards ECB policy normalisation, which is a ostensibly a good thing, could occur under undesirable circumstances. This inflation would reflect an overall impoverishment of the economy. For example, sustained higher oil prices would effectively amount to a transfer of wealth from oil-importing to oil-exporting economies. Similarly, rising protectionism impoverishes domestic consumers via higher prices of imported consumer goods, higher production costs for domestic firms and a generally less efficient resource allocation in the economy.

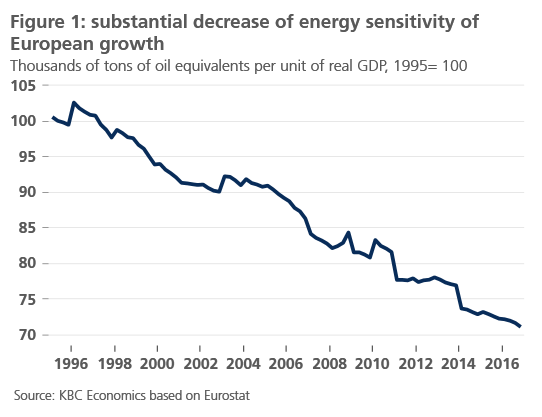

After it briefly reached a peak of 70 USD per barrel Brent at the height of the US-Iran political tension, the oil price quickly declined again to currently below 65 USD. This means that this upward price shock was very temporary and probably too short to have any noticeable impact on future economic growth or inflation. consequently, central banks will obviously not react. We should, however, not dismiss too easily the risk that the European economy may face a negative supply shock in the future. However, such a shock would not necessarily have a devastating impact on the economy. Indeed, as far as energy prices are concerned, it is rather unlikely that a negative shock would be sufficiently sizeable and sustained. Figure 1 shows that the energy dependency of the euro economy is now about 30% lower than it was 25 years ago, thanks to increased energy efficiency and an increased share of GDP coming from the services sector. This suggests that the size of an oil price increase must be notably higher now to have the same economic impact that it would have had in the past. The sustainability of a sizeable upward price shock has also become less likely as a result of the existence of highly price-elastic shale oil supply.

A clearer stagflationary risk to the world economy is coming from the global trade conflicts. If they escalate further, and for example involve the EU more closely than has been the case so far, they have the potential to act as a sizeable and permanent negative supply shock.