Is the affordability of Belgian real estate under threat?

Abstract

The Belgian housing market continued to perform strongly during the coronavirus pandemic, with significant price increases in 2021 especially. The strong growth in residential real estate prices, which has persisted for more than two decades now, have led many to question whether Belgian homes are still affordable. For first-time buyers on the housing market, in particular, it is often said that it is almost impossible to buy or build a house. To shed some light on the situation, in this research report we calculate some simple affordability measures and look at the inequality that is emerging in the Belgian housing market. We also look ahead to the future.

According to the interest-adjusted affordability measure, which takes into account both household incomes and interest payments, the Belgian housing market is currently expensive, but affordability on the whole is reasonable. During the 2009-2012 financial crisis, for example, the market was more expensive than it is today. Surveys also suggest that Belgians, unlike the Dutch, for example, do not see housing as one of the most pressing problems today. Nevertheless, a growing divide is emerging between those who are still willing and able to buy property easily because they have the means to do so (the 'still able', i.e. investors and young families who receive help from parents) and those for whom buying a home is moving more and more beyond their reach (the 'no longer able').

How affordability will evolve in the future is difficult to gauge. A simulation based on the ECB's long-term forecasts for house prices, household incomes, and long-term interest rates suggests that the Belgian market is likely to remain expensive in the coming years, driven not just by the expected increase in interest rates but also by other factors, such as more expensive construction costs. This is likely to exacerbate the inequality or duality in the Belgian housing market. The problematic affordability, at least for some, makes a well-functioning rental market increasingly important and could provide a boost for new housing trends (such as cohousing, tiny houses, etc.), which currently account for only a small part of the housing stock.

The sharp rise in residential property prices over the past two decades has led many to ask whether Belgian homes are still affordable. There are particular concerns that young families wanting to buy or build their first flat or house (the 'starters' on the housing market) are finding it almost impossible to do so. In this research report we try to provide an answer to whether this is actually the case. We focus on the current situation around affordability (section 2), and also try to gauge housing affordability over the next decade (section 3). In the introduction to the report (section 1), we first discuss the concept of 'affordability' and its determinants. Section 4 offers some concluding thoughts.

1. Introduction: Affordability and its determinants

In this research report we interpret the affordability of residential property in terms of how financially accessible the acquisition of property is for Belgian households. Affordability is determined by the relationship between housing price trends and factors that determine whether or not households are actually able to pay the cost of a home. In essence, it comes down to the amount of cash that households have to spend each month on owning their own home (mainly interest payments and mortgage repayments) as a proportion of their total monthly disposable income. The focus in this report is mainly on the buying and building market ('property acquisition'), not on the wider housing affordability problem, which also takes into account other housing expenses (e.g. rent, maintenance costs, utilities expenses, etc.).

The factors influencing the affordability of real estate are very diverse and multi-dimensional. The most essential determinant is, of course, the past increase in housing prices and therefore current price levels. This implies that all the supply and demand factors which determine prices on the housing market play a role. Demographic and social changes are absolutely key. Factors such as the trend in the number of households and their composition (e.g. the increasing number of singles and the growing complexity of families), international migration, population ageing, etc., determine the extent to which housing demand matches the existing supply at any given time. A housing stock which is slow to adapt to demand or is mismatched (e.g. too many large houses in a context of shrinking households) can squeeze the market and push up prices.

Note that more expensive property does not necessarily imply more unaffordable property. Affordability is also influenced by the trend in a number of economic factors, and especially disposable household income and (long-term) interest rates. For example, a sharp rise in incomes and/or falling interest rates can (partially) compensate for a steep rise in house prices and thus keep real estate affordable. However, low interest rates can also stimulate investor interest in real estate (e.g. for renting out or as a second home), which can lead to sustained price increases and therefore an 'expensive' housing market for first-time buyers. The crucial economic parameters (income and interest rates) are in turn determined by the general economic climate (GDP growth, labour market situation, monetary policy, etc.).

The affordability of real estate also depends on specific characteristics of the mortgage and construction market. For households with a mortgage loan - which is the majority of them - the applicable lending criteria also play a role: the mortgage interest rate, loan to value ratio, term and maximum amount of the loan... Relevant characteristics of the construction market include the scarcity (and thus the price) of building land and the trend in material and equipment costs. New lending techniques (e.g. intergenerational lending), new building technologies ('proptech', such as 3D printing, modular building systems, etc.) and alternative forms of housing (cohousing, cooperative living, multi-generational living, tiny houses, etc.) can also influence the affordability of housing.

