A collapse of OPEC+ alliance triggers oil price war

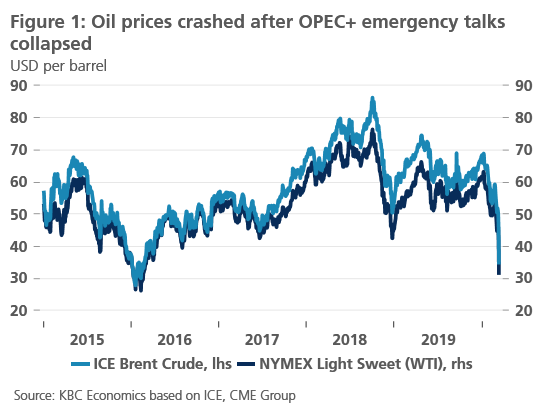

A collapse of OPEC+ emergency talks in Vienna has turned the global oil market upside down. Oil prices crashed on Monday with the sharpest drop since the 1991 Gulf war, and Brent crude has been hovering just above $35 a barrel, its lowest level since January 2016. This reflects an underlying shift in oil market dynamics, with OPEC+ abandoning the production cuts policy that underpinned the market and helped to keep prices relatively range-bound in the last three years. Instead, Saudi Arabia has opted for a dramatic change in its modus operandi, i.e. to fight for market share at the expense of price stability. As a result, the oil market is now facing a simultaneous coronavirus-induced negative demand shock and positive supply shock, likely resulting in a historically unprecedented market surplus in H1 2020. In the absence of Saudi-Russia supply management, such an adverse fundamental outlook will keep oil prices under severe pressure throughout 2020.

The collapse of OPEC+ extraordinary meeting in Vienna on Friday sent a shockwave through the global oil market. Following the Thursday core-OPEC meeting that resulted in a recommendation of additional cuts of 1.5 million barrels per day until end-2020, Friday’s meeting failed to deliver a group-wide deal. Despite Saudi Arabia pushing hard for an aggressive response to the coronavirus and crumbling oil demand, Russia rejected further cuts on the basis of the unclear scope and scale of the coronavirus shock to oil demand as well as a further decline in the market share, something Moscow has been highly sensitive about more recently.

Since the Saudis made the deal contingent on Russia agreeing to deeper production curbs, that left the coalition not only in a state of de facto death (formally the partnership continues), but most importantly without any agreement on output cuts. The existing agreement from December to cut output by 2.1 million barrels per day (including a 400,000 barrels per day voluntary contribution by the Saudis) is set to expire by the end of March. That is to say, the alliance has now effectively eliminated the floor under oil prices. Since late 2016 it was precisely the production curbs that underpinned the market and helped to keep prices relatively range-bound.

The Saudis opened the door to a full-blown oil price war

While different scenarios remain currently on the table, we argue that the Saudis' aggressive U-turn over the weekend opens the door for a full-blown oil price war. Saudi Arabia is arguably ready to significantly ramp-up production, likely topping 10 million barrels per day, and already offered deep price discounts (the largest in more than twenty years) in a move to win new customers. This further supports the shift in underlying market dynamics mentioned above and reflects a dramatic change in Saudi modus operandi from prioritising price-stability to prioritising market share. In the past, we have argued that the existing OPEC+ output cuts were unsustainable in the long-term. However, the start of a painful market rebalancing process amid low oil prices now came sooner than expected primarily due to the coronavirus outbreak.

The Saudis' motivation for such an abrupt change in its policy is twofold in our view. First, we believe that the Kingdom would like to put more pressure on Russia (that itself signals an output boost) to get them to the table once again. This will be difficult for a number of reasons, but most importantly because Russia is significantly more resilient to lower oil prices than Saudi Arabia given recent efforts to increase macroeconomic stability and rebuild buffers (see also KBC Economic Opinion 12 November 2019).

Second, Saudi Arabia is clearly targeting the US shale sector. While during 2015-2016 the strategy to push shale oil producers out of the market largely failed, this time, the Saudis might count on continued vulnerabilities and the financial distress of, in particular, smaller independent producers. For them, a low-price environment might indeed result in large-scale bankruptcies. On the other hand, oil majors operating in the most proliferous shale basins can rely on much more robust balance sheets. Either way, we expect to see a sharp drop in sequential shale production growth starting in Q3 2020.

Hence, lower oil prices will have important implications not only for the shale oil industry, but also for the US economy. Late last year, precisely thanks to the home-grown shale oil boom, the US turned from a net importer of crude oil and refined products into a net exporter. While this might insulate the economy in times of a sharp rise in oil prices, the low-price environment will result in an overall mixed effect on the economy, as rising household disposable income is set to be somewhat offset by a decline in investment in oil exploration and drilling. This is in sharp contrast to Europe, which remains largely a net oil importer, meaning that current low prices might to some extent ease the pressure of the coronavirus shock.

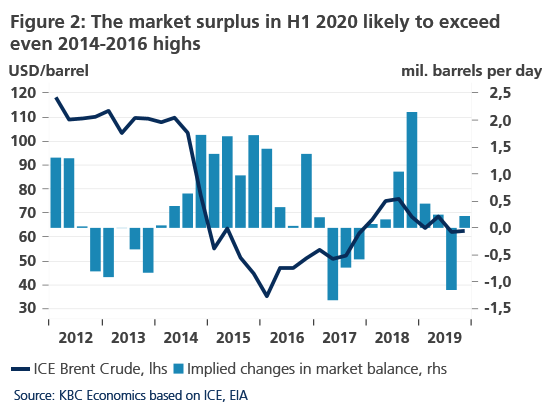

Simultaneous demand and supply shocks make the situation worse than in 2014-2016

Overall, the fundamental situation on the oil market seems to resemble the oil price collapse during 2014-2016. Still, there is one major difference that needs to be considered. The global oil market is currently facing a simultaneous negative demand shock and positive supply shock. While the former is due to the coronavirus, which might bring year-on-year growth in global oil demand into negative territory for the first time since 2008, the latter includes a lift of all output restrictions on OPEC+ supply. Putting this together, this will result in a historically unprecedented market surplus (depending on how aggressively Saudi Arabia and Russia will eventually hike their output), exceeding that of 2014-2016 severalfold.

Such an adverse fundamental outlook has materially changed our oil price forecast. Assuming that Saudi Arabia and Russia do not renew cooperation on supply management in the foreseeable future (which is currently the main upside risk), we believe that the oil market has entered a new era of lower oil prices. Given the large market surplus, we expect oil prices to remain under pressure throughout 2020 but to ultimately trough in Q2 2020 at $30 a barrel along with the most severe pressure in terms of an inventories build-up. Still, a dip below that level cannot be ruled out in the light of existing downside risks (with the most important one being a sharper-than-expected increase in Saudi or Russian production). A market rebalancing process, i.e. a recovery in oil demand after coronavirus disruptions ease and low prices stimulate consumption, as well as a supply response from shale oil, should gradually bring some moderate recovery in oil prices in H2 2020 and further in 2021. That is to say, once the process of the market rebalancing is completed, we expect prices to settle around a long-term market equilibrium price, which we now estimate at $55 a barrel in 2022.