A double-dip recession in Central and Eastern Europe

While Central and Eastern Europe (CEE) largely avoided a widespread Covid-19 outbreak in spring months, the second wave of the pandemic has spiralled out of control. We estimate that a growth hit from renewed lockdowns will push the CEE economies into a double-dip recession in Q4 2020. Still, the economic impact should be less severe than earlier this year due to the less stringent lockdowns. Furthermore, industrial production, which accounts for a sizable share of CEE economies’ output, remains insulated from broad-based closures and major supply chain disruptions. Overall, the annual growth outlook for next year has been adjusted downward across the region; however, we see a more upbeat picture emerging from the second half of 2021, backed by progress on the Covid-19 vaccine front. At the same time, a sizable boost from the upcoming 2021-2027 EU budget allocation should help the CEE economies return on their pre-crisis convergence paths.

With the second wave of the pandemic in full swing, Central and Eastern Europe has emerged as a major hotspot for the Covid-19 virus. This is in stark contrast to the spring outbreak, when the region was widely praised for avoiding widespread infection by imposing early national lockdowns. The ensuing economic downturn across the CEE economies in H1 2020 proved, on aggregate, somewhat less severe than that in the euro area. In the third quarter, all economies in the region rebounded strongly, even though output remains below pre-pandemic levels.

From a success story to reverse

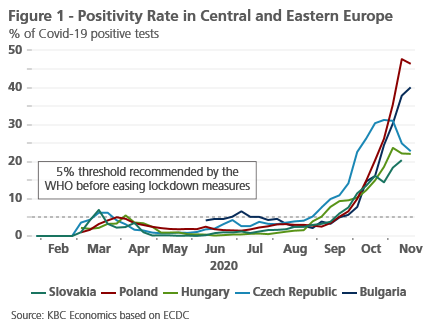

At the same time, strong third-quarter figures have masked a deteriorating economic backdrop. Since early October, the CEE-region has been among the hardest-hit by the second wave, reversing the earlier success of containing the virus. Following a rapid removal of restrictions through summer, a lack of an efficient test-and-trace system, and a late government response, the second outbreak has spiralled out of control, particularly in Czechia, where the infection rate (per 100,000 inhabitants) has surged to the highest in the EU, and Poland. Notwithstanding different local dynamics, the rest of the region is on a parallel trajectory, ultimately threatening to overwhelm the medical systems. An elevated positivity rate highlights that the spread of the virus has yet to be contained (chart 1).

As a result, governments have re-imposed strict containment measures, dampening the near-term economic outlook. We expect another contraction in economic activity across CEE economies in Q4, though it should be less severe than earlier this year. Assuming a limited easing of restrictions through the remainder of the year, our analysis - based on the relationship between the stringency of containment measures and activity - suggests the most severe sequential hit to Q4 real GDP growth will be in Czechia (4.5 pp), Slovakia (4.5 pp) and Poland (4.0 pp). Hungary (3.5 pp) and Bulgaria (2.5 pp) will see more limited impact. While uncertainty around our estimates remains elevated, they point to less than half of the economic impact seen in Q2 2020.

Milder lockdowns imply a less severe economic hit

The fact that new lockdown measures are, on balance, less stringent implies a more limited economic impact. The major burden of autumn lockdowns has been borne by the services sector, such as hospitality, entertainment and travel, while industrial production has remained largely insulated from broad-based closures and spring-like supply chain disruption. Considering the sizable share of export-oriented manufacturing in overall output, this is particularly important for the CEE economies. Furthermore, given the high integration into German value chains (not least in the automotive sector), there are already positive spill-overs from the resilience of industrial production in Germany, which in turn owes much to a strong post-lockdown recovery in China.

Fiscal support also remains in place across the region, though its overall size is less impressive than in the euro area and some heterogeneity is emerging across CEE countries. While the government in Czechia, for example, has introduced an ambitious fiscal package for 2021 with a major income tax reduction (estimated at some CZK 130 billion, or 2.3% of 2019 GDP), Bulgaria signalled a swift return to fiscal prudence amid prospects of the euro adoption. On the monetary front, the room to manoeuvre appears more limited with conventional monetary policy space almost exhausted. Still, we expect the accommodative stance to be maintained through 2021 in the whole region.

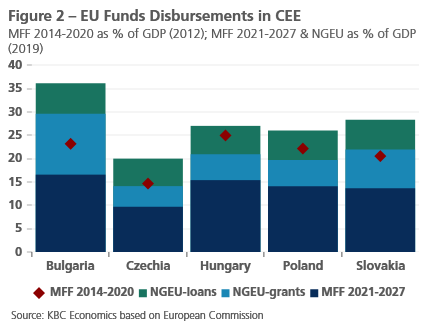

On top of national fiscal support, the CEE economies are set to remain important net beneficiaries from the upcoming 2021-2027 EU budget once it’s approved. Before the pandemic outbreak, the expectations had been that the region would see a sizable pullback in gross (and net) receipts due to increased levels of per capita income and a reduction in the EU budget after the UK’s departure. However, combining the preliminary allocations from the Multiannual Financial Framework for 2021-2027 and the EUR 750 billion Next Generation EU, the CEE economies are now expected to receive greater benefits (including low-interest-rate loans) in the upcoming budget cycle than in the 2014-2020 cycle (chart 2). As such, a substantial inflow of EU funds will likely remain an important growth driver in the CEE region in the coming years.

After a temporary setback, the convergence is set to continue

Overall, in our November monthly outlook, we revised downward the growth outlook for 2021 across the CEE region on the back of large negative overhang and still sluggish activity anticipated at the beginning of 2021 amid ongoing restrictions. For the full year, we expect the strongest growth in Poland (4.2%), followed by Slovakia (4.0%) and Hungary (3.5%). In Bulgaria and Czechia, we expect annual growth of 3.0% and 2.5%, respectively.

At the same time, we do see a more upbeat picture gradually emerging from the second half of 2021 onwards, assuming a gradual roll-out of a Covid-19 vaccine. In this respect, the CEE economies should benefit from the EU level coordination of vaccines procurement, implying a similar timeline of receiving the vaccines as more advanced economies. In conjunction with a sizable boost from EU funds, we expect that after a temporary pandemic-induced setback, the CEE economies will return on a real convergence path towards Western Europe.