Finally, transaction costs (e.g. legal fees) and government policy interventions can also impact the affordability of real estate. The main policy-related factors are property taxation (registration fees, VAT on new buildings, etc.), but also, more broadly, things such as planning regulations and energy or environmental standards. However, the impact is not always clear-cut: the tax incentives to support the affordability of homes (e.g., the housing bonus that applied until recently) may already be factored into house prices, wholly or partly cancelling out the benefits. Energy standards will initially make the construction of a house more expensive, but will ultimately lower the housing costs.

2. Affordability of real estate today

Affordability criteria

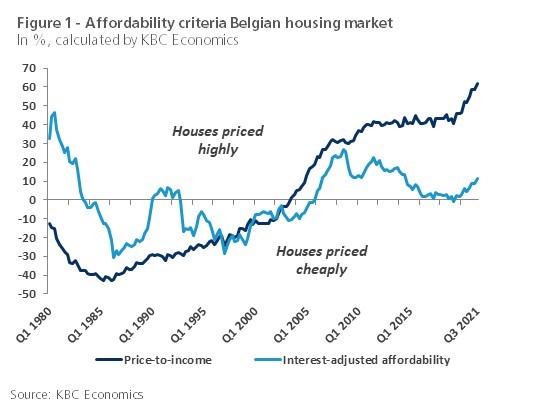

To assess whether real estate is still affordable for an average household today, we use two criteria: price-to-income ratio and interest-adjusted affordability. The price-to-income ratio is a very simple measure of affordability that relates changes in house prices to changes in average disposable household income. The rationale is that this income is needed in the first place to build up some equity in the home, but more particularly to enure sufficient repayment capacity. The current level of the ratio is compared with its long-term average, which is assumed to correspond to an equilibrium level. If the ratio rises too far above its long-term average, that is an indication that the capacity of households to finance the purchase of a home is in jeopardy and that house prices have probably risen too far. Calculated in this way, Belgian house prices were no less than 62% too expensive in the third quarter of 2021 (Figure 1).

The affordability of real estate depends not just on income, but also on the trend in mortgage interest rates, which determine the repayment burden and thus the borrowing capacity of buyers. If we adjust the price-to-income ratio for the trend in mortgage interest rates, this gives us the interest-adjusted affordability. The total amount that a borrower has to pay on their mortgage loan each year (capital repayment plus interest, with an assumed mortgage term of 20 years and a fixed interest rate) is compared with the disposable income per household (for ease of calculation, we do not include state benefits). The greater the divergence between a household’s annual mortgage payment and income, the more difficult it is to finance the purchase of a home. As with the price-to-income ratio, this more detailed measure of affordability is expressed as a percentage deviation from its long-term average. Calculated in this way, Belgian house prices were still too expensive in the third quarter of 2021, though much less than under the price-to-income ratio (11%) (Figure 1).

According to the broader measure of interest-adjusted affordability, therefore, residential property in Belgium is reasonably affordable on average. The reason for this is the sharp fall in long-term interest rates in international markets, which has also taken Belgian mortgage rates to an all-time low. Galloping house prices have made Belgian real estate more expensive again in the last few years, but the ‘overpricing’ of the market, at 11%, is well below the figures seen during the huge housing market boom in the early 1980s and the financial crisis in 2009-2012 (Figure 1).

Growing divide

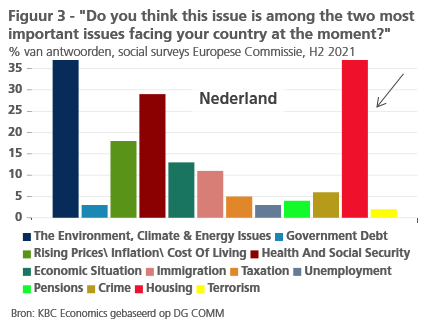

As suggested in the introduction, whether property is too expensive and unaffordable for the average household is determined by a multitude of factors, not all of which can be captured in a simple affordability measure. It is therefore also good to look at the results of surveys indicating what the Belgian public themselves think. The social surveys carried out by the European Commission (EC) contain a question about what respondents see as the most pressing problems of the moment. Interestingly, in spite of the steep price rises in recent years, according to the survey Belgians do not consider 'housing' to be one of the main problems; this is in contrast to the Dutch, for example (Figures 2 and 3, the EC survey refers to the second half of 2021). This appears to be a further indication that the average Belgian does not currently perceive buying a home as a major problem. Granted, the question in the survey concerns the broader concept of 'housing', of which the feasibility of acquiring a home is only one - albeit an important - element.

