How will Biden’s agenda shape the oil market?

The Biden administration has opened a new chapter for US energy policy. Importantly, this includes different positions on oil-relevant issues from those favoured by President Trump with far-reaching implications for the global oil market. We believe that Biden’s proposals to green the US economy will result in lower oil consumption over the long run. However, with massive fiscal stimulus boosting growth, the near-term oil demand outlook still looks upbeat. On the supply side, both bullish and bearish factors are at play. The former reflects Biden’s plan to crack down on the shale oil industry, dampening its growth and increasing the cost of production. The latter reflects a softer approach towards Iran, paving a way to sanctions relief and a subsequent increase in Iranian oil supplies. Overall, we see Biden’s agenda supporting oil prices in the short term with downward pressures emerging over the longer-term horizon.

After a year in the grip of the pandemic, the global oil market is on track for a strong recovery. Among a host of factors shaping the post-pandemic outlook, President Biden’s extensive policy agenda stands out in particular. With a focus on addressing the threat of climate change, Biden’s presidency has opened a new chapter for US energy policy, standing ready to unwind large parts of Trump’s energy agenda. Importantly, this includes different positions on oil-relevant issues, which may have far-reaching implications for the oil market, affecting oil supply and demand dynamics domestically and abroad.

A green push set to weaken oil demand

On the demand side, there is a growing consensus that Biden’s proposals to green the US economy will result in lower oil consumption over the long run. As an integral part of his climate platform, President Biden has pledged to put the US on the path to net-zero greenhouse gas emissions for the power sector by 2035, and for the whole economy by 2050. This should be achieved by stricter environmental regulations, reversing the Trump administration’s rollback of fuel economy standards. Furthermore, the ambitious climate targets rely on sizable public investment, aiming at a faster deployment of renewable sources of energy, or accelerating the transition toward electric vehicles. As a result, US oil demand is ultimately poised to weaken, in particular as we head towards the latter part of the 2020s.

Nonetheless, in the near term, Biden’s (economic) agenda is expected to boost oil demand, reinforcing our constructive view on oil prices. An expected massive fiscal package up to USD 1.9 trillion has significantly improved the US growth outlook in 2021 and 2022, and most recently even raised some concerns about an overheating of the economy (see February KBC Economic Perspectives). We consequently expect higher energy demand with commodity-intensive consumption particularly boosted by lower-income households. Paradoxically, a ramp-up in infrastructure spending, as a part of Biden’s climate plan, will add further momentum to the energy-intensive recovery in the coming years, stimulating oil demand long before a negative ‘green’ effect on long-term oil demand starts materialising.

Bullish and bearish factors on the supply side

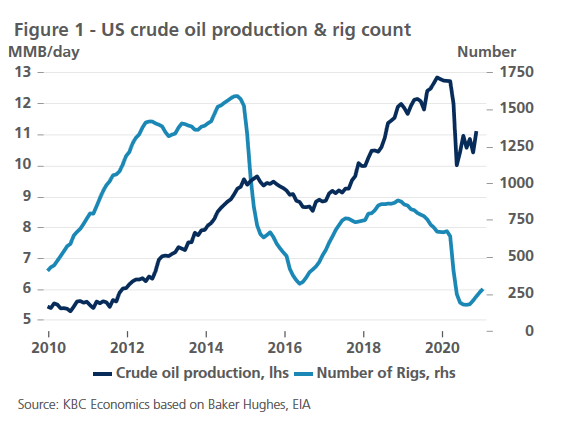

The implications of Biden’s policies appear even more nuanced on the supply side. Domestically, the result of the US election casts a shadow over the shale oil industry. Under the light touch of the Trump administration, the industry flourished and turned the US into the world’s largest crude oil producer, surpassing both Russia and Saudi Arabia. Furthermore, for the first time in eight decades, the US became a net exporter of oil and refined products, upending the global energy landscape. The shale oil producers were, however, hit particularly hard by the pandemic-induced collapse of oil prices in 2020 (figure 1). This has prompted a painful shift to a free cash flow-oriented business model with more disciplined spending, which is taking place on the back of tougher regulations introduced under the Biden administration in 2021.

The Biden’s first step in this regard has been a 60-day ban on new permits for drilling on US federal lands and waters (accounting for approximately one-fifth of total US oil production). While this approach has been somewhat more aggressive and has come earlier than expected, a temporary permitting ban will have a limited impact on short-term producer activity. This is because Biden’s executive order does not affect existing permits and many producers accumulated federal drilling permits in anticipation of policy changes. Still, rising regulatory headwinds (e.g. stricter methane restrictions) are likely to weigh on the sector, though we do not expect the worst-case scenario of an outright ban on hydraulic fracturing, or ‘fracking’. Coupled with a focus on capital discipline, shale oil supply growth is set to be more muted after the pandemic. At the same time, shale oil production is likely to become more expensive under the Biden administration, implying a higher marginal cost of production on the global market.

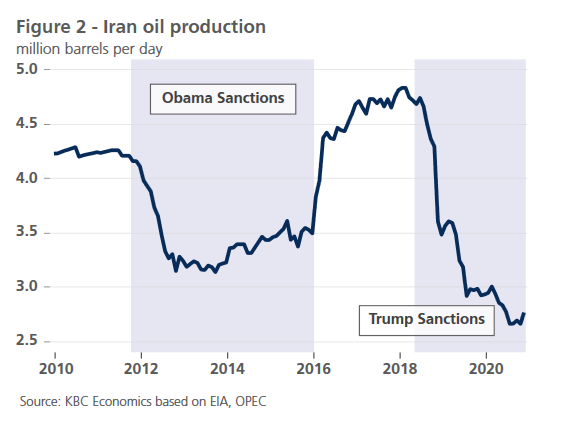

On the foreign policy front, President Biden signals a softer approach towards Iran, reversing the Trump administration’s hard-line stance on sanctions. Under the Biden administration, the US is presumed to renegotiate the Obama-era nuclear deal (the Joint Comprehensive Plan of Action), leading to potential sanctions relief and a subsequent increase in Iranian oil supplies. The timing is nonetheless far from certain with negotiations unlikely to start before the Iranian presidential elections in June 2021. A sanctions-free Iran could boost its oil production to 4.5 million barrels per day, implying up to 2 million barrels per day returning to the global oil market (figure 2).

All in all, we expect Biden’s extensive policy agenda to support oil prices in the short term, largely on the account of aggressive fiscal stimulus and stronger economic growth. Conditional on the scope and timing, the shale supply headwinds are likely to offset the return of Iran oil production over the medium term. Admittedly, the OPEC+ coalition’s response to these supply-side developments will be an important force shaping the oil market outlook. Finally, in the long run, Biden’s green push is set to weaken US oil demand, putting downward pressure on international oil prices.