The general findings set out above still imply that, for a section of the population, the affordability of buying their own home can indeed be an issue. In practice, we are seeing a growing divide between those who are still able to buy their own home and those for whom this is out of reach. This manifests itself in two large, contrasting groups: those who are still willing and (easily) able to buy or build a home because they have the means to do so (often as an investment, but also young people who get help from parents); and a group whose finances are under increasing pressure or who can no longer afford a home of their own.

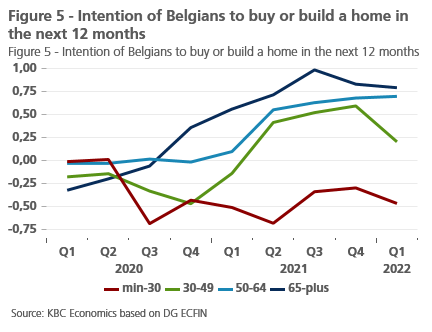

In practice, this divide is reflected in figures on home ownership broken down by income category (figure 4). Among low earners, with an income below 60% of the median, home ownership has not only decreased, but is also substantially lower in Belgium than the average in the European Union. This indicates that inequality in home ownership is relatively high in Belgium. A European Commission survey also found that in the youngest age group (those aged under 30), the intention to buy or build a home decreased during the pandemic, while in the older age groups it increased significantly (Figure 5). This illustrates that young people are finding it relatively more difficult to buy their own home.

3. Future affordability of real estate

Macroeconomic parameters

It is difficult or impossible to say with any certainty what the future holds for many of the determinants of affordability referred to in the introduction. We can however make a (tentative) long-term forecast for the relevant macroeconomic parameters.

First, it looks likely that the affordability of real estate will no longer be supported by falling/low interest rates. In anticipation of the normalisation of monetary policy, long-term interest rates in international markets have already risen considerably in recent months. Ten-year bond yields in Belgium, too, have risen from -0.4% at the beginning of 2021 to around 1.0% today. KBC Economics is projecting that interest rates will rise further to 1.4% by the end of 2022 and 1.7% by the end of 2023. Mortgage interest rates will follow suit, and also rise. A key question is how house prices will respond. If they continue to rise (sharply), the interest rate effect will be eroded and affordability will come under pressure for borrowers. A situation of continually rising prices combined with rising interest rates may arise, for example, if investor interest in real estate persists (for example given the current environment of high inflation and geopolitical uncertainty).

Affordability will be further compromised in the event of low economic growth and, consequently, low growth in disposable household income. KBC Economics expects real GDP growth to fall to 1.4% in 2023 and 2024. The European Commission is predicting longer-term GDP growth for the Belgian economy of only around 1% between 2025 and 2035. The low GDP growth rate also means that the scope for real wage increases and employment growth - the two engines of income growth - is likely to be fairly limited. There is a caveat here, however. The low potential GDP growth in the medium term is partly due to the demographic decline in the working-age population. It is thus the low potential employment growth that is slowing the growth rate of the economy, not the other way around. Due to the tightness of the labour market, young families (especially the highly skilled) are likely to continue to find jobs easily and may also increase their wage demands. This can then support the affordability of real estate.

Other determinants

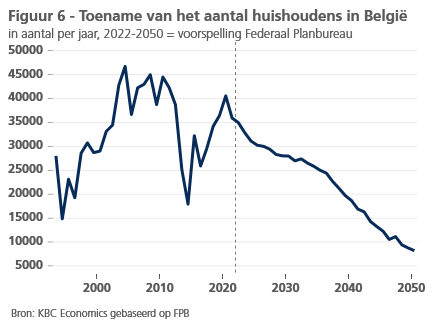

The affordability of real estate in the future also depends on specific supply and demand factors that help determine the dynamics of the housing market. On the demand side, the main factor is the expected demographic trend. The Federal Planning Bureau's projections suggest that the number of Belgian households - an indicator of the additional need for housing - will continue to grow in the coming years, but at a slowing rate (Figure 6). This will dampen price pressure on the housing market from the demand side. Another striking observation in the demographic outlook is the sharp rise in the number of 'single-person households' (Figure 7). Since these are, by definition, single-income households, and the mortgage loan therefore has to be paid off by one rather than two incomes, this trend could impact the affordability of real estate for those concerned.

On the supply side, rising construction costs play a role. The additional cost of new construction due to more expensive materials and increasingly strict standards or regulations (with regard to energy, indoor climate, water recuperation, provision of parking spaces to prevent parking on public roads, etc.) threatens to make building a new home affordable only for the ‘happy few’: young households who receive financial support from parents and older households who have built up sufficient savings. On the other hand, the additional investment needed for a sustainable home contributes to lower housing costs (lower energy and water consumption), which in principle can increase borrowing capacity. The problem is that it is not always clear how much the lower housing cost will actually be and whether it will have a big enough impact on borrowing capacity. There are plenty of tax breaks available to help make the additional investment in 'sustainability' more affordable. However, given the poor state of Belgium’s public finances, it is also unclear whether this will remain the case in the future.

Simulation of affordability criteria

Whether or not housing affordability will continue to deteriorate in the years ahead essentially depends on how the affordability criteria discussed in section 2 (price-to-income ratio and interest-adjusted affordability) evolve. KBC Economics simulated both measures for the period 2022-2050 based on a database made available by the European Central Bank (ECB) at the beginning of this year as part of the Climate Stress Tests imposed on banks. The database is interesting because it contains all the necessary data to quantify the affordability criteria.

As Figure 8 shows, the ECB numbers indicate that the exaggerated price-to-income ratio in Belgium is gradually disappearing, and will even turn negative over the long term. This is because the ECB data show a relatively strong increase in nominal disposable household income relative to house prices in the coming years. The interest-adjusted affordability criterion does increase somewhat, to 13.5% in 2030, due to rising interest rates (the ECB projects Belgian interest rates of 3.6% in 2030). Thus, the favourable income dynamics largely compensate for the impact of the rise in interest rates. The interest-adjusted affordability measure shows that the Belgian market is likely to remain expensive in the next few years, then, but in the longer term this measure, too, will turn negative. Of course, how useful this simulation is depends on how accurate the ECB data proves to be. Given the relatively more modest growth rates in the past, the prediction of strong growth in household income, in particular, seems uncertain.

4. A few final thoughts

It is difficult at this juncture to give a precise answer to the question of how the future affordability of property for an average household will evolve. It is however likely that the divide on the housing market between the ‘still able’ and the ‘no longer able’ will become more pronounced, especially if house prices continue to rise sharply. This increasing inequality on the housing market poses challenges to Belgian society and policymakers. For example, the reduction in home ownership among the 'no longer able' means that the associated benefits will accrue to a smaller proportion of the population. Home ownership provides greater housing security and is generally seen as a good buffer against poverty, especially during retirement.

If owner-occupied homes are unaffordable for certain households, it is important that government policy focuses adequately on ensuring a well-functioning private and public rental market, with good quality, affordable rental homes. In a properly functioning rental market, declining home ownership need not be a problem. The high rate of home ownership in Belgium, which for a long time was strongly promoted through taxation, has also led to undesirable side-effects, including low residential and job mobility. The question, therefore, is whether we should not focus more on the affordability of housing rather than the affordability of buying a home. Rent is also an important factor. For some people, especially young people, renting is increasingly a conscious choice because it offers them more flexibility (e.g. greater job mobility) or the opportunity to enjoy life more (no big loans, so they can afford to travel more often, for example).

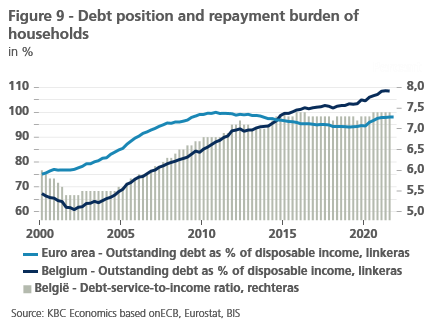

It is also important in this context to ensure that high rates of home ownership do not lead to the accumulation of excessive household debt. Problems with affordability often go hand in hand with a substantial build-up of debt. Over the past two decades, the indebtedness of Belgian households has risen sharply; expressed as a percentage of disposable household income, it stood at 109% in Q3 2021, compared to an average of 98% across the euro area as a whole. This debt accumulation also led to an increase in the household repayment burden (the ‘debt-service-to-income ratio’) from the early 2000s onwards, although it has stabilised in recent years (Figure 9).

Finally, it is worth noting that changing residential patterns, as well as the affordability problems faced by some people, are spawning a growing interest in new residential trends (cohousing, multi-generational living, etc.), although the share of these new trends in the total housing stock is currently still very small. A specific problem is that those who want to live in an alternative form of housing often still encounter legal restrictions and mismatched regulations. Numerous surveys have also shown that, for the time being, the dream of most Belgians is still focused on having their own 'traditional' home. This is not entirely surprising, since the purported advantages of new housing concepts do not yet outweigh the disadvantages of sacrificing a degree of privacy; a cultural change is required here. Nevertheless, given the affordability and sustainability considerations, a number of current trends are likely to continue and possibly accelerate. These includes smarter use of space (e.g. communal gardens, more compact construction, etc.), or a central building for jointly purchased items or facilities that are not used much (e.g. lawnmower, coworking space, etc